- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Molina Healthcare (MOH): Assessing Valuation After Class Action Lawsuits and Guidance Reductions

Reviewed by Kshitija Bhandaru

Molina Healthcare is under pressure after a series of class action lawsuits accused the company of misleading investors regarding adverse medical cost trends and recent cuts to financial guidance. These claims come after two swift guidance reductions, raising fresh concerns for shareholders.

See our latest analysis for Molina Healthcare.

After a turbulent few months with surprise cuts to financial guidance and ongoing legal challenges, it is not shocking that investor sentiment around Molina Healthcare has cooled. Over the last year, the company has delivered a 12-month total shareholder return of -0.38%, reflecting both the sharp post-guidance-cut declines and broader uncertainty in the sector. With longer-term performance also registering in negative territory, price momentum for Molina is clearly fading as the market weighs ongoing profit pressures and regulatory risks.

If Molina’s recent volatility has you weighing other options, now is the perfect opportunity to discover more names in healthcare: See the full list for free.

With shares now trading well below last quarter’s highs and guidance reset lower, investors may wonder whether the recent turbulence has created a compelling entry point for value seekers or if the market is already discounting Molina's slower growth outlook.

Most Popular Narrative: 6.6% Overvalued

Despite Molina Healthcare's robust history of contract wins and disciplined cost management, the latest consensus sets a fair value of $189.43, which is about 6.6% below the last closing price of $201.97. This gap raises immediate questions: Is the market betting on a turnaround or simply overlooking emerging headwinds?

"Molina's successful track record of winning RFPs, including new contracts in Nevada and Illinois, is expected to drive significant revenue growth, with projected incremental annual premium revenue of approximately $800 million. This should positively impact revenue and EPS growth."

Want to know what bold financial moves underpin this valuation? A series of key growth assumptions about new contracts, margins, and future profitability form the heart of this striking fair value. Find out how these projections connect; one surprising metric could flip the narrative entirely. The full story awaits.

Result: Fair Value of $189.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential Medicaid funding cuts or costly integration of recent acquisitions could disrupt Molina's growth story and place pressure on earnings expectations.

Find out about the key risks to this Molina Healthcare narrative.

Another View: The Value Signal from Market Comparisons

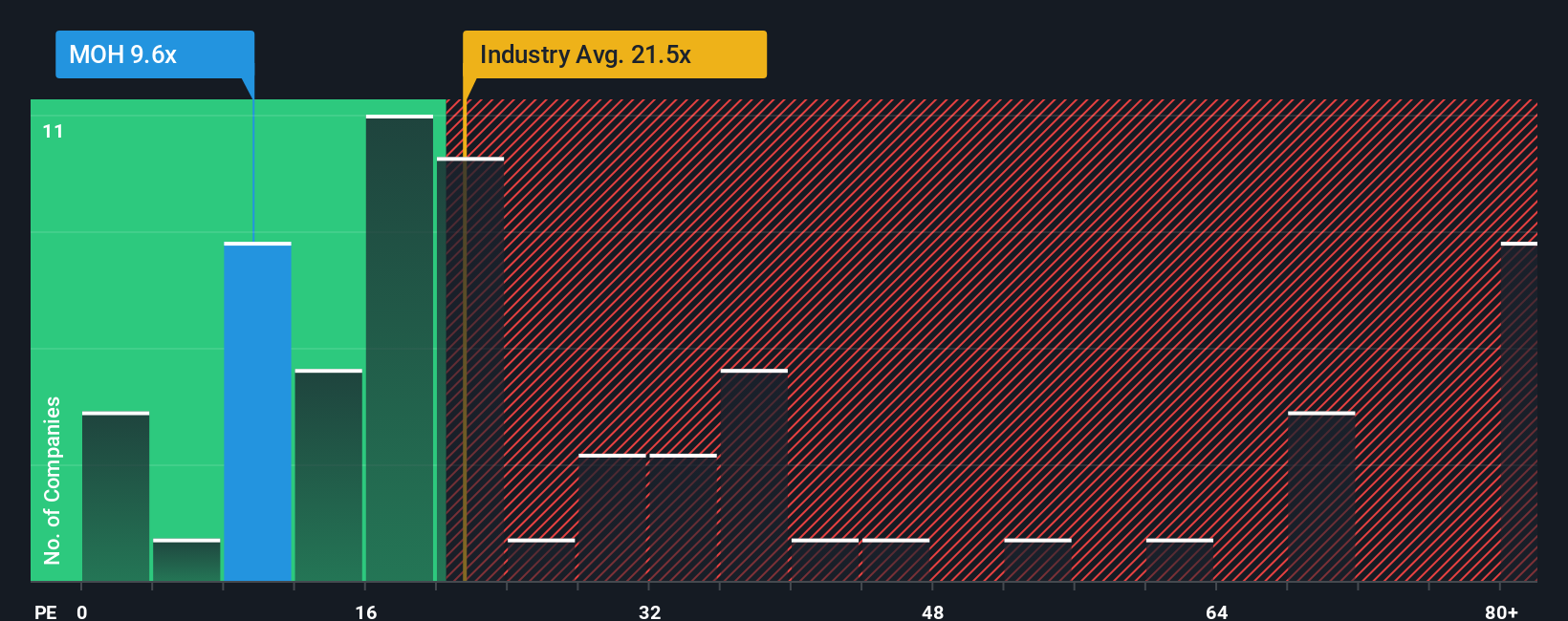

Looking through another lens, Molina Healthcare’s valuation appears attractive on a simple earnings yardstick. With a price-to-earnings ratio of 9.7x, the stock trades well below the US Healthcare industry average of 21.4x and also below the peer average of 29.1x. Compared to its fair ratio of 26.4x, this pricing suggests plenty of market skepticism or perhaps an overlooked investment case. Could this gap indicate opportunity, or is the low multiple a sign that risk lies ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Molina Healthcare Narrative

If you see Molina Healthcare’s story unfolding differently, or want to put your own assumptions to the test, you can craft a custom view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Molina Healthcare.

Looking for more investment ideas?

Staying ahead is as much about knowing where to look as what to buy. Let Simply Wall Street help you spot unique opportunities you might be missing.

- Unlock the potential of tomorrow’s leaders by checking out these 24 AI penny stocks, which are making waves in artificial intelligence innovation, automation, and real-world applications across every industry.

- Strengthen your portfolio’s income stream with these 19 dividend stocks with yields > 3%, which consistently offer yields above 3%. This can provide you with financial growth and reliability in any market.

- Tap into fast-emerging trends by exploring these 78 cryptocurrency and blockchain stocks as they drive the evolution of payment systems, digital assets, and blockchain-powered business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives