- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (SYK): Valuation Insights Following New R&D Center Launch and Siemens Collaboration

Reviewed by Kshitija Bhandaru

Stryker (SYK) has just launched a 140,000-square-foot research and development center in Bangalore, India, focused on robotics, artificial intelligence, digital health, and product security. The company also unveiled a partnership with Siemens Healthineers to develop a robotic system for neurovascular procedures.

These moves represent a proactive push into emerging medical technology fields and give investors a fresh reason to watch how Stryker’s innovation efforts might influence future growth and its position in specialized healthcare markets.

See our latest analysis for Stryker.

After a year of steady innovation and notable partnerships such as the recent Siemens Healthineers collaboration, Stryker’s stock has shown modest momentum with a year-to-date share price return of 1.6%. Over a longer horizon, however, its total shareholder return stands out at 3.5% for the past year and an impressive 79.6% over the last three years. This hints at persistent long-term value as the company invests in new technologies.

Curious about more companies shaping the future of healthcare? Take your research further with the latest discoveries in our See the full list for free..

With Stryker trading about 14 percent below intrinsic value estimates and analysts forecasting further upside, the question now is whether investors are looking at an appealing entry point or if the market has already priced in its innovation-led growth.

Most Popular Narrative: 15.8% Undervalued

Stryker’s most popular narrative sets its fair value at $433, a notable premium above the last close of $364.6. The outlook points to strong industry trends that are shaping this positive perspective.

Significant international growth runway remains, especially as emerging markets in Asia-Pacific and Latin America expand healthcare infrastructure and as critical new products (like Insignia and Pangea) achieve regulatory approvals outside the US. This supports both near and long-term top-line growth.

Curious what’s fueling that optimistic valuation? Analysts are considering a potential increase in profits, driven by expansion abroad, new technology launches, and rising margins. See what big assumption could move the market.

Result: Fair Value of $433 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory hurdles and ongoing supply chain disruptions could limit Stryker’s international growth and near-term earnings potential, which may challenge the optimistic narrative.

Find out about the key risks to this Stryker narrative.

Another View: Multiples Paint a Different Picture

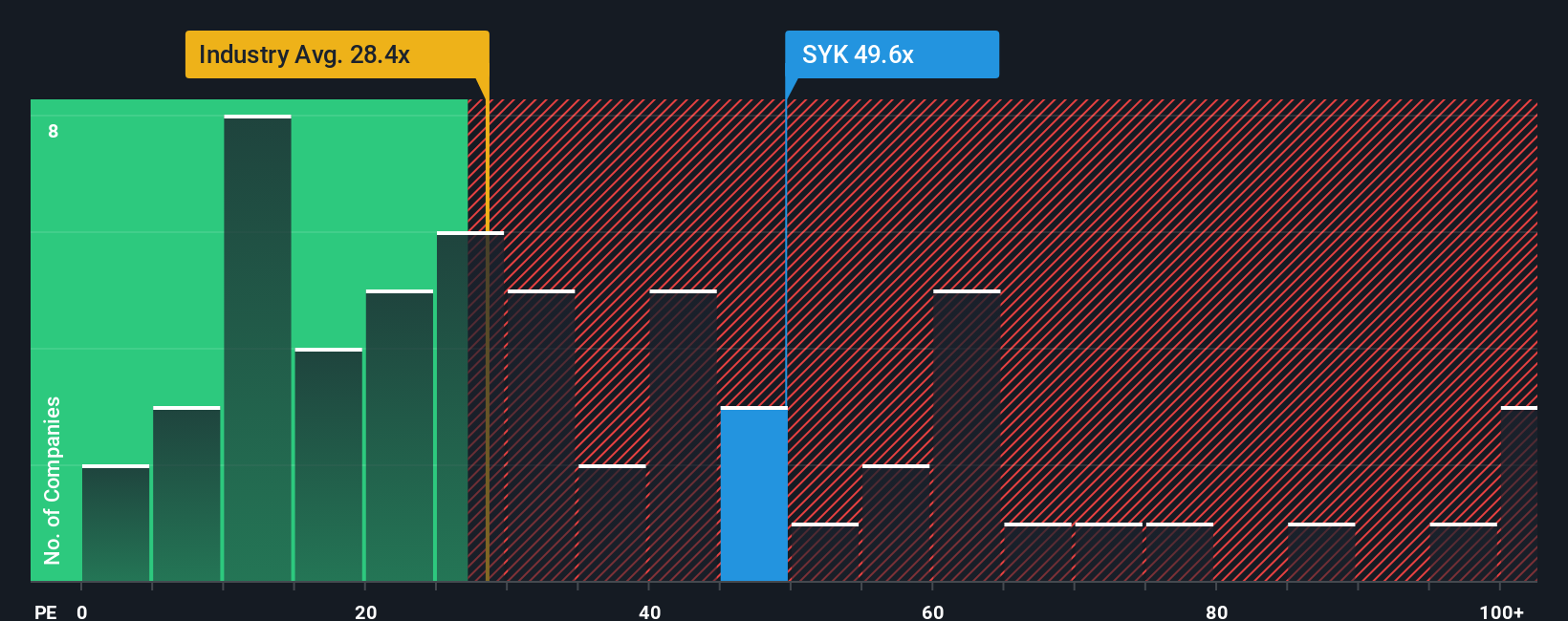

While one method says Stryker is undervalued, a closer look at its price-to-earnings ratio tells a different story. Stryker currently trades at 47.8 times earnings, much higher than the industry average of 29.5 times and the peer average of 39.6 times. The fair ratio of 33.7 times suggests the shares could come under pressure if the market shifts expectations. Does the multiple signal over-optimism, or is there something the ratio is missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stryker Narrative

If you see the numbers differently, or want to dig into the data on your own terms, you can shape your own view in just a few minutes with Do it your way.

A great starting point for your Stryker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take action now to get ahead with strategies that are moving the market, rather than just following it. The right theme could make all the difference in your portfolio.

- Capture growing income by targeting stocks with attractive yields when you research these 19 dividend stocks with yields > 3%, which have consistently rewarded shareholders.

- Tap into potential breakout businesses by reviewing these 3583 penny stocks with strong financials, which back up promise with solid fundamentals and real growth metrics.

- Accelerate your exposure to game-changing innovation through these 24 AI penny stocks, focusing on artificial intelligence trailblazers in high-impact industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives