- United States

- /

- Healthcare Services

- /

- NYSE:PACS

How Might PACS Group's (PACS) CFO Change Shape Its Governance Reputation Going Forward?

Reviewed by Simply Wall St

- On September 2, 2025, PACS Group announced that Chief Financial Officer Derick Apt resigned following an internal investigation revealing violations of company policy involving gifts from business partners.

- The board's immediate appointment of co-founder and long-serving executive Mark Hancock as interim CFO highlights the company's focus on leadership stability during a period of heightened scrutiny.

- We'll explore the implications of this executive transition, particularly how the leadership changes affect PACS Group's governance narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is PACS Group's Investment Narrative?

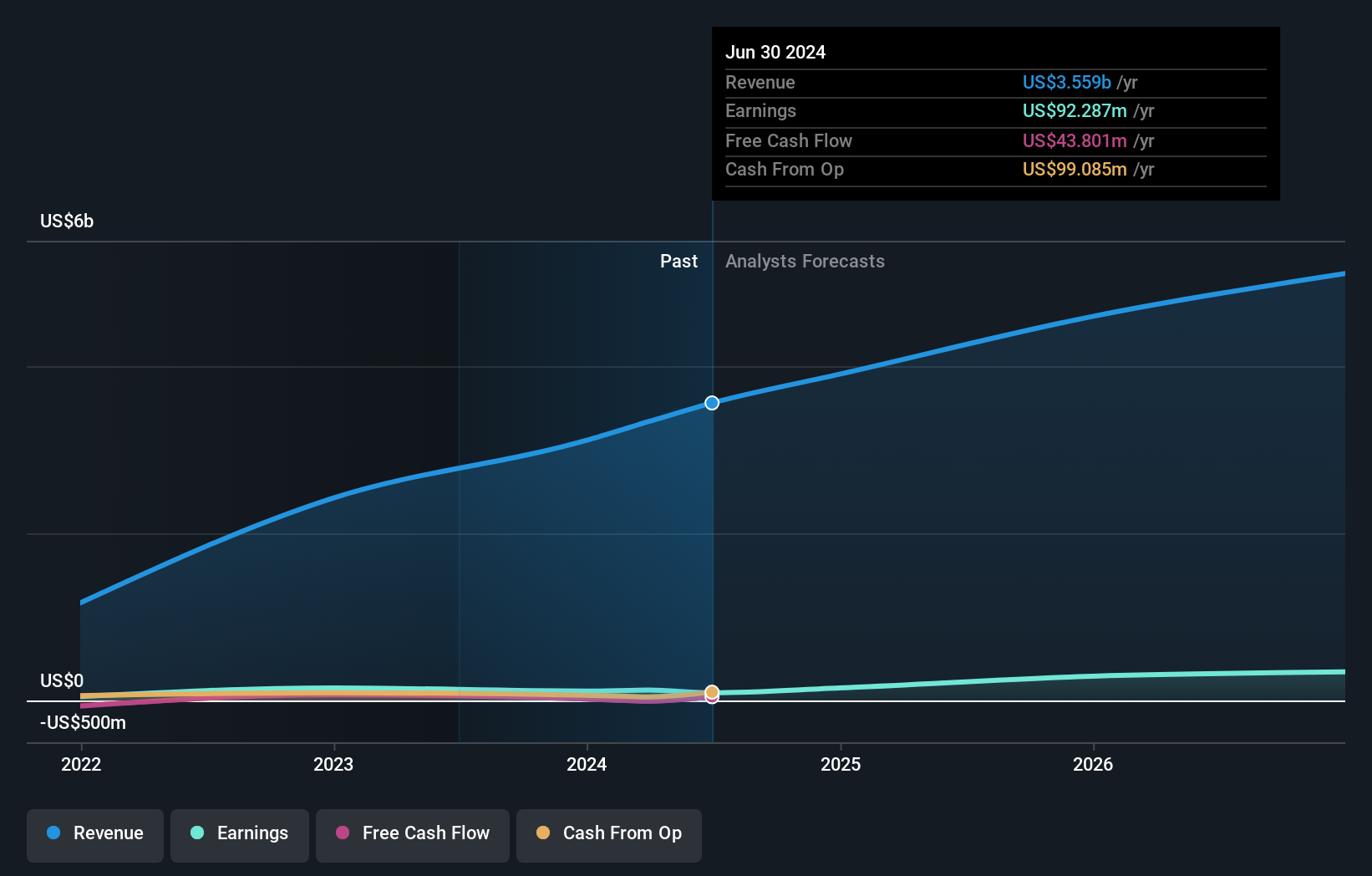

For investors considering PACS Group, the core belief is that value will be realized through the company’s ability to execute operational expansion while addressing ongoing financial and governance issues. The unexpected resignation of the CFO amid a policy breach certainly puts the spotlight on internal controls and leadership reliability, especially with prior delays in SEC filings and recent legal scrutiny. Bringing back co-founder Mark Hancock as interim CFO should provide short-term stability, and the market’s muted initial price reaction suggests that the transition itself may not materially impact the company's most important immediate catalysts, which continue to be restoring timely financial reporting, resolving debt covenant waivers, and improving earnings quality. Nonetheless, this executive reshuffle could intensify risk around governance perception and the company’s path to normalized financial disclosure. Investors must keep a close eye on whether PACS can rebuild trust and momentum.

But, the company’s recurring delays in financial reporting remain a key risk that investors should not overlook. PACS Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on PACS Group - why the stock might be worth over 2x more than the current price!

Build Your Own PACS Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACS Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PACS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACS Group's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACS

PACS Group

Through its subsidiaries, operates skilled nursing facilities and assisted living facilities in the United States.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives