- United States

- /

- Healthcare Services

- /

- NYSE:OMI

Owens & Minor, Inc. Earnings Missed Analyst Estimates: Here's What Analysts Are Forecasting Now

There's been a notable change in appetite for Owens & Minor, Inc. (NYSE:OMI) shares in the week since its yearly report, with the stock down 15% to US$16.40. Statutory earnings per share fell badly short of expectations, coming in at US$0.29, some 77% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at US$10.0b. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Owens & Minor after the latest results.

See our latest analysis for Owens & Minor

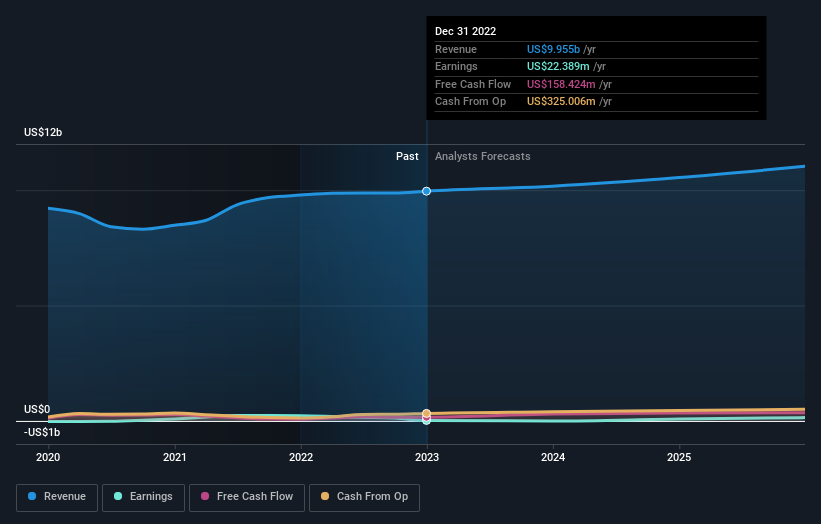

Taking into account the latest results, the current consensus from Owens & Minor's six analysts is for revenues of US$10.2b in 2023, which would reflect an okay 2.2% increase on its sales over the past 12 months. Earnings are expected to tip over into lossmaking territory, with the analysts forecasting statutory losses of -US$0.21 per share in 2023. In the lead-up to this report, the analysts had been modelling revenues of US$10.1b and earnings per share (EPS) of US$1.39 in 2023. So despite reconfirming their revenue estimates, the analysts are now forecasting a loss instead of a profit, which looks like a definite drop in sentiment following the latest results.

With the increase in forecast losses for next year, it's perhaps no surprise to see that the average price target dipped 8.1% to US$19.00, with the analysts signalling that growing losses would be a definite concern. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Owens & Minor analyst has a price target of US$25.00 per share, while the most pessimistic values it at US$14.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Owens & Minor's growth to accelerate, with the forecast 2.2% annualised growth to the end of 2023 ranking favourably alongside historical growth of 0.8% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 7.7% annually. So it's clear that despite the acceleration in growth, Owens & Minor is expected to grow meaningfully slower than the industry average.

The Bottom Line

The most important thing to take away is that the analysts are expecting Owens & Minor to become unprofitable next year. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Owens & Minor's future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Owens & Minor going out to 2025, and you can see them free on our platform here.

Even so, be aware that Owens & Minor is showing 3 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OMI

Undervalued low.