- United States

- /

- Healthcare Services

- /

- NYSE:MD

While shareholders of Pediatrix Medical Group (NYSE:MD) are in the black over 1 year, those who bought a week ago aren't so fortunate

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. To wit, the Pediatrix Medical Group, Inc. (NYSE:MD) share price is 55% higher than it was a year ago, much better than the market return of around 31% (not including dividends) in the same period. So that should have shareholders smiling. In contrast, the longer term returns are negative, since the share price is 44% lower than it was three years ago.

In light of the stock dropping 4.6% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for Pediatrix Medical Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Pediatrix Medical Group saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

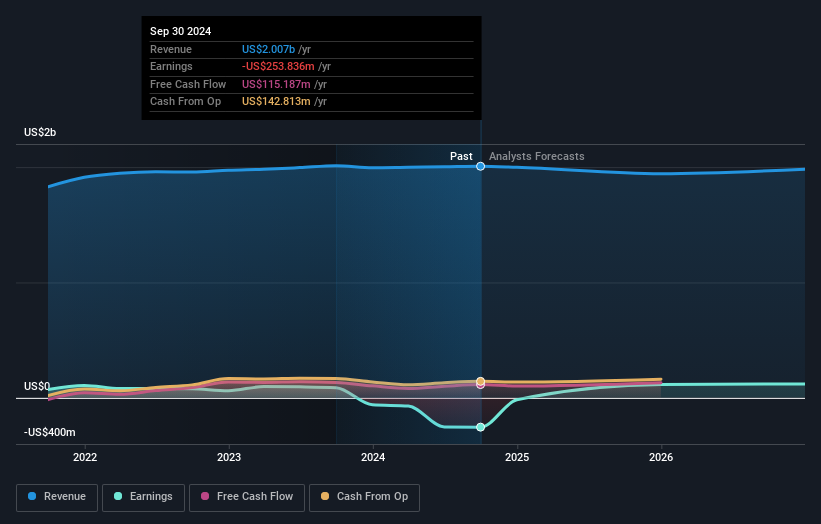

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Pediatrix Medical Group stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're pleased to report that Pediatrix Medical Group shareholders have received a total shareholder return of 55% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Pediatrix Medical Group , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MD

Pediatrix Medical Group

Provides newborn, maternal-fetal, pediatric cardiology, and other pediatric subspecialty care services in the United States.

Good value with adequate balance sheet.