- United States

- /

- Healthcare Services

- /

- NYSE:MCK

Does McKesson Stock Still Have Room to Grow After 38% Surge in 2025?

Reviewed by Bailey Pemberton

If you have been following McKesson lately, you have probably noticed the stock has been making headlines for its impressive performance. Just this past week alone, shares climbed 4.2%, adding to a 9.9% surge over the past month. Year-to-date, McKesson is up a remarkable 38.1%, and if you zoom out to the last five years, you will see a jaw-dropping 427.1% return. That kind of long-term momentum does not go unnoticed and has certainly gotten investors talking about whether the company’s share price still offers room to run or if things are getting a bit stretched.

It is not just short-term excitement. Much of this steady climb can be traced to broader healthcare sector trends and McKesson’s continued role as a crucial supply chain player meeting increased demand for pharmaceuticals and medical products. As investor confidence in the distribution side of healthcare has grown, so too has McKesson’s stock price, reflecting a shift in how the market views risk in this space.

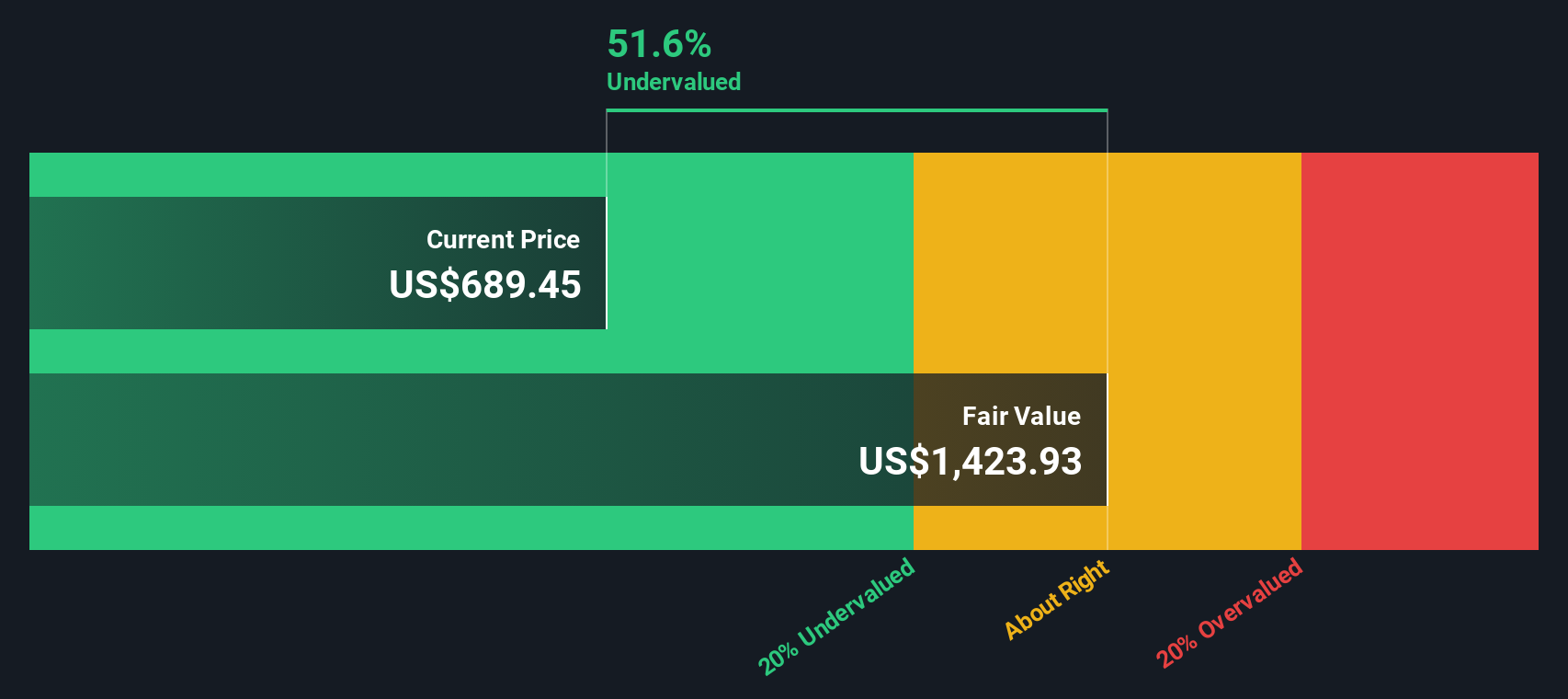

But just because a stock has run up, that does not automatically mean it is overvalued. If you are like most investors, you want a clear sense of whether there is still value left on the table, or if you are chasing returns. That is where valuation analysis comes in. For McKesson, our standard approach adds up to a value score of 3 out of 6, meaning it screens as undervalued on half of our key metrics.

Of course, no single score tells the whole story. Let us dig into how each of these valuation checks works. Stick around, because by the end we will tackle an even smarter way to think about what McKesson is really worth.

Approach 1: McKesson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model provides a fundamental approach to estimating a company’s value by projecting its future cash flows and discounting them back to their present worth. This method is widely used to determine if a stock’s current price reflects its underlying business performance and future earning potential.

For McKesson, the DCF analysis begins with a strong base. Its latest twelve-month free cash flow stands at $5.7 billion. Analysts project steady growth over the next five years, with free cash flow expected to reach about $7.0 billion by the year ending March 2030. While initial estimates are backed by analyst forecasts, projections beyond that point are carefully extrapolated, helping to map out the company’s long-term potential.

Using the 2 Stage Free Cash Flow to Equity model, the calculated intrinsic fair value is $1,366 per share. The current market price reflects a 42.8% discount to this estimated value, and the model indicates that McKesson shares are trading well below what future cash generation would suggest.

In summary, this DCF approach highlights substantial upside and confirms that McKesson is attractively valued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McKesson is undervalued by 42.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

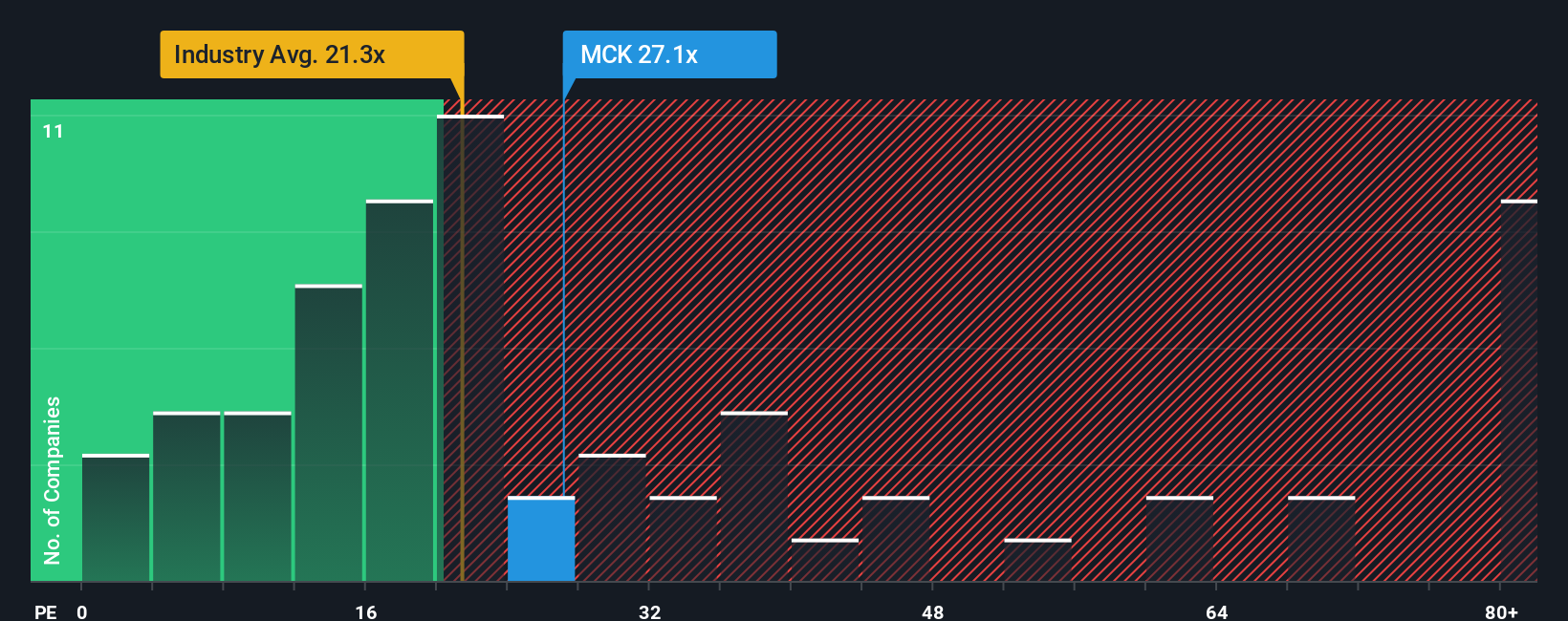

Approach 2: McKesson Price vs Earnings

For established, profitable companies like McKesson, the Price-to-Earnings (PE) ratio remains one of the most widely used metrics to evaluate valuation. The PE ratio helps investors quickly gauge how much they are paying for a dollar of current earnings, which makes it particularly useful for businesses with stable and growing profits.

Of course, what counts as a “fair” PE ratio depends on both growth expectations and the risks involved. Companies with stronger growth prospects generally command higher PE multiples. Those facing more risk or cyclical headwinds tend to see lower ratios. For context, McKesson currently trades at a PE of 30.7x. That is well above the healthcare industry average of 20.8x and its peer group average of 23.0x. This reflects the market’s recognition of McKesson’s strong recent performance and the expectation that this growth will likely continue.

Simply Wall St’s Fair Ratio for McKesson is calculated at 31.1x. Unlike a simple industry or peer comparison, the Fair Ratio takes into account not just the company’s current growth, but also its profit margins, scale, risk profile, industry norms, and market cap. This proprietary calculation provides a more tailored and meaningful benchmark for today’s valuation than raw comparisons alone.

Comparing McKesson’s actual PE of 30.7x with its Fair Ratio of 31.1x, the numbers are remarkably close. This suggests the stock is priced about right based on its fundamentals, growth outlook, and risk profile at this point in time.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

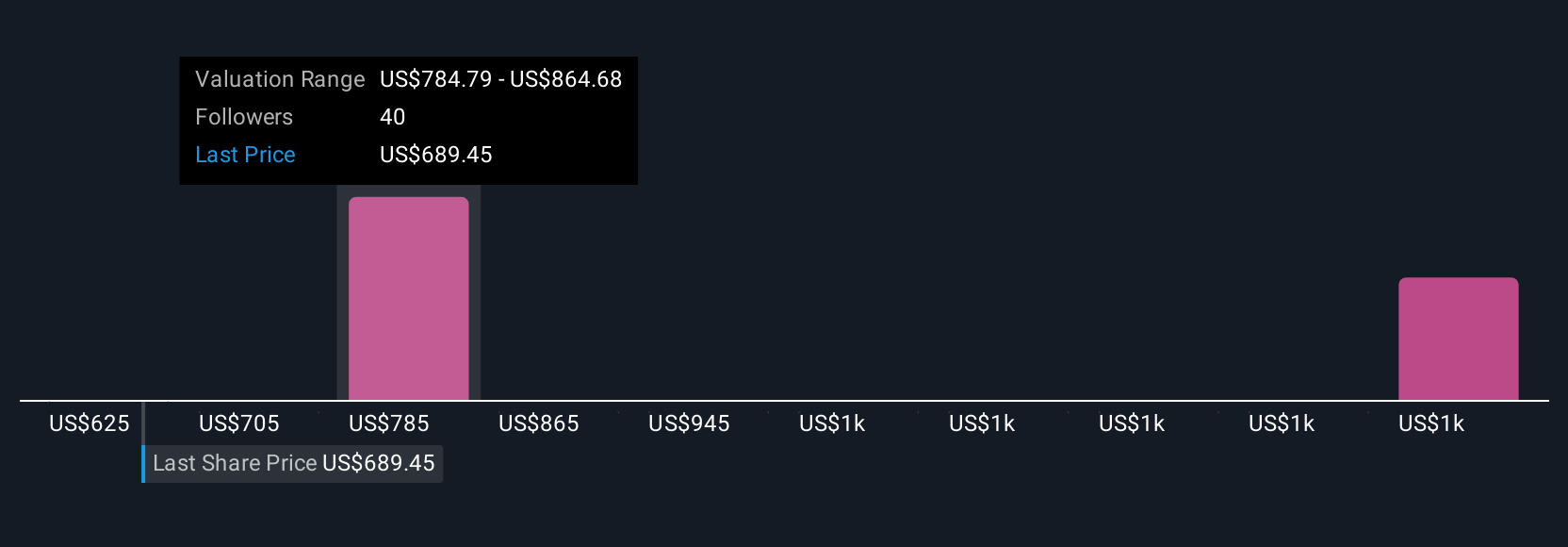

Upgrade Your Decision Making: Choose your McKesson Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. In essence, a Narrative is your opportunity to connect the story you believe about a company, such as your own expectations for McKesson’s future revenue, profit margins, and business catalysts, to the numbers behind fair value calculations. Instead of just relying on static ratios, Narratives allow you to articulate why you think McKesson will outperform or face challenges, map that perspective into a tailored financial forecast, and see a fair value that truly matches your outlook.

Narratives are available as a simple and dynamic tool on Simply Wall St’s Community page, used by millions of investors. With Narratives, you can identify if today’s price offers an opportunity or if the stock looks expensive by aligning your story with updated fair value estimates. The platform automatically updates your Narrative whenever new information, such as news, earnings, or company guidance, comes in, so your valuation always reflects the latest context.

For example, some investors believe McKesson will benefit from strong pharmaceutical demand and digital automation, supporting a fair value as high as $830 per share. Others worry about regulation and competition, leading to estimates as low as $640. This shows how Narratives capture diverse perspectives in real time.

Do you think there's more to the story for McKesson? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCK

McKesson

Provides healthcare services in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives