- United States

- /

- Healthcare Services

- /

- NYSE:MOH

The Bull Case for Molina Healthcare (MOH) Could Change Following Guidance Cut Amid Rising Medical Costs

Reviewed by Simply Wall St

- Molina Healthcare recently experienced a technical rebound after a sharp sell-off prompted by its second-quarter earnings miss and reduced full-year guidance due to rising medical cost pressures.

- This renewed investor interest follows high volatility and a reassessment of the company's valuation in the context of sustained cost challenges, particularly within its government-backed insurance business and Florida operations.

- We'll examine how the impact of escalating medical costs and lowered guidance may alter Molina Healthcare's long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Molina Healthcare Investment Narrative Recap

To be a shareholder in Molina Healthcare, you need to believe the company can manage ongoing medical cost pressures while maintaining premium revenues and government contracts. The recent rebound in share price does not materially change the short-term catalyst, which remains Molina's ability to align Medicaid and Marketplace rate adjustments with rising healthcare costs; however, these cost pressures are still the biggest risk facing the business right now, particularly in its Florida segment.

Among recent announcements, Molina's Q2 2025 earnings update is the most relevant: adjusted EPS fell 6.5% year-over-year and full-year guidance was trimmed due to escalating medical expenses. This news directly ties into ongoing concerns about cost containment and margin protection, both of which are key to supporting future growth and restoring Wall Street confidence.

By contrast, investors should be aware that the pace and scale of medical cost inflation could ...

Read the full narrative on Molina Healthcare (it's free!)

Molina Healthcare's narrative projects $50.9 billion revenue and $1.5 billion earnings by 2028. This requires 6.9% yearly revenue growth and a $0.4 billion increase in earnings from $1.1 billion.

Uncover how Molina Healthcare's forecasts yield a $203.07 fair value, a 12% upside to its current price.

Exploring Other Perspectives

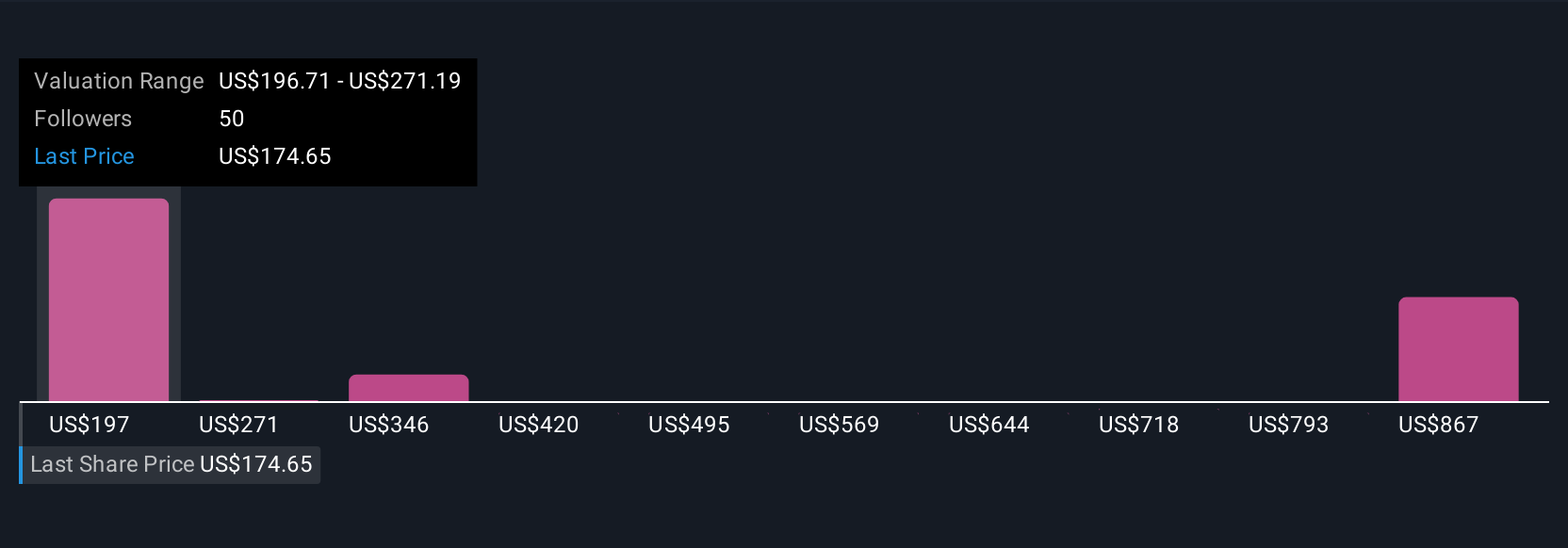

Community fair value estimates for Molina Healthcare currently range from US$203 to US$965 per share, based on 11 different investor perspectives in the Simply Wall St Community. While many are focused on long-term revenue growth and new contracts, you should also consider the outsized impact that medical cost trends could have on future earnings and capital allocation.

Explore 11 other fair value estimates on Molina Healthcare - why the stock might be worth just $203.07!

Build Your Own Molina Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Molina Healthcare research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Molina Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Molina Healthcare's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 29 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives