- United States

- /

- Medical Equipment

- /

- NYSE:MDT

Medtronic (MDT) Expands MiniMed System To Type 2 Diabetes With FDA Approvals

Reviewed by Simply Wall St

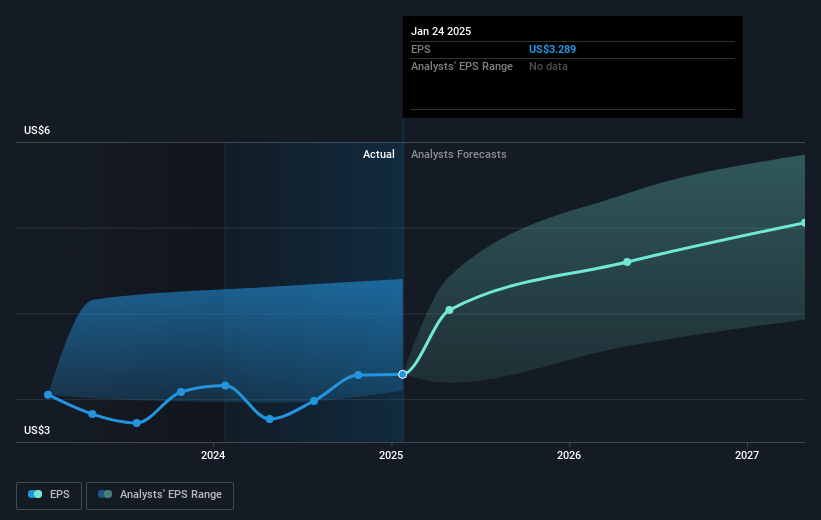

Medtronic (MDT) recently achieved significant FDA regulatory milestones with its MiniMed™ 780G system, notably enhancing its diabetes management capabilities. This advancement, along with Medtronic's consistent financial performance—evident in stable earnings and a 48-year streak of increasing dividends—aligned with an upward trend in tech stocks, contributed to the company's 9% share price gain last quarter. Despite market uncertainties, such as fluctuating treasury yields and varying economic indicators, Medtronic's innovative product developments and shareholder-friendly policies likely provided supportive momentum for its positive share performance amidst broader market trends.

We've spotted 1 possible red flag for Medtronic you should be aware of.

The recent FDA regulatory milestones for Medtronic's MiniMed™ 780G system are expected to reinforce its narrative of expanding its reach through robotics and digital health innovations. This strategic expansion is likely to support accelerated top-line growth and enhance Medtronic's market share, aligning with the narrative's emphasis on chronic disease management and technological advancements. Such developments may bolster revenue forecasts, potentially increasing from the current US$34.20 billion as the company leverages innovations in digital health and robotics. Earnings forecasts, expected to grow from US$4.66 billion, reflect these growth prospects.

Over the past three years, Medtronic has achieved a total shareholder return of 19.63%, indicating a healthy long-term performance despite recent market fluctuations. When comparing recent performance, Medtronic's shares have exceeded the US Medical Equipment industry over the past year, although they underperformed the broader US market, which grew 17.5%.

Currently, Medtronic's share price of US$93.33 is slightly below the consensus analyst price target of US$98.44, reflecting a 5.47% discount. This proximity suggests that analysts view Medtronic as fairly priced, considering its anticipated revenue growth and robust earnings potential. Investors may interpret the recent FDA advancements as reaffirming the company's future potential, possibly narrowing the gap to the price target over time.

Assess Medtronic's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MDT

Medtronic

Develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients in the United States, Ireland, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives