- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (MDT) Valuation in Focus After Landmark FDA Approval Expands Bladder Control Portfolio

Reviewed by Kshitija Bhandaru

If you have been watching Medtronic (MDT) lately, the news out this week might have caught your eye. The company just landed U.S. FDA approval for its Altaviva tibial neuromodulation device, designed to treat urge urinary incontinence. This is a significant step, considering how tough it is to bring new, patient-friendly therapies to this space. With this approval, Medtronic is the only player with a complete lineup of neuromodulation treatments for bladder control, using a device that promises both simplicity and immediate results for patients when they leave the hospital.

This announcement adds fresh momentum to Medtronic’s stock, which has been gaining ground for most of the year. The shares are up just under 19% year to date and about 10% over the last year, reflecting optimism that goes beyond just this one device. Medtronic has also moved to separate its lower-margin diabetes unit to boost profitability, and the company continues its impressive streak of dividend increases, improving sentiment around long-term stability and growth.

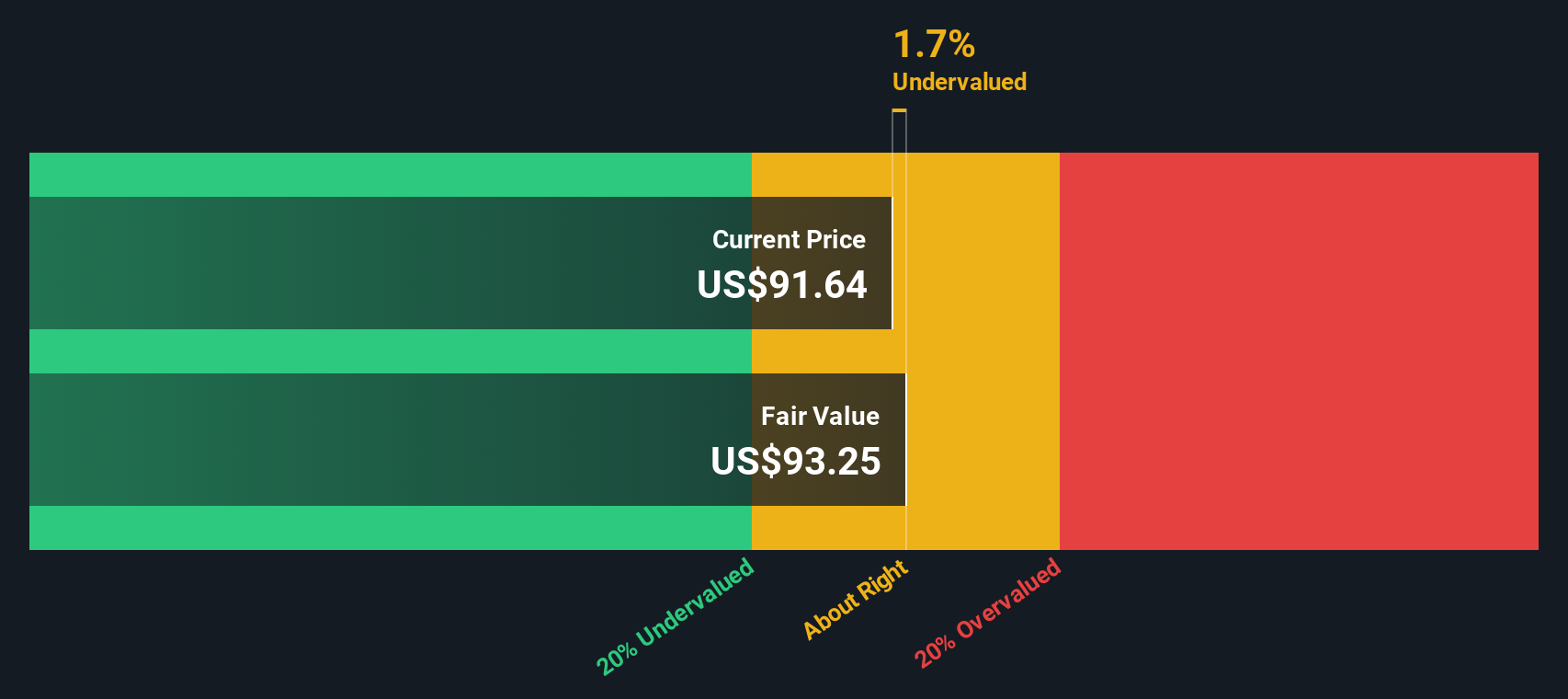

With major innovation now in the spotlight and shares climbing this year, is Medtronic still undervalued, or is the market already banking on robust future growth?

Most Popular Narrative: 10% Overvalued

According to the most widely followed narrative, Medtronic’s current valuation stands about 10% above its estimated fair value. This narrative weighs a blend of financial resilience and emerging growth catalysts, but signals the shares are trading at a modest premium versus underlying fundamentals.

Financial Resilience: Strong cash flow ($5.8B operating cash flow FY2023) supports a dividend yield of ~3.4%, with 46 consecutive years of dividend increases. This is a track record few medtech peers can match. Attractive valuation metrics (P/E ~16x vs. industry avg. ~20x) suggest undervaluation.

Curious about what’s pushing this fair value projection into premium territory? The narrative hints at impressive cash generation and global strategy, but there’s a big debate about future profit multiples that could surprise anyone tracking this stock. What drives the gap between market price and the narrative’s fair value? Is it sustained margins, breakthrough tech, or something else entirely?

Result: Fair Value of $95 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued delays in FDA approvals or intensified competition in diabetes care could quickly challenge the positive outlook for Medtronic’s valuation.

Find out about the key risks to this Medtronic narrative.Another View: Cash Flow Perspective

Stepping back from current market multiples, our DCF model suggests Medtronic might actually be trading just below its estimated fair value. This approach focuses on the company’s expected future cash flows, rather than price ratios. Which method tells a more accurate story: market signals or long-term fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medtronic Narrative

If you prefer to dive deeper and reach your own conclusions, you can assemble a personal take on the numbers in just a few minutes. Do it your way

A great starting point for your Medtronic research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Smart Move?

If you want to stay ahead of the crowd, don’t settle for obvious picks alone. Target new growth themes and possibilities with the right screeners today. You might just uncover your next best opportunity before everyone else even spots it.

- Capture income potential with reliable returns by checking out dividend payers offering yields above 3% in our dividend stocks with yields > 3%.

- Ride the momentum of artificial intelligence breakthroughs by finding cutting-edge contenders through our selection of AI penny stocks.

- Spot undervalued gems others overlook and act before the market catches up with our insights on undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients in the United States, Ireland, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives