- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (SYK): Assessing Valuation After Robotics Partnership With Siemens and Bangalore R&D Expansion

Reviewed by Kshitija Bhandaru

Stryker (SYK) has been making headlines after announcing a strategic collaboration with Siemens Healthineers to co-develop a new robotic system targeting neurovascular procedures. In addition, the company just expanded its R&D center in Bangalore, emphasizing robotics, AI, and digital innovation. If you’ve been on the fence about what to do with Stryker stock, these bold moves might be catching your eye and prompting a closer look at what the future could hold.

This activity is shaping perceptions around Stryker’s longer-term growth trajectory. Shares have climbed 4% this year, with sustained annual revenue and net income growth reinforcing investor confidence. However, the past month has brought a 5% dip as the market digests the implications of these significant strategic moves. While past three- and five-year returns have been remarkable, the recent pullback is hard to ignore. Momentum appears to be in flux as Stryker continues to invest in advanced technology initiatives and global expansion.

So the real question is, with shares off recent highs and the company doubling down on future innovation, is Stryker shaping up as a buying opportunity or is the market already pricing in those growth ambitions?

Most Popular Narrative: 13.8% Undervalued

The prevailing narrative sees Stryker stock as trading at a significant discount to its consensus fair value, reflecting optimism around future earnings and growth potential.

Robust innovation pipeline, particularly in robotic-assisted surgery (Mako platform) and next-generation devices, is driving greater market share, higher average selling prices, and service revenues. This is expected to accelerate both revenue and margin expansion over time.

Want to know the secret sauce behind Stryker’s hefty fair value upgrade? The market consensus is built on aggressive revenue expansion and powerful margin lift. Wondering what future scenario has analysts predicting such a big gap to today’s price? Unpack the full narrative to discover the bold quantitative assumptions. One of these turns on Stryker’s future earnings power and valuation multiple, and might surprise even seasoned investors.

Result: Fair Value of $433.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory delays or extended supply chain disruptions could pressure Stryker’s margins and cloud the otherwise positive outlook for its stock.

Find out about the key risks to this Stryker narrative.Another View: What Do Market Comparisons Reveal?

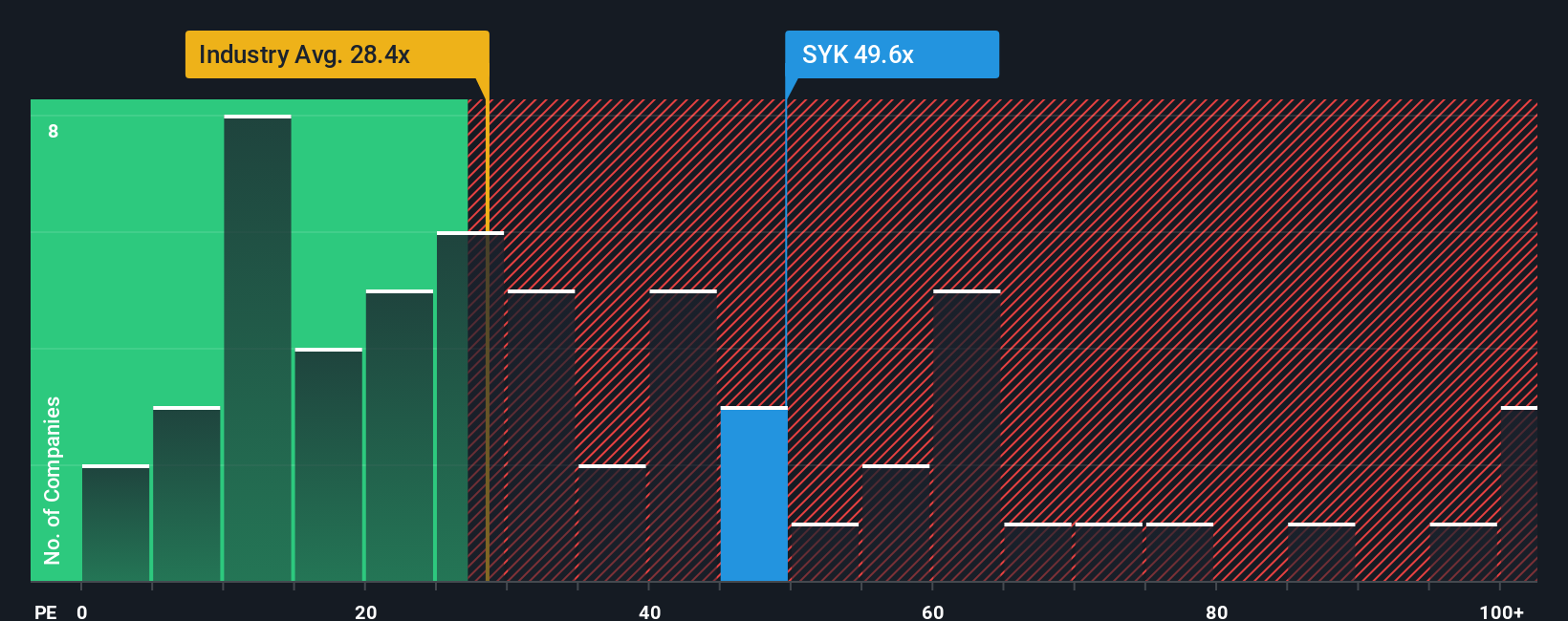

Looking from another angle, some investors weigh up Stryker’s valuation by comparing its price-to-earnings ratio to others in its industry. On this measure, Stryker looks pricey compared to similar healthcare companies. Does this metric challenge the upbeat outlook, or does it simply reflect high expectations for sustained growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Stryker to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Stryker Narrative

Of course, if you want to dig into the numbers yourself and shape your own view, it’s quick to explore and build your take in just minutes. Do it your way

A great starting point for your Stryker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Opportunities?

Smart investors never settle for yesterday’s trends. Give yourself an edge by tapping into out-of-the-box stocks and sectors that could deliver your next breakthrough win. Don’t miss these promising paths. Each offers a unique angle for building a stronger, future-focused portfolio.

- Target reliable income and seek financial stability by scanning for dividend stocks with yields > 3% that stand out for their impressive yields above 3% and resilient fundamentals.

- Tap into game-changing tech and track firms at the forefront of tomorrow’s finance through cryptocurrency and blockchain stocks featuring companies involved in cryptocurrency and blockchain advancements.

- Hunt for smart value plays that the market may have overlooked with undervalued stocks based on cash flows. These companies could offer genuine upside potential based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives