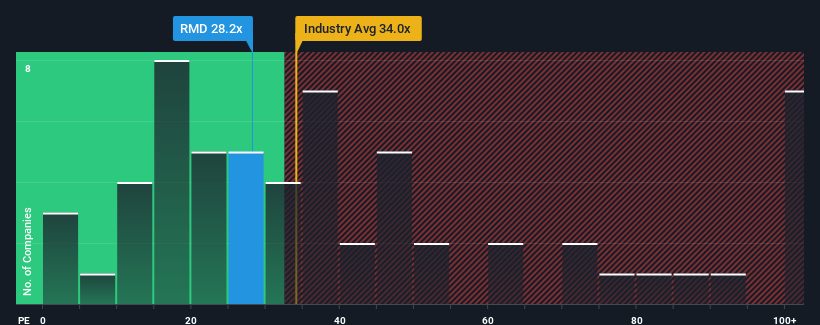

ResMed Inc.'s (NYSE:RMD) price-to-earnings (or "P/E") ratio of 28.2x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 18x and even P/E's below 11x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, ResMed has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for ResMed

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as ResMed's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 40% last year. The strong recent performance means it was also able to grow EPS by 137% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% per annum, which is not materially different.

With this information, we find it interesting that ResMed is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From ResMed's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of ResMed's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for ResMed you should know about.

Of course, you might also be able to find a better stock than ResMed. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026