- United States

- /

- Medical Equipment

- /

- NYSE:SYK

Stryker (NYSE:SYK) Expands Pain Therapy With FDA Clearance For OptaBlate BVN System

Reviewed by Simply Wall St

Stryker (NYSE:SYK) recently secured FDA clearance for its OptaBlate BVN system, aiming to enhance its portfolio in advanced pain therapy solutions. The company's share price rose 14% over the past month. This increase parallels the broader market trends, bolstered by their expansion efforts, such as pursuing mergers and acquisitions and the positive earnings guidance update. Additionally, the declaration of a 5% dividend increase likely provided investor confidence. While the market experienced mixed movements, Stryker's recent advancements seemed to resonate positively with investors, aligning with the S&P 500's general upward trajectory over the same period.

Every company has risks, and we've spotted 3 risks for Stryker you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

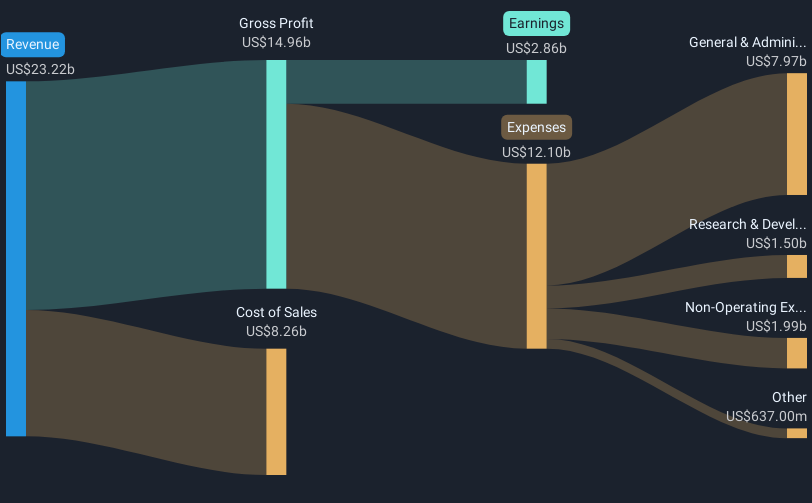

Stryker's recent FDA clearance for its OptaBlate BVN system has likely provided fresh momentum for the company's growth narrative, particularly in advanced pain therapy solutions. This development, along with the recent 5% dividend increase, has likely boosted investor confidence, contributing to the recent 14% rise in share price. However, the company's total shareholder return over the past five years, including share price appreciation and dividends, is a more comprehensive measure of performance. Over this period, Stryker achieved a 126.1% total return, illustrating strong long-term growth, which significantly surpasses the 11.7% return of the broader US Market over the past year.

Looking forward, the positive news surrounding the FDA clearance and the company's ongoing efforts in mergers and acquisitions may influence revenue and earnings forecasts. Analysts predict an annual revenue growth of 8.2% over the next three years, with earnings anticipated to reach US$5.2 billion by 2028. These forecasts, combined with a potential increase in profit margins, reflect optimism about Stryker's future despite challenges like tariffs and supply chain disruptions. The current share price of US$377.52 remains below the analyst consensus price target of US$424.26, indicating a potential upside. Investors are encouraged to assess these developments against the backdrop of broader market trends and their impact on the medical technology sector.

Assess Stryker's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SYK

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives