- United States

- /

- Medical Equipment

- /

- NYSE:INSP

Assessing Inspire Medical Systems After 60% Share Price Drop and Medicare Expansion News

Reviewed by Bailey Pemberton

If you're on the fence about what to do with Inspire Medical Systems stock, you're not alone. After a steep fall from its highs, the stock closed most recently at $76.37. Even with a modest 1.0% gain in the past week, the journey over the last year has been rough: down 11.7% in the last month, off a massive 59.6% year-to-date, and sinking 63.1% over the last twelve months. Such price moves have naturally shifted how investors perceive both the risk and future potential of Inspire Medical Systems, especially given the shifting market landscape for innovative medical technologies.

Now, you might be wondering if all this turbulence means there could finally be some undervalued opportunity here. According to our valuation score, a metric where one point is earned for each of six undervalued criteria, the company checks just two boxes, giving it a value score of 2. That's worth digging into, because with numbers like these, whether you see a turnaround play or lingering risk depends on how you look at valuation.

So let's dive into the main valuation methods investors use and explore what they reveal about Inspire Medical Systems. If you want an even deeper understanding of how to judge the company's true worth, stick around, because we'll wrap up with a smarter way to look beyond standard valuation metrics.

Inspire Medical Systems scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Inspire Medical Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's present value by projecting its future cash flows and discounting them back to today's dollars. This helps investors gauge what a company might be worth, independent of market noise.

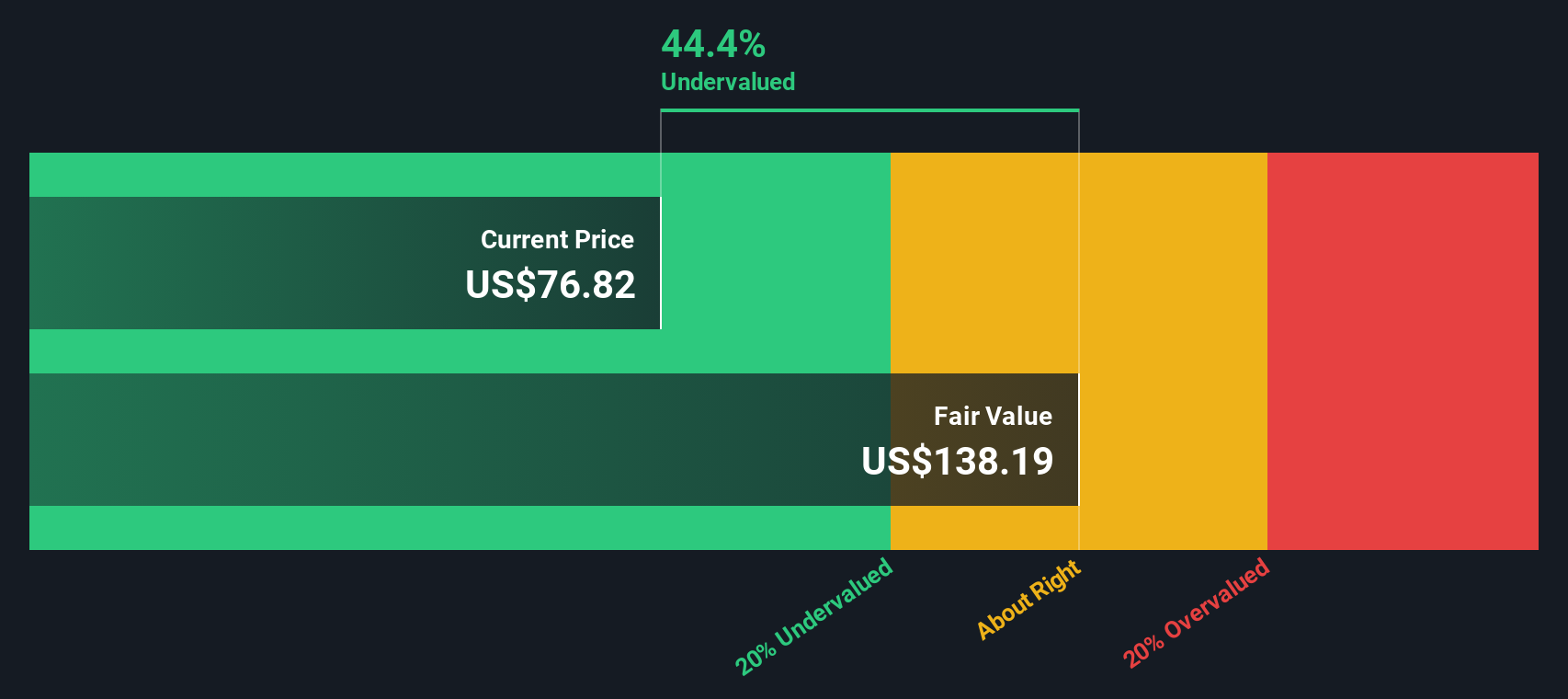

For Inspire Medical Systems, DCF analysis starts with its current Free Cash Flow, which stands at $81.8 million. Over the next ten years, analysts and projections anticipate this figure to grow steadily, reaching about $236.3 million in 2035. While precise analyst forecasts cover only the next five years, further growth projections are mathematically extrapolated to reflect a plausible path forward based on current trends.

After crunching these cash flows, the DCF valuation model indicates an intrinsic value of $138.19 per share. Compared to the latest share price of $76.37, this implies the stock trades at a significant discount, about 44.7 percent below its calculated fair value.

Put simply, the DCF model suggests Inspire Medical Systems appears undervalued at current levels, especially if long-term cash flow growth plays out as forecasted.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Inspire Medical Systems is undervalued by 44.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Inspire Medical Systems Price vs Earnings

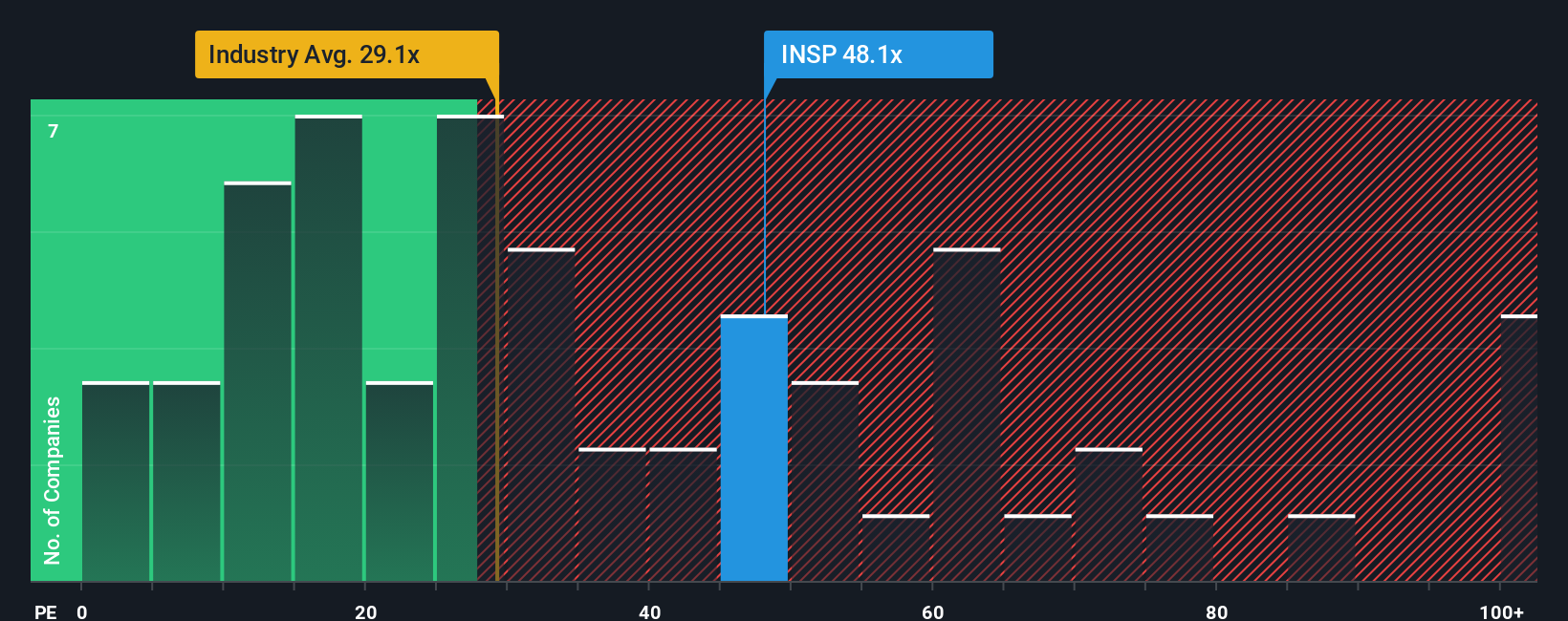

For companies with consistent profitability, the Price-to-Earnings (PE) ratio is a widely used metric to assess valuation because it directly relates a company's market value to its earnings power. It helps investors understand how much they are paying for each dollar of future profit. This is especially relevant for mature, profit-generating businesses like Inspire Medical Systems.

The "normal" or fair PE ratio for any stock is heavily influenced by its expected growth and potential risks. Fast-growing companies often command a higher PE as investors are willing to pay more today for better future earnings. Conversely, companies facing higher risks, slower growth, or industry headwinds tend to have a lower fair PE.

Currently, Inspire Medical Systems trades at a PE ratio of 42.52x. This is above the industry average of 30.61x and slightly above the peer average of 40.72x. However, these benchmarks only show part of the picture because they do not fully account for Inspire's specific prospects, risk profile, and market positioning.

That is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated at 35.99x for Inspire, is designed to factor in earnings growth expectations, profit margins, industry dynamics, market cap, and relevant risks. By doing so, it offers a more tailored benchmark than simply looking at the industry or peer group.

Since Inspire's current PE of 42.52x is higher than its Fair Ratio of 35.99x, this suggests the stock is trading at a premium relative to what would be justified by its fundamentals and outlook. Investors are paying extra for potential or perceived growth, making the stock look overvalued by this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Inspire Medical Systems Narrative

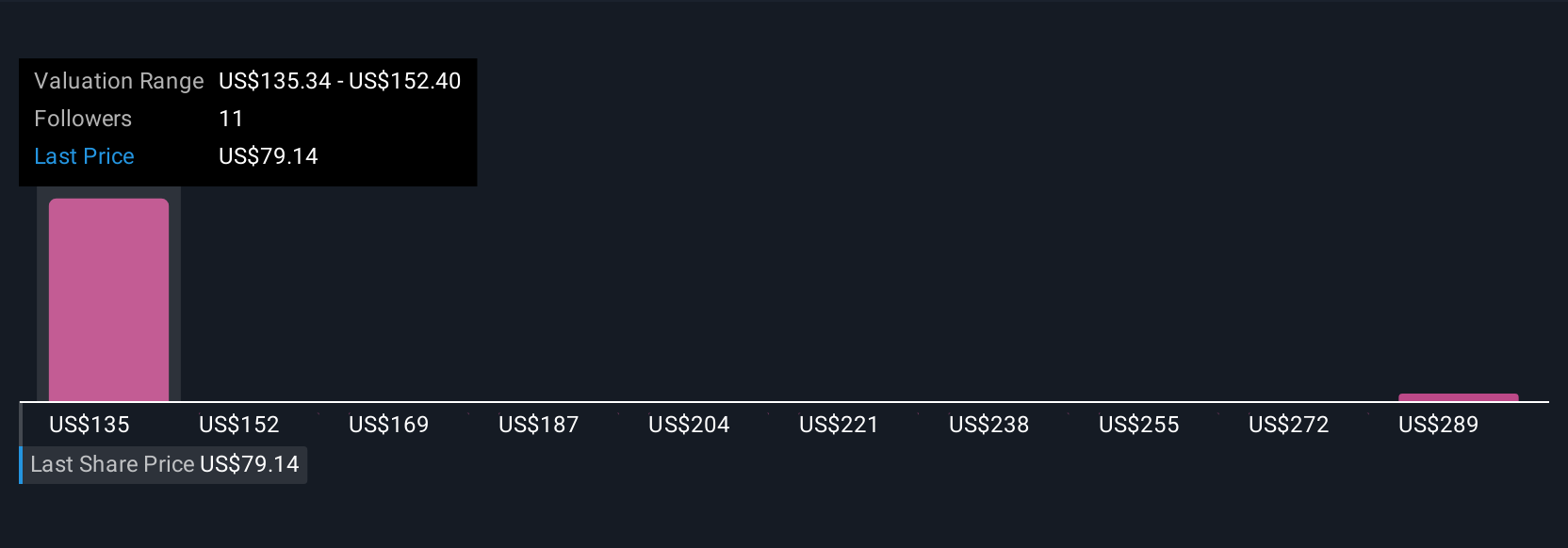

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is a simple, powerful approach that lets you connect your unique story about a company, your big-picture beliefs about its future, with concrete forecasts for revenue, earnings, margins, and ultimately, a fair value estimate. Narratives bridge qualitative factors, such as management moves or disruptive technology, with the numbers, helping you see how your perspective translates to valuation.

Available in the Simply Wall St Community page and used by millions, Narratives make smart investing more accessible by letting you clearly document the "why" behind your numbers, update assumptions as news breaks or earnings are released, and compare your fair value to the current market price to guide your buy or sell decisions.

For example, with Inspire Medical Systems, one Narrative might assume procedure improvements and expanding Medicare access will unlock strong growth, arriving at a fair value of $230 per share. Another Narrative might focus on operational delays or industry risks, leading to a fair value as low as $97. Narratives update dynamically as new information emerges, letting you easily adjust your view and track how your investment thesis evolves over time.

Do you think there's more to the story for Inspire Medical Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSP

Inspire Medical Systems

A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives