- United States

- /

- Healthcare Services

- /

- NYSE:MOH

Evaluating Molina Healthcare's (MOH) Valuation After Renewed Institutional Interest and Positive Sector Comparisons

Reviewed by Kshitija Bhandaru

If you have Molina Healthcare (NYSE:MOH) on your radar, recent headlines should have your attention. The spotlight on big managed care players has intensified, thanks to renewed institutional buying across the sector and positive comparisons that showcase Molina’s growth and valuation versus its peers. While Molina is navigating policy headwinds and funding uncertainties, market sentiment has shifted as investors are revisiting the company’s prospects and enthusiasm returns to the sector overall.

This renewed optimism comes just as some industry rivals, like Centene, struggle to regain their footing after withdrawing guidance. By contrast, Molina’s share price has managed a 6% gain over the past month, reversing some of the earlier year’s declines, even as the stock remains down sharply year-to-date. In the bigger picture, momentum is starting to build again for Molina, with operational and profitability metrics shining brighter than those of at least one larger competitor.

The real question now is this: with investor confidence picking up and Molina outperforming on the fundamentals, is the stock still undervalued, or has the market already priced in a new phase of growth?

Most Popular Narrative: 53% Undervalued

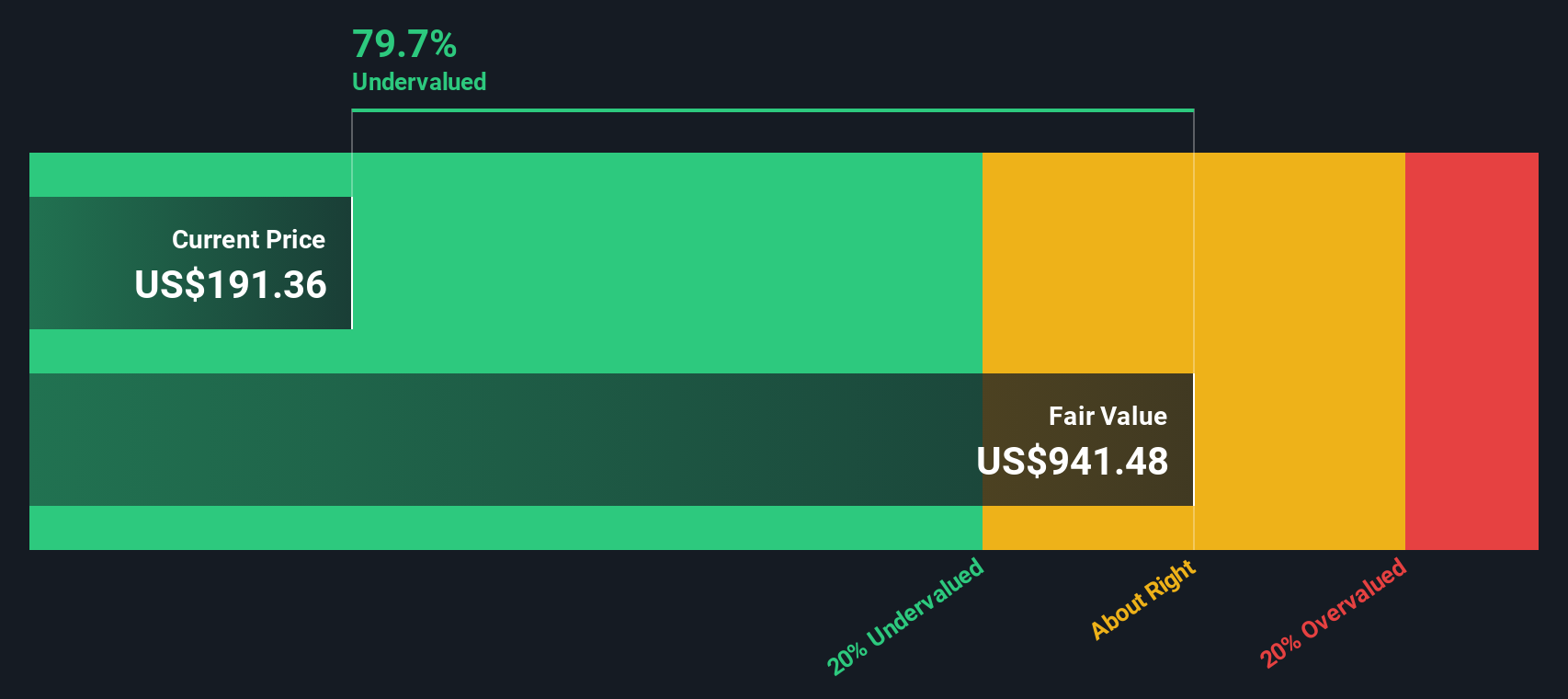

According to the most popular narrative, Molina Healthcare is considered to be trading far below its estimated fair value. This suggests there is meaningful upside if the narrative's assumptions hold true.

Catalysts

- Membership Growth: MOH has seen a 9% increase in members year over year, reaching approximately 5.7 million members as of March 31, 2024. This growth is driven by new contract wins, acquisitions, and expansion.

Curious about what drives this bold undervaluation? There are several key numbers hidden in the narrative’s models that most investors overlook. What underlying assumptions are fueling such an aggressive price target for Molina? Discover the powerful trends in growth and profitability that could change how investors view the stock.

Result: Fair Value of $411.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory uncertainty and the potential for rising medical costs remain significant challenges. These factors could quickly temper the current optimism around Molina.

Find out about the key risks to this Molina Healthcare narrative.Another View: What Does Our DCF Model Say?

While the popular view sees Molina Healthcare as undervalued, a completely different approach comes from our SWS DCF model. This method also points to undervaluation; however, does it capture the full story, or could future assumptions change the outcome?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Molina Healthcare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Molina Healthcare Narrative

If you prefer to chart your own course or question these conclusions, you can analyze the numbers and shape your own narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Molina Healthcare.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your watchlist and fuel your next move by checking out other high-potential themes available through our robust screeners.

- Target big potential in tomorrow’s technology by tapping into quantum breakthroughs with our quantum computing stocks.

- Secure passive income streams by searching for dividend stocks with yields > 3% in markets worldwide.

- Uncover future growth stories by scanning for AI penny stocks and the innovators powering artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MOH

Molina Healthcare

Provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives