- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

How Strong Q2 2025 Earnings Growth at Integer Holdings (ITGR) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Integer Holdings Corporation recently reported its second quarter 2025 financial results, with sales rising to US$476.49 million and net income increasing to US$37.01 million compared to the prior year period.

- This performance reflects stronger year-over-year quarterly growth, even as six-month net income figures lag behind those reported last year.

- We'll explore how Integer Holdings' higher quarterly earnings, including improved earnings per share, may influence its outlook and investment thesis.

Integer Holdings Investment Narrative Recap

To be a shareholder in Integer Holdings, you'd need confidence in the company’s ability to drive consistent sales and earnings growth, whether from high demand in medical markets, successful integration of acquisitions, or improved margins. The latest quarterly results show stronger earnings per share and revenue, but this uptick does not substantially change the immediate focus on delivering organic sales growth or reduce the ongoing risk of acquisition performance and integration challenges. Among recent developments, the addition of Michael Coyle to the board in July 2025 stands out. Bringing decades of industry experience, his appointment may support continued execution on operational and growth objectives, which ties directly to the company’s central catalyst of capturing new opportunities in medical device manufacturing. Yet, despite these positive signals, investors should be aware that unlike recent improvements, the ongoing integration risk related to acquisitions remains...

Read the full narrative on Integer Holdings (it's free!)

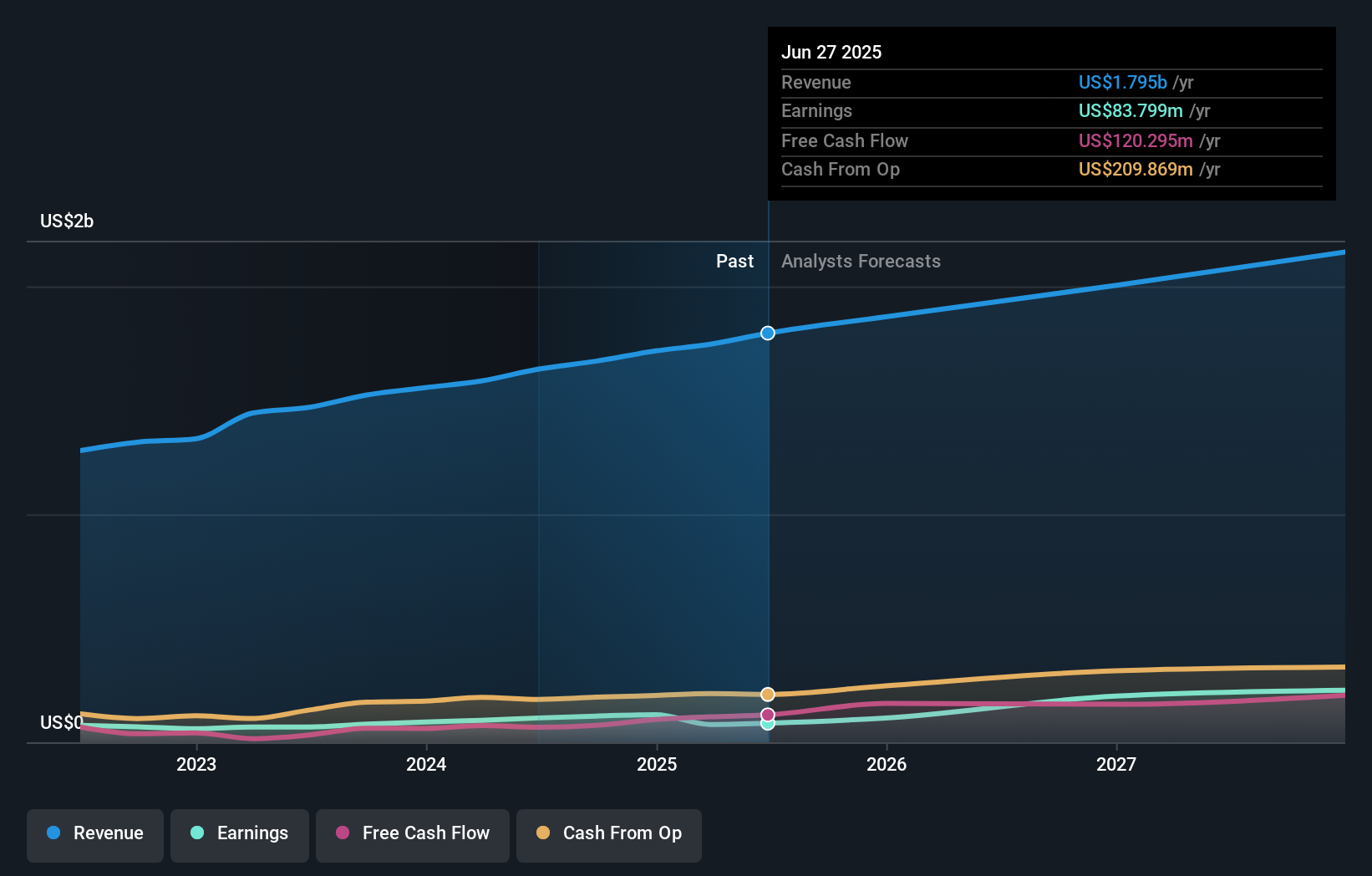

Integer Holdings' outlook forecasts $2.2 billion in revenue and $289.1 million in earnings by 2028. This scenario assumes a 7.6% annual revenue growth rate and an increase in earnings of $211.1 million from the current $78.0 million.

Exploring Other Perspectives

Two Simply Wall St Community members estimate Integer Holdings’ fair value between US$148.75 and US$158.40 per share. While some focus on growth and successful acquisition outcomes, others watch for continued execution risk that could affect future earnings, highlighting the importance of considering several viewpoints before making decisions.

Build Your Own Integer Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Integer Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Integer Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Integer Holdings' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives