- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Should Goldman’s Conviction List Exit and New Stock Plans Require Action From ResMed (RMD) Investors?

Reviewed by Sasha Jovanovic

- ResMed recently saw Richard Sulpizio step down from its board and filed two employee stock ownership-related shelf registrations totaling about US$1.32 billion in common stock, while Goldman Sachs removed the company from its APAC Conviction List.

- Together, these moves highlight a mix of ordinary corporate housekeeping and a meaningful reassessment by a major broker that could reshape how investors view ResMed’s prospects.

- Next, we’ll explore how Goldman Sachs’ decision to drop ResMed from its APAC Conviction List may influence the company’s existing investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

ResMed Investment Narrative Recap

To own ResMed, you generally need to believe in the long term demand for sleep and respiratory care solutions, as well as the company’s ability to defend its market position against new therapies and pricing pressure. Goldman Sachs removing ResMed from its APAC Conviction List may weigh on sentiment, but it does not appear to materially alter the key near term catalyst of execution in its core devices and software ecosystem, or the central risk of reimbursement and pricing pressure.

The most relevant recent announcement here is ResMed’s pair of ESOP related shelf registrations totaling about US$1,317.2 million in common stock, which could modestly influence how investors think about future share issuance and capital allocation. While the filings themselves are routine for many large companies, they sit alongside the evolving debate about growth, competition from alternative sleep apnea treatments and how ResMed balances investment, employee ownership, and shareholder returns.

But investors should also be aware of how renewed pressure on reimbursement and pricing could interact with...

Read the full narrative on ResMed (it's free!)

ResMed's narrative projects $6.4 billion revenue and $1.9 billion earnings by 2028.

Uncover how ResMed's forecasts yield a $295.13 fair value, a 18% upside to its current price.

Exploring Other Perspectives

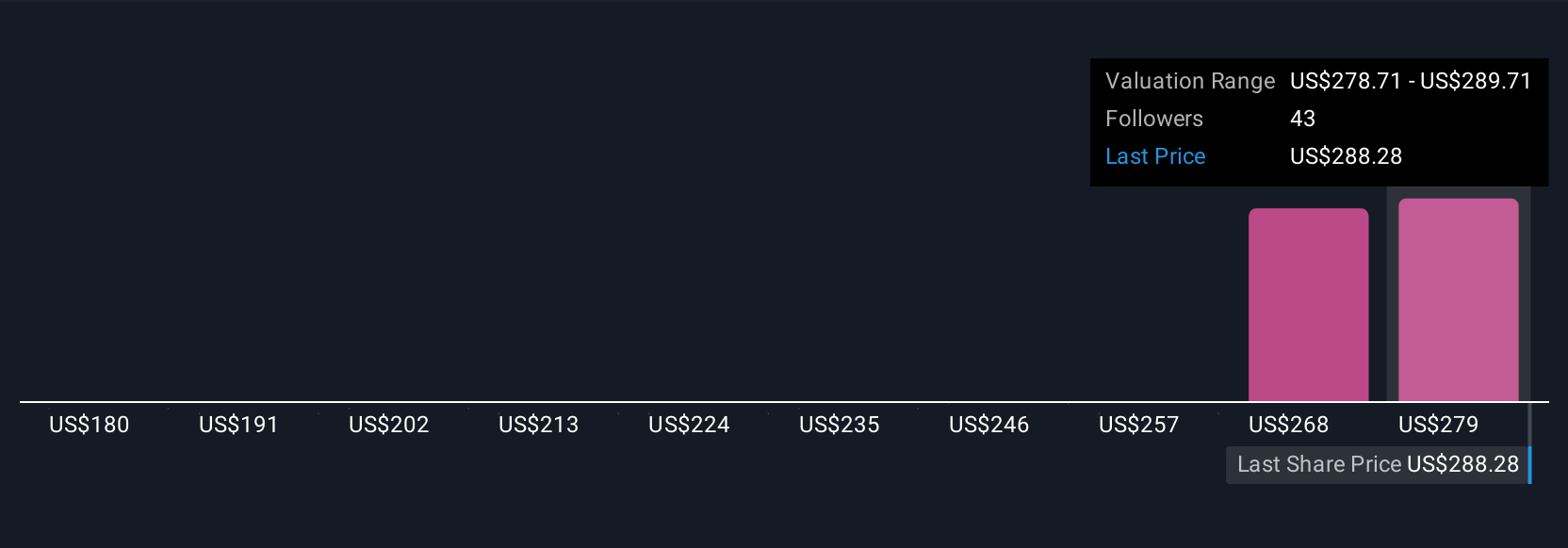

Seven fair value estimates from the Simply Wall St Community range from US$193.80 to US$295.13, underlining how far apart individual views can be. You are weighing those opinions against real business risks, including the possibility that tighter reimbursement or pricing pressure could directly affect ResMed’s revenue growth and profitability over time.

Explore 7 other fair value estimates on ResMed - why the stock might be worth 23% less than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026