- United States

- /

- Healthcare Services

- /

- NYSE:MCK

Should You Reassess McKesson After Its Double Digit Gains and CVS Collaboration in 2025?

Reviewed by Simply Wall St

Approach 1: McKesson Cash Flows

A Discounted Cash Flow (DCF) model is a classic way to estimate what a company is really worth by projecting its future cash flows and then discounting them back to today’s value. Put simply, this approach looks ahead at how much cash McKesson could generate in the future, brings those numbers to the present using a set discount rate, and lands on what the business might be intrinsically worth right now.

Currently, McKesson generates robust Free Cash Flow (FCF), with $5.7 billion produced over the last twelve months. Analysts expect this number to keep growing, projecting FCF to reach approximately $8.9 billion by 2035. This reflects a solid uptrend, with 10-year projections steadily increasing each year.

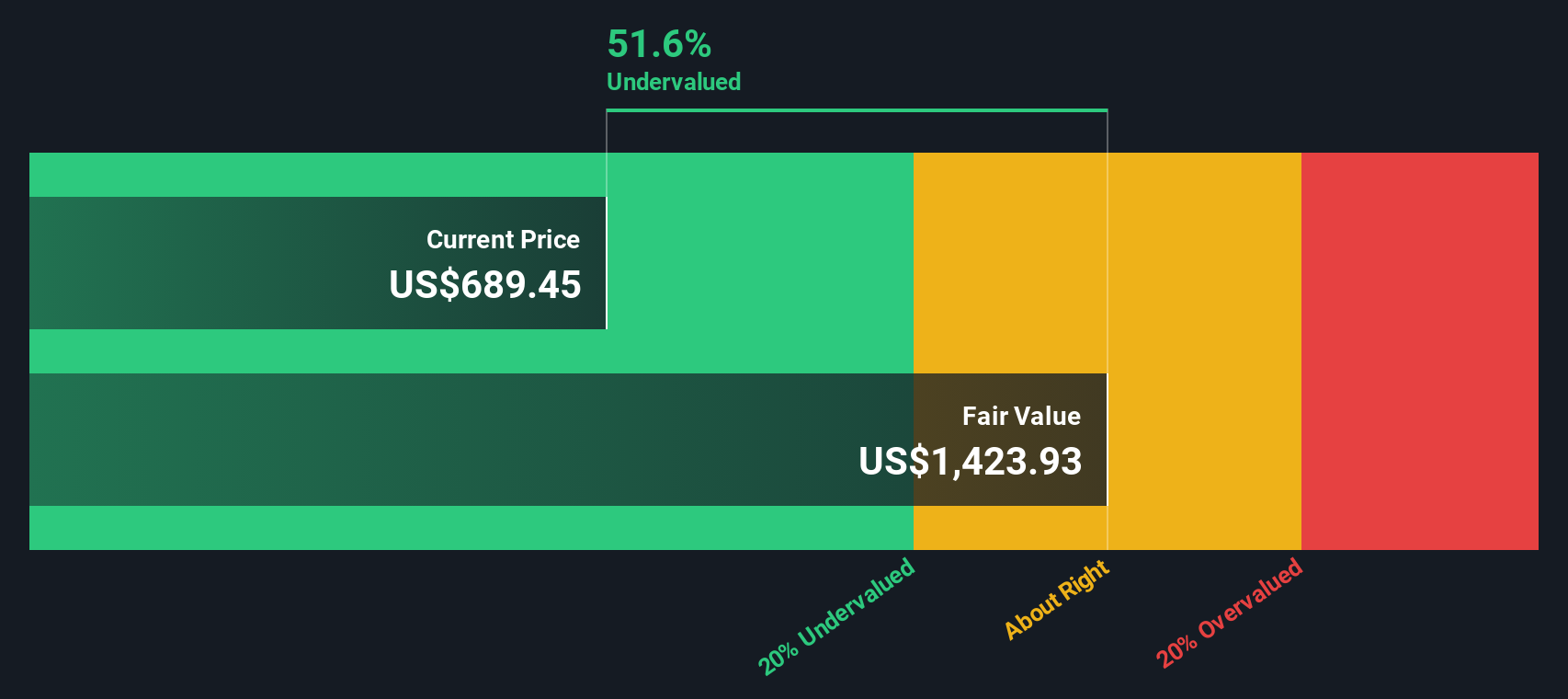

Using these figures in a two-stage Free Cash Flow to Equity model results in an estimated intrinsic value of $1,423.93 per share. This valuation suggests McKesson stock is trading at a significant 52.5% discount to its underlying worth. In other words, it may be considered 52.5% undervalued based on its long-term cash-generating potential.

For investors focused on the fundamentals, this DCF approach highlights considerable upside if those cash flows materialize as forecast.

Result: UNDERVALUED

Approach 2: McKesson Price vs Earnings

For profitable companies like McKesson, the Price-to-Earnings (PE) ratio is one of the most widely used tools for evaluating whether a stock is trading at a reasonable valuation. The PE ratio helps investors understand how much they are paying for each dollar of the company's earnings. This is especially useful when those earnings are consistent and reliable.

A "normal" or "fair" PE ratio depends on several factors, including a company’s expected growth rate and the level of risk investors are willing to accept. Higher anticipated growth or lower risk often justifies a higher PE ratio. Conversely, slower growth or more uncertainty may lead to lower multiples being considered appropriate.

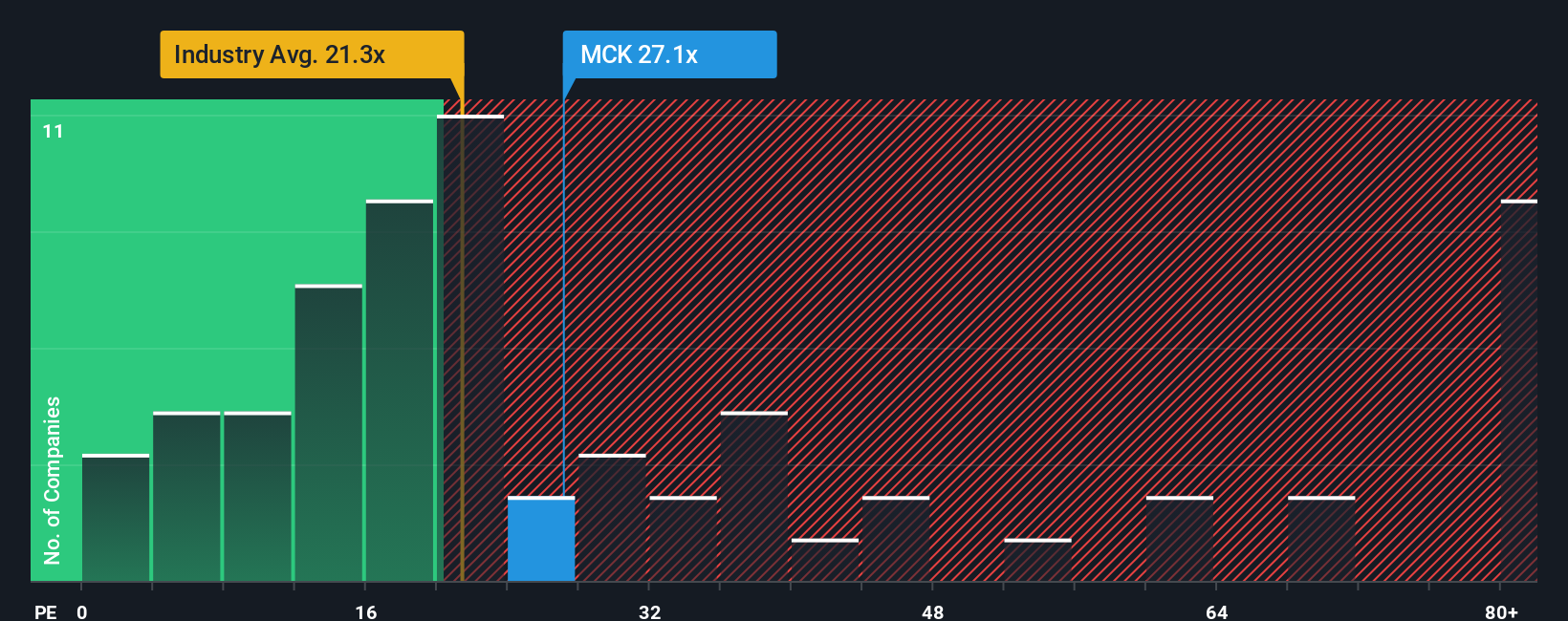

Looking at the numbers, McKesson currently trades at a PE ratio of 26.6x. This is above both the Healthcare industry average of 21.3x and the average PE ratio of close peers, which sits at 22.6x. However, Simply Wall St’s proprietary Fair Ratio for McKesson is 31.9x. This figure takes into account the company’s earnings growth prospects, its size, profit margins, and risks relative to industry norms.

With the Fair Ratio notably higher than McKesson’s current PE, this approach suggests that the stock may actually be undervalued relative to what its fundamentals warrant, even though it appears pricier than some industry benchmarks.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your McKesson Narrative

Beyond ratios and cash flow models, Narratives offer a smarter, more dynamic way to make investment decisions by connecting a company's story—your personal perspective, assumptions, and insights on its future—to its estimated fair value. A Narrative empowers you to weave together everything you know or believe about McKesson, from evolving healthcare demand and digital innovation to regulatory risks and shifting business models. You can then use those expectations to forecast future revenue, earnings, margins, and ultimately, what you think the shares are truly worth.

Within the Simply Wall St platform and investor community, Narratives are effortless to create and update. They provide you with an accessible tool that exists alongside millions of other perspectives. By constantly incorporating the very latest news and earnings data, your Narrative helps you instantly see how your fair value view compares with the current market price, clarifying whether it might be more appropriate to buy, hold, or sell.

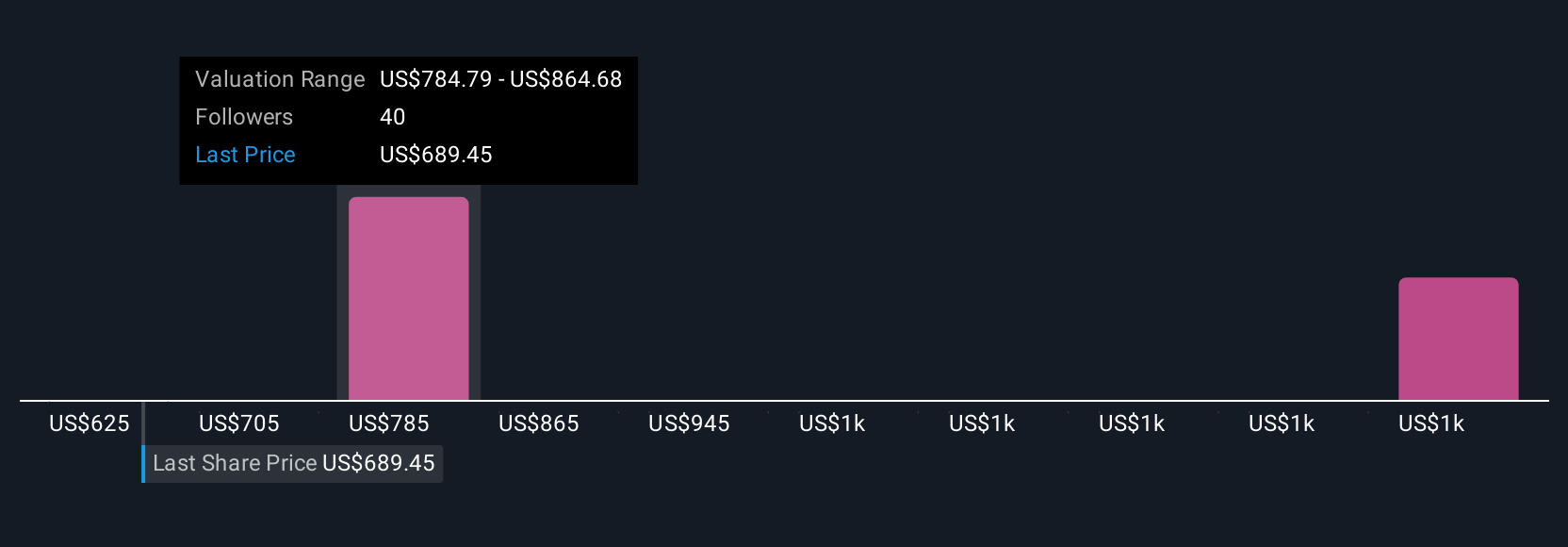

For example, even among professionals, one Narrative sees McKesson as worth as much as $830.00 per share thanks to optimism about pharmaceutical demand and automation. Another places fair value at $640.00 due to concerns over tighter regulation and industry disruption. The power of Narratives lies in making these differing perspectives crystal clear, letting you decide which story fits you best.

Do you think there's more to the story for McKesson? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives