- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (NYSE:MDT) Boosts FY 2025 Guidance Amid Strong Q1 Earnings and Strategic Share Buybacks

Medtronic (NYSE:MDT) is currently navigating a landscape marked by both promising innovations and significant challenges. Recent developments, such as the company's strong performance in neuromodulation and strategic partnerships, highlight its growth potential, while operational inefficiencies and competitive pressures pose notable risks. In the discussion that follows, we will delve deeper into Medtronic's core strengths, critical weaknesses, strategic opportunities, and external threats to provide a comprehensive analysis of its market positioning and future outlook.

Click here to discover the nuances of Medtronic with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success for Medtronic

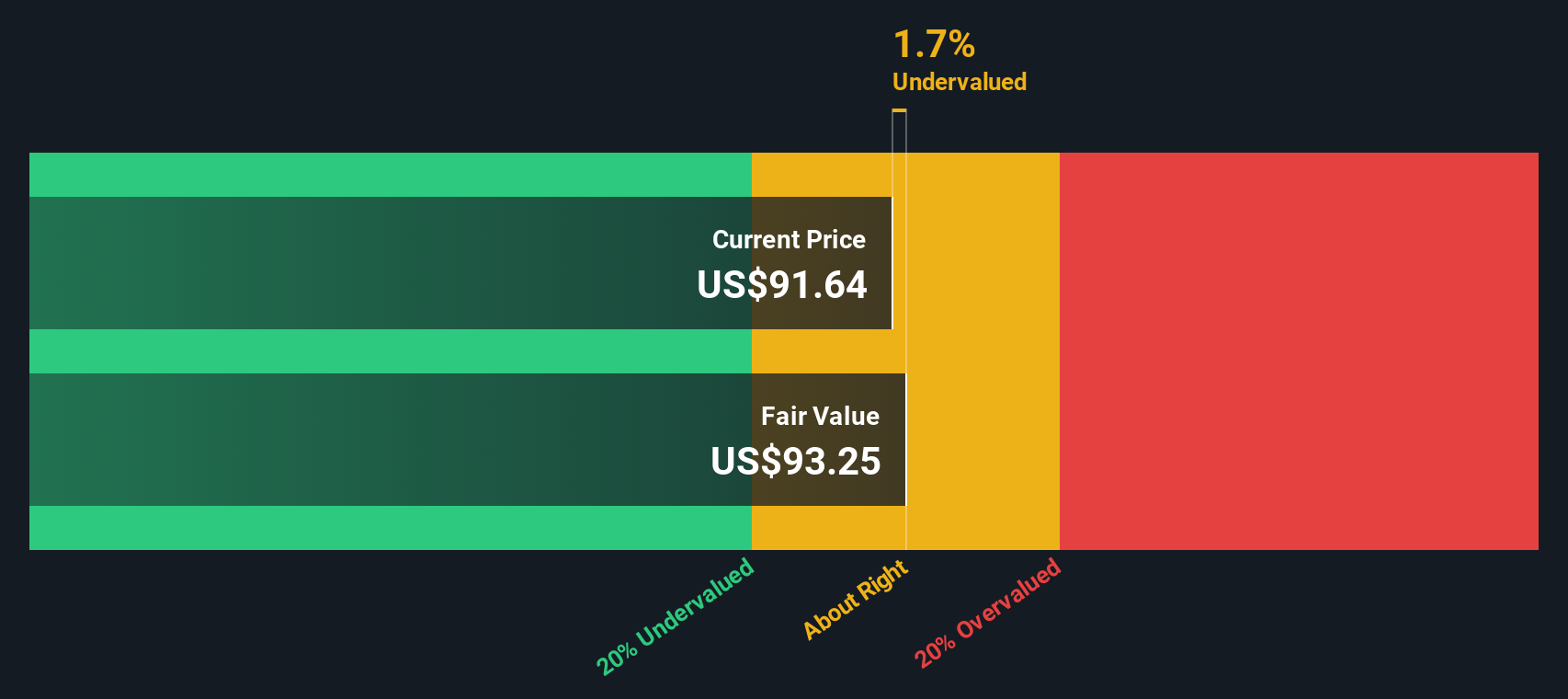

Medtronic's financial health is underpinned by consistent revenue and earnings growth. CEO Geoffrey Martha highlighted that the company has delivered mid-single-digit revenue growth for seven consecutive quarters, with earnings per share increasing by 8% on a constant currency basis. This growth is bolstered by Medtronic's diversified product pipeline, including innovations in diabetes management, pulse field ablation, and robotics. The company's strong market position is evident in its neuromodulation segment, which grew by 10%, outperforming the market. Additionally, Medtronic's management team is experienced, contributing to strategic stability and execution. Notably, Medtronic is trading at a price significantly below its estimated fair value of $133.47, indicating it may be undervalued compared to both industry and peer averages.

Weaknesses: Critical Issues Affecting Medtronic's Performance and Areas for Growth

Despite its strengths, Medtronic faces several challenges. The company's adjusted gross margin declined by 50 basis points to 65.9%, as noted by Interim CFO Gary Corona. This margin pressure, although ahead of expectations, highlights operational inefficiencies. Additionally, Medtronic's dependence on new product launches, such as the 780G in the diabetes segment, poses a risk if market adoption slows. The company's return on equity (ROE) is forecasted to be 14.9% in three years, which is considered low compared to the industry standard. Furthermore, Medtronic's earnings growth of 11.2% per year is slower than the US market average of 15.3%.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Medtronic has several strategic opportunities to enhance its market position. The company is focusing on securing broad reimbursement for its Symplicity blood pressure procedure, which could unlock significant market potential. Additionally, a global partnership with Abbott to bring an integrated CGM to market exemplifies Medtronic's strategy to leverage partnerships for growth. Emerging markets also present a robust growth avenue, with international markets growing in the high single digits and mid-teens growth in emerging markets, as highlighted by Corona. These initiatives, coupled with innovative technologies, position Medtronic to capitalize on emerging opportunities. Learn more about how these opportunities could impact Medtronic's future growth by reviewing our analysis of Medtronic's Future Performance.

Threats: Key Risks and Challenges That Could Impact Medtronic's Success

Medtronic faces significant external threats that could impact its growth and market share. The company is up against strong competition in the soft tissue space, as noted by Martha, which could erode its market position. Economic factors, such as unfavorable foreign exchange rates, are expected to impact fiscal 2025 by $110 million to $210 million, adding financial pressure. Regulatory risks also loom large, with ongoing engagements with CMS to establish coverage for new therapies. Additionally, operational risks, including potential capacity constraints, could disrupt supply chains and affect customer satisfaction. These external factors necessitate strategic vigilance to mitigate their impact on Medtronic's competitive positioning.

Conclusion

In conclusion, Medtronic's robust financial health, driven by consistent revenue and earnings growth, alongside its diversified product pipeline, positions the company for sustained success. However, challenges such as margin pressures and slower earnings growth compared to the US market highlight areas needing operational improvements and strategic focus. The company's strategic initiatives, including securing reimbursement for new procedures and expanding in emerging markets, present significant growth opportunities. Despite external threats like competition and economic factors, Medtronic's current trading price below its estimated fair value of $133.47 suggests that the market may not fully recognize its potential, offering a compelling case for future performance improvement and market revaluation.

Already own Medtronic? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients in the United States, Ireland, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives