MDT Stock Overview

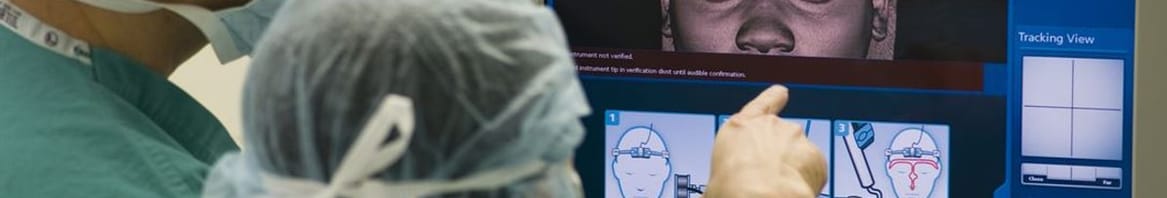

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. More details

| Snowflake Score | |

|---|---|

| Valuation | 4/6 |

| Future Growth | 1/6 |

| Past Performance | 2/6 |

| Financial Health | 4/6 |

| Dividends | 5/6 |

Rewards

Risk Analysis

No risks detected for MDT from our risk checks.

Community vs My Fair Value

Create NarrativeSelect a narrative for quick price alerts from the community, or create your own.

Medicare Approval Of RDN Technique Will Strengthen Future Prospects

Medtronic Stock: A Compelling Buy for Value and Income Investors as Robotics, Innovation Catalysts Ignite Upside to $105+

MDT Market Outlook

Medtronic plc Competitors

Price History & Performance

| Historical stock prices | |

|---|---|

| Current Share Price | US$88.86 |

| 52 Week High | US$96.25 |

| 52 Week Low | US$75.96 |

| Beta | 0.82 |

| 1 Month Change | -5.77% |

| 3 Month Change | 10.77% |

| 1 Year Change | 4.54% |

| 3 Year Change | -20.46% |

| 5 Year Change | -10.50% |

| Change since IPO | 60,969.23% |

Recent News & Updates

Medtronic: A Great Business, But With Low Growth

Mar 27Medtronic: Strength In Cardiac Ablation Solutions, Upgrade To Buy

Mar 20Recent updates

Medtronic: A Great Business, But With Low Growth

Mar 27Medtronic: Strength In Cardiac Ablation Solutions, Upgrade To Buy

Mar 20Weekly Picks: SOUN's moat, FVRR's big bets and MDT's advantage

Feb 19Weekly Picks: SOUN's moat, FVRR's big bets and MDT's advantage

Feb 19

Medtronic Stock: A Compelling Buy for Value and Income Investors as Robotics, Innovation Catalysts Ignite Upside to $105+

Feb 17Strengths and Competitive Advantages:Diverse Product Portfolio: Medtronic operates across four key segments—Cardiovascular, Medical-Surgical, Neuroscience, and Diabetes—providing revenue stability andMedtronic (NYSE:MDT) Has More To Do To Multiply In Value Going Forward

Feb 17Medtronic: Several Reasons For Optimism Before The Upcoming Earnings Release

Feb 15Medtronic: Undervalued But Underperforming - Why Innovation Isn't Enough To Lift The Stock

Feb 07We Think Medtronic (NYSE:MDT) Can Stay On Top Of Its Debt

Jan 20Medtronic: A Dividend Aristocrat That's Poised To Pop

Jan 06Investors Appear Satisfied With Medtronic plc's (NYSE:MDT) Prospects

Jan 06Medtronic Stock Is Still A Great "Buy"

Dec 26Medtronic (NYSE:MDT) Is Posting Promising Earnings But The Good News Doesn’t Stop There

Dec 03Medtronic Q3 Earnings: A Solid Performance, But Bottom Line Still Needs Fixing

Nov 19Medtronic (NYSE:MDT) Hasn't Managed To Accelerate Its Returns

Nov 08Medtronic: Undervalued But Trapped In Slow Growth (Rating Downgrade)

Oct 31Is It Time To Consider Buying Medtronic plc (NYSE:MDT)?

Oct 13Medtronic: Undervalued Dividend Aristocrat With High Margins

Oct 10An Intrinsic Calculation For Medtronic plc (NYSE:MDT) Suggests It's 33% Undervalued

Sep 30Medtronic (NYSE:MDT) Boosts FY 2025 Guidance Amid Strong Q1 Earnings and Strategic Share Buybacks

Sep 16Medtronic: An Undervalued Stock With Durable Competitive Advantages

Sep 16Medtronic (NYSE:MDT) Seems To Use Debt Quite Sensibly

Sep 05Medtronic: Is The Company Back?

Aug 26Medtronic: Still A Buy Before Earnings

Aug 17Returns At Medtronic (NYSE:MDT) Appear To Be Weighed Down

Aug 08Medtronic: An Out Of Favor Healthcare Stock With A Pulse On Profit Potential

Jul 16At US$77.06, Is Medtronic plc (NYSE:MDT) Worth Looking At Closely?

Jul 11Medtronic (NYSE:MDT) Is Paying Out A Larger Dividend Than Last Year

Jun 27Medtronic: Why I Disagree With The Crowd

Jun 14Medtronic's (NYSE:MDT) Upcoming Dividend Will Be Larger Than Last Year's

Jun 10Medtronic: Net Income Could Fall $3.38B, The Stock Would Still Be Undervalued

May 27Medtronic (NYSE:MDT) Has Announced That It Will Be Increasing Its Dividend To $0.70

May 26These 4 Measures Indicate That Medtronic (NYSE:MDT) Is Using Debt Reasonably Well

May 22Medtronic Stock Looks Promising Before Fiscal Q4 2024 Release

May 13Is Medtronic plc (NYSE:MDT) Trading At A 20% Discount?

May 0135% Undervalued? Medtronic's Future Looks Very Bright

Apr 12Medtronic: Buy This Dividend Aristocrat Diamond In The Rough Now

Mar 27Medtronic: Undervalued Medical Devices Stock With Robust Demand And Strong Dividend Growth

Mar 11

Innovations and Strategic Exits to Drive Profitability and Market Expansion

Feb 28Rapid product approvals and investment in robotics, AI, and closed-loop systems are poised to boost Medtronic's revenue by enhancing its portfolio and market competitiveness.Shareholder Returns

| MDT | US Medical Equipment | US Market | |

|---|---|---|---|

| 7D | 0.7% | -0.7% | -3.0% |

| 1Y | 4.5% | 5.0% | 7.5% |

Return vs Industry: MDT matched the US Medical Equipment industry which returned 5% over the past year.

Return vs Market: MDT underperformed the US Market which returned 7.5% over the past year.

Price Volatility

| MDT volatility | |

|---|---|

| MDT Average Weekly Movement | 3.7% |

| Medical Equipment Industry Average Movement | 8.6% |

| Market Average Movement | 6.4% |

| 10% most volatile stocks in US Market | 16.9% |

| 10% least volatile stocks in US Market | 3.2% |

Stable Share Price: MDT has not had significant price volatility in the past 3 months compared to the US market.

Volatility Over Time: MDT's weekly volatility (4%) has been stable over the past year.

About the Company

| Founded | Employees | CEO | Website |

|---|---|---|---|

| 1949 | 95,000 | Geoff Martha | www.medtronic.com |

Medtronic plc develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients worldwide. The Cardiovascular Portfolio segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; cardiac ablation products; insertable cardiac monitor systems; TYRX products; and remote monitoring and patient-centered software. It also provides aortic valves, surgical valve replacement and repair products, endovascular stent grafts and accessories, and transcatheter pulmonary valves; and percutaneous coronary intervention products, percutaneous angioplasty balloons, and other products.

Medtronic plc Fundamentals Summary

| MDT fundamental statistics | |

|---|---|

| Market cap | US$113.49b |

| Earnings (TTM) | US$4.26b |

| Revenue (TTM) | US$33.20b |

26.8x

P/E Ratio3.4x

P/S RatioIs MDT overvalued?

See Fair Value and valuation analysisEarnings & Revenue

| MDT income statement (TTM) | |

|---|---|

| Revenue | US$33.20b |

| Cost of Revenue | US$11.42b |

| Gross Profit | US$21.78b |

| Other Expenses | US$17.52b |

| Earnings | US$4.26b |

Last Reported Earnings

Jan 24, 2025

Next Earnings Date

May 21, 2025

| Earnings per share (EPS) | 3.32 |

| Gross Margin | 65.59% |

| Net Profit Margin | 12.83% |

| Debt/Equity Ratio | 53.5% |

How did MDT perform over the long term?

See historical performance and comparisonDividends

3.2%

Current Dividend Yield85%

Payout RatioDoes MDT pay a reliable dividends?

See MDT dividend history and benchmarks| Medtronic dividend dates | |

|---|---|

| Ex Dividend Date | Mar 28 2025 |

| Dividend Pay Date | Apr 11 2025 |

| Days until Ex dividend | 6 days |

| Days until Dividend pay date | 8 days |

Does MDT pay a reliable dividends?

See MDT dividend history and benchmarksCompany Analysis and Financial Data Status

| Data | Last Updated (UTC time) |

|---|---|

| Company Analysis | 2025/04/02 22:11 |

| End of Day Share Price | 2025/04/02 00:00 |

| Earnings | 2025/01/24 |

| Annual Earnings | 2024/04/26 |

Data Sources

The data used in our company analysis is from S&P Global Market Intelligence LLC. The following data is used in our analysis model to generate this report. Data is normalised which can introduce a delay from the source being available.

| Package | Data | Timeframe | Example US Source * |

|---|---|---|---|

| Company Financials | 10 years |

| |

| Analyst Consensus Estimates | +3 years |

|

|

| Market Prices | 30 years |

| |

| Ownership | 10 years |

| |

| Management | 10 years |

| |

| Key Developments | 10 years |

|

* Example for US securities, for non-US equivalent regulatory forms and sources are used.

Unless specified all financial data is based on a yearly period but updated quarterly. This is known as Trailing Twelve Month (TTM) or Last Twelve Month (LTM) Data. Learn more.

Analysis Model and Snowflake

Details of the analysis model used to generate this report is available on our Github page, we also have guides on how to use our reports and tutorials on Youtube.

Learn about the world class team who designed and built the Simply Wall St analysis model.

Industry and Sector Metrics

Our industry and section metrics are calculated every 6 hours by Simply Wall St, details of our process are available on Github.

Analyst Sources

Medtronic plc is covered by 65 analysts. 31 of those analysts submitted the estimates of revenue or earnings used as inputs to our report. Analysts submissions are updated throughout the day.

| Analyst | Institution |

|---|---|

| Kadambari Daptardar | Accountability Research Corporation |

| Harshit Gupta | Accountability Research Corporation |

| David Toung | Argus Research Company |