- United States

- /

- Medical Equipment

- /

- NYSE:NVST

Assessing Envista After Recent Earnings Miss and Share Price Discount in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Envista Holdings, you are probably wondering if now is the time to buy, sell, or hold. The stock sits at $20.19 after a bit of a rollercoaster ride lately: down nearly 2% in the last week and about 3% over the past month. Looking further back, the situation gets interesting. Year to date, Envista has eked out a 5.7% gain, and it is up 12.7% from a year ago. However, if you zoom out to three and five years, there is a sharp divergence, with the stock still down 40% and 23.1%, respectively, over those periods.

What is driving these ups and downs? Much of it can be traced to shifting sentiment in the broader dental supplies and equipment sector, where investors are reassessing growth potential and risk following recent industry developments. While no single piece of news seems to be moving the needle day to day, the wider market’s push and pull has clearly influenced how traders view shares of Envista.

When it comes to valuation, the numbers paint a telling story. Out of six standard checks for undervaluation, Envista passes just one, giving it a value score of 1. That might leave many investors wondering whether there is hidden value waiting to be unlocked or if caution is still warranted.

Next, we will dig deeper into each major valuation method so you can see exactly how Envista measures up by the numbers. Stick around, because later we will explore an even smarter way to assess what the stock could really be worth.

Envista Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Envista Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future cash flows and discounting them back to today's dollars. This helps investors assess what Envista Holdings might truly be worth based on its ability to generate cash over time.

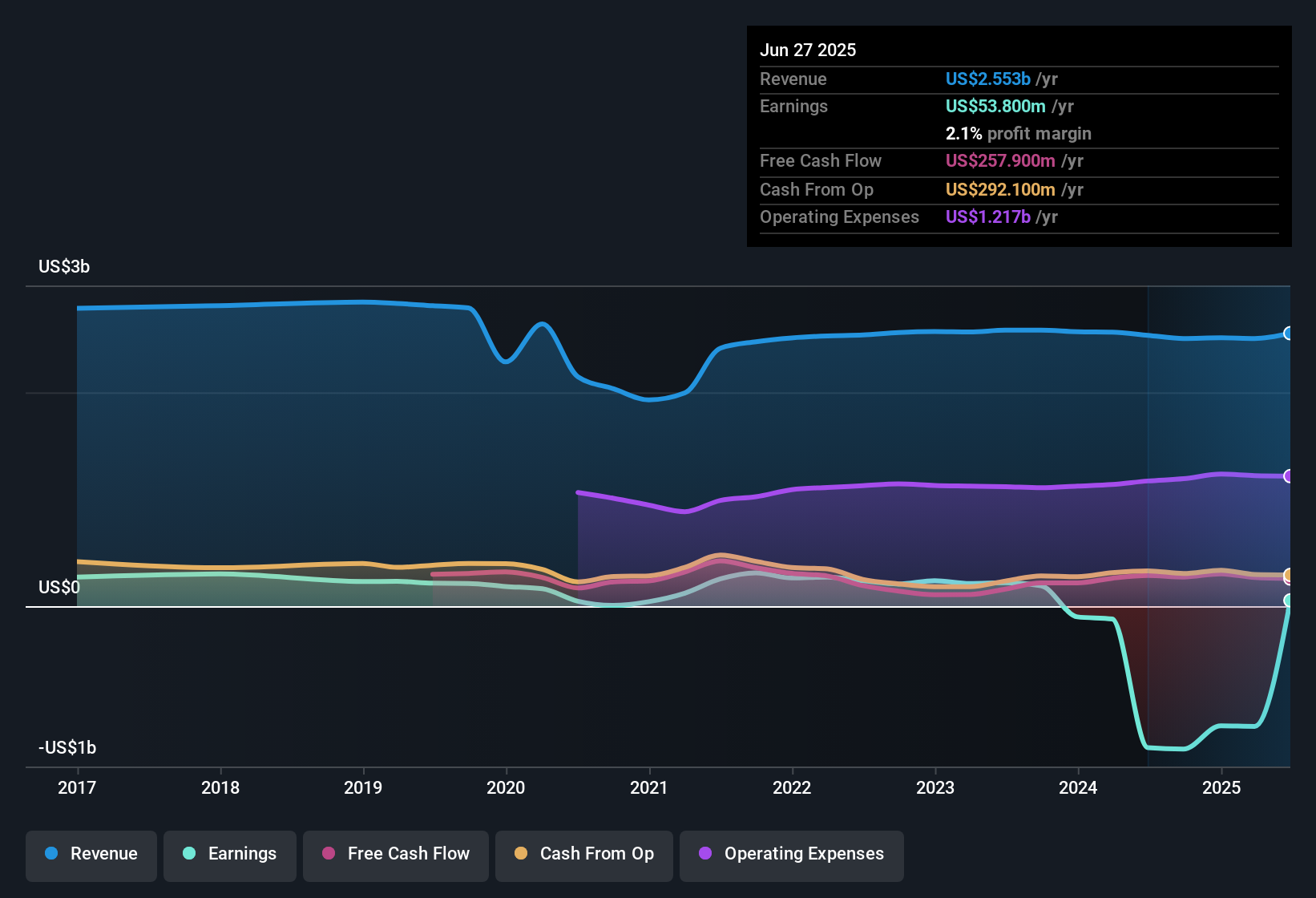

According to the 2 Stage Free Cash Flow to Equity model, Envista Holdings delivered $240.8 million in Free Cash Flow (FCF) over the last twelve months. Analysts expect FCF to continue growing, with projections reaching $276 million by 2028. After the first five years of analyst estimates, further cash flow projections are extrapolated, showing steady performance through 2035. These figures, all reported in US dollars, reflect the company’s ongoing ability to generate cash, which is fundamental to its long-term valuation.

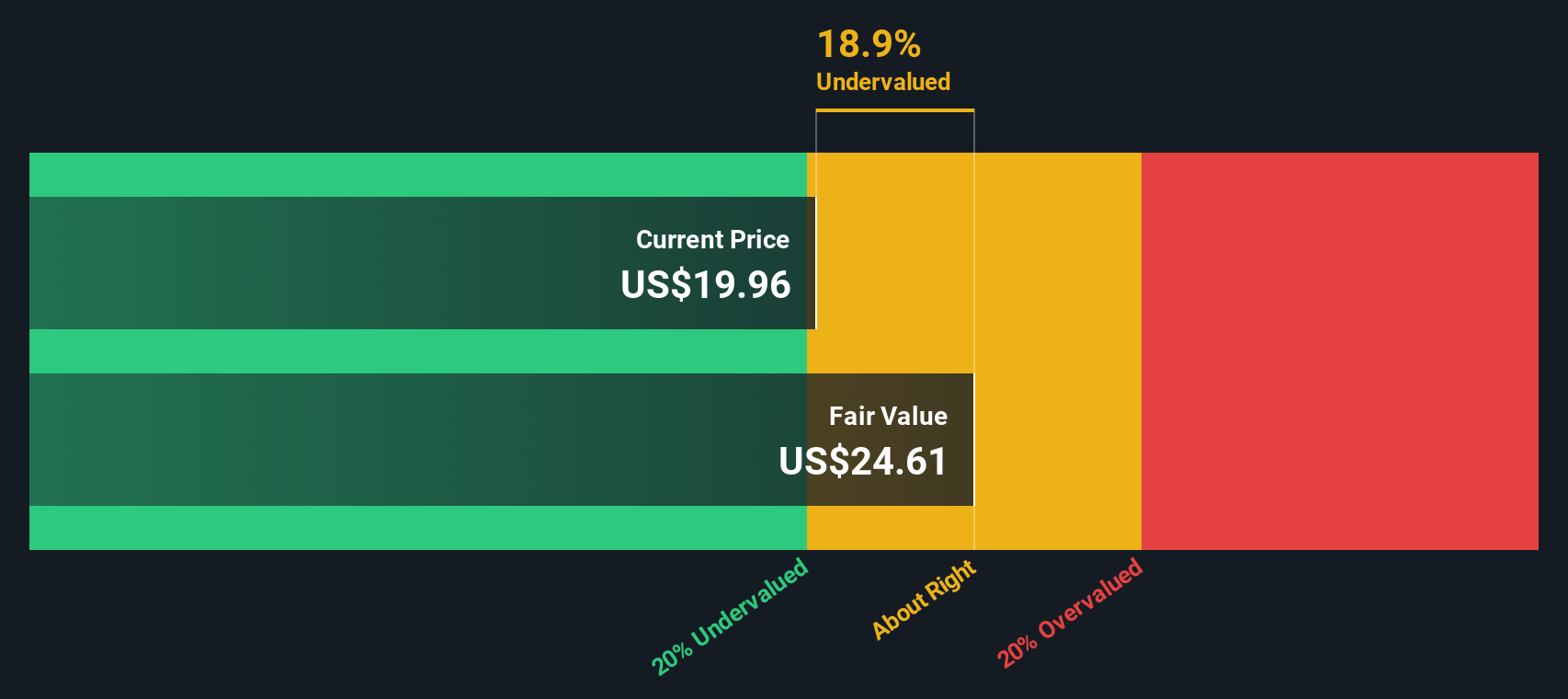

When these projected flows are discounted to their present value using the DCF method, the intrinsic value comes out to $24.79 per share. With shares currently trading at $20.19, this suggests Envista Holdings is trading at an 18.5% discount relative to its underlying cash flow potential. Using this approach, Envista appears undervalued based on forward-looking fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Envista Holdings is undervalued by 18.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Envista Holdings Price vs Earnings

The price-to-earnings (PE) ratio is often considered the most relevant valuation metric for profitable companies because it directly relates a company’s market price to its earnings power. A higher PE ratio can reflect optimism about future growth, while a lower one may signal risk, slowing prospects, or undervaluation. What constitutes a “fair” PE depends on factors like expected future earnings growth, the stability of those earnings, and the broader market or industry norms.

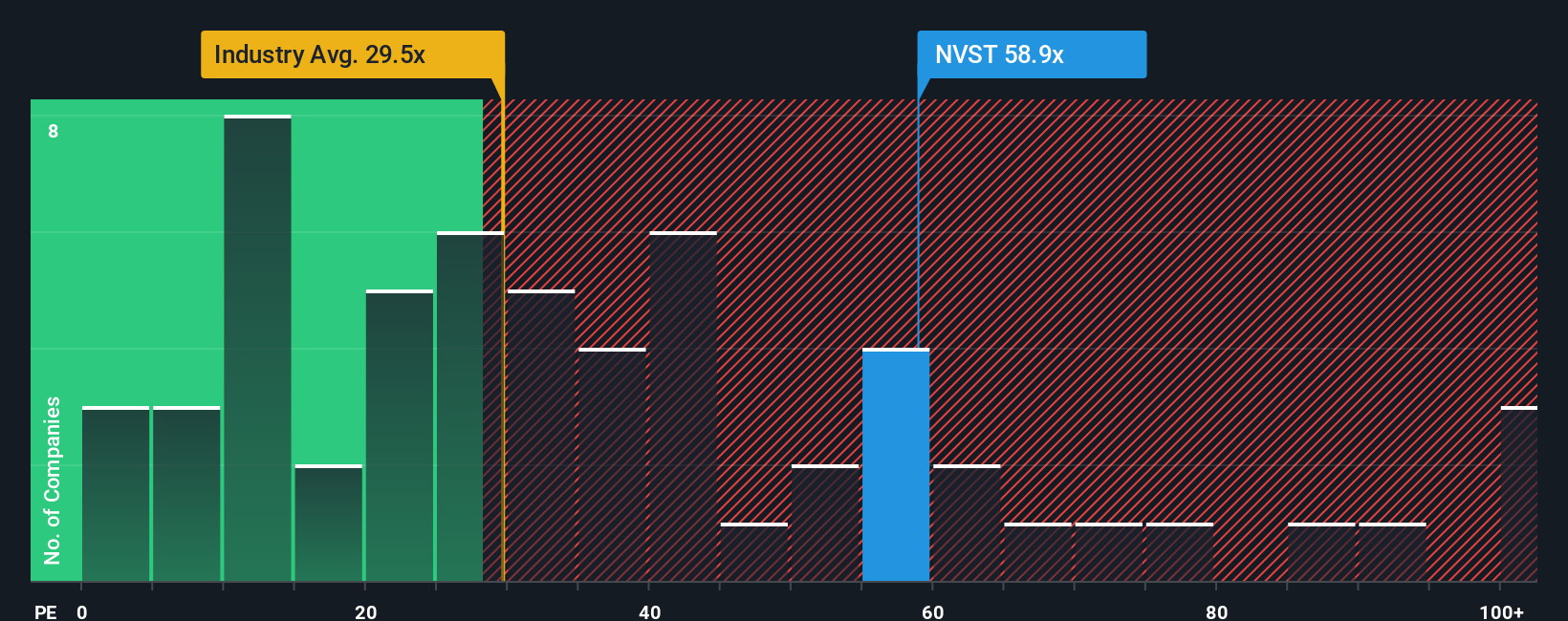

Currently, Envista Holdings trades on a PE ratio of 62.4x, which is noticeably higher than the industry average PE of 30.1x and the average among its peers at 44x. On the surface, that might make the stock look expensive compared to its segment. However, simple comparisons can be misleading, since not all companies have the same growth profile, risk factors, or profitability margins.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio for Envista is 30.2x, a figure tailored to the company’s unique growth outlook, risk profile, profit margins, and the characteristics of both its industry and its market cap. Because the Fair Ratio takes into account these nuances, it provides a more precise gauge of value than broad peer or industry averages.

Comparing Envista’s actual PE ratio (62.4x) to its Fair Ratio (30.2x) indicates that the stock is trading well above where its fundamentals suggest it should be. That signals the market is currently assigning a significant premium to Envista’s earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Envista Holdings Narrative

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, a tool that empowers you to add the story behind a company's numbers, bringing your own assumptions about Envista Holdings’ future revenue, earnings, and margins into the financial forecast and estimated fair value.

A Narrative connects your insights about Envista’s strategy, products, risks, and the broader industry landscape directly to future financials. This makes it easy to see how different scenarios could play out. For example, one investor might build a bullish Narrative expecting earnings to surge toward $181 million, while another might take a far more cautious view, forecasting earnings as low as negative $30 million by 2028.

On Simply Wall St’s Community page (used by millions of investors), you can create, edit, and share Narratives with just a few clicks. Importantly, they update dynamically as new earnings, news, or company data are released, so your Fair Value is never out of date.

By comparing your Narrative-derived Fair Value to today’s share price, you can quickly decide whether Envista Holdings looks like a buy, hold, or sell according to your own outlook, making your investment decisions smarter and more personalized than ever before.

Do you think there's more to the story for Envista Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envista Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVST

Envista Holdings

Develops, manufactures, markets, and sells dental products in the United States, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives