- United States

- /

- Healthtech

- /

- NYSE:PHR

Phreesia (PHR): Assessing Valuation Following Sesame Workshop Partnership on Pediatric Health Content

Reviewed by Simply Wall St

Most Popular Narrative: 7.6% Undervalued

According to community narrative, Phreesia is viewed as undervalued, with market price trailing consensus fair value. This perspective hinges on anticipated fundamental improvements and growth catalysts.

The continued rollout and adoption of new value-added modules, such as appointment readiness, enhanced bill pay, and post-script engagement, are increasing recurring revenue per client and expanding Phreesia's addressable market. This supports both top-line growth and enhanced net margins over time.

Curious about why analysts think this healthcare stock could unlock way more value? The secret lies in bold assumptions around rising sales and a dramatic turnaround in profits. The narrative's fair value is built on projections not everyone will agree with. But what might be missing from the surface? Find out how fast growth and margin leaps shape the price target; these numbers might surprise you.

Result: Fair Value of $32.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition or shifts in healthcare regulations could challenge Phreesia’s outlook and slow the pace of its expected growth.

Find out about the key risks to this Phreesia narrative.Another View: What Does a Revenue-Based Valuation Say?

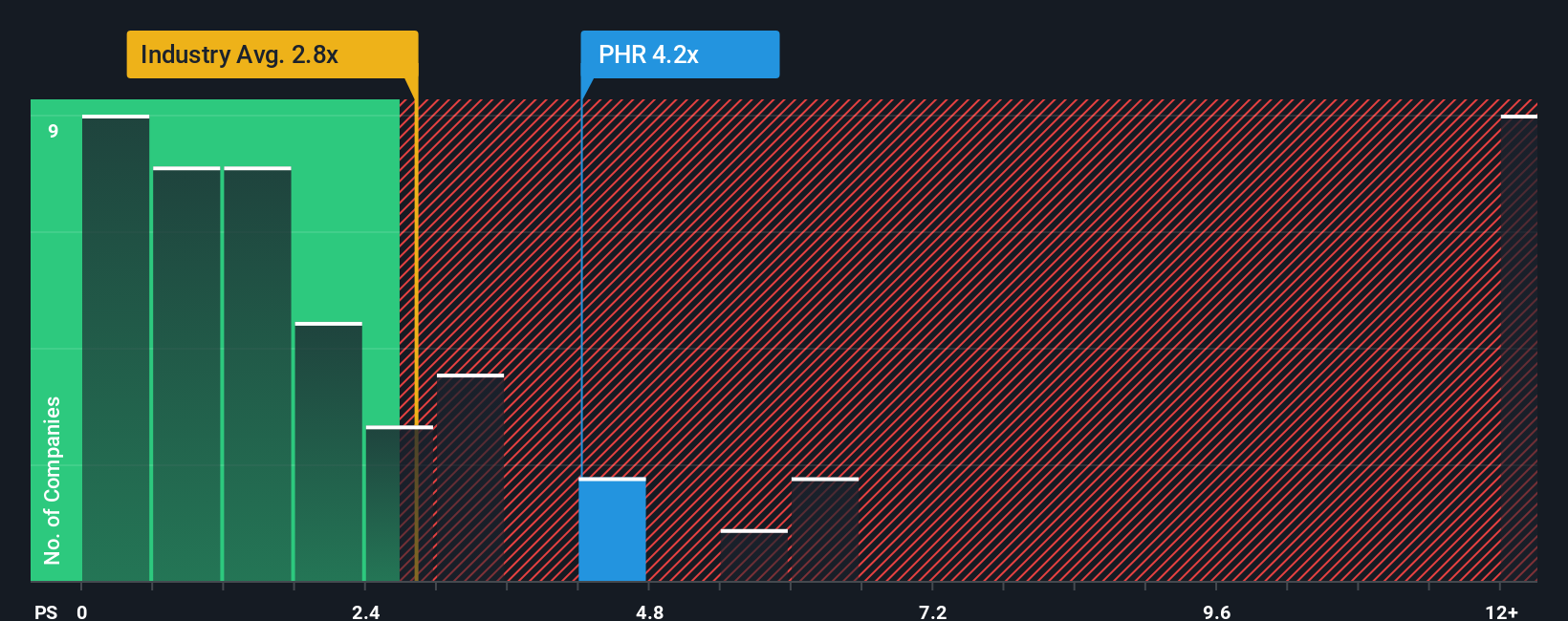

While the earlier verdict suggests Phreesia is undervalued, there is a different perspective. Looking at how its share price compares to its sales versus industry averages, the stock actually comes across as expensive. This could raise the question of whether expectations have already run ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phreesia Narrative

If you see things differently or want to dig deeper into the numbers on your own, it only takes a few minutes to shape your own narrative, so why not do it your way.

A great starting point for your Phreesia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more smart investment opportunities by checking out stocks with distinct advantages right now. Waiting could mean missing out on trends and hidden gems that are already building momentum. Keep growing your portfolio and seizing opportunities with these handpicked screens:

- Spot reliable income streams when you review stocks offering generous yields in our selection of dividend stocks with yields > 3%.

- Catch the surge in artificial intelligence and healthcare innovation by scanning this list of promising healthcare AI stocks.

- Act early on emerging trends with our up-to-date picks of penny stocks with strong financials, which pair strong financial growth with penny stock value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives