- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Humana (NYSE:HUM) Launches US$250 Million Fixed-Income Offering

Reviewed by Simply Wall St

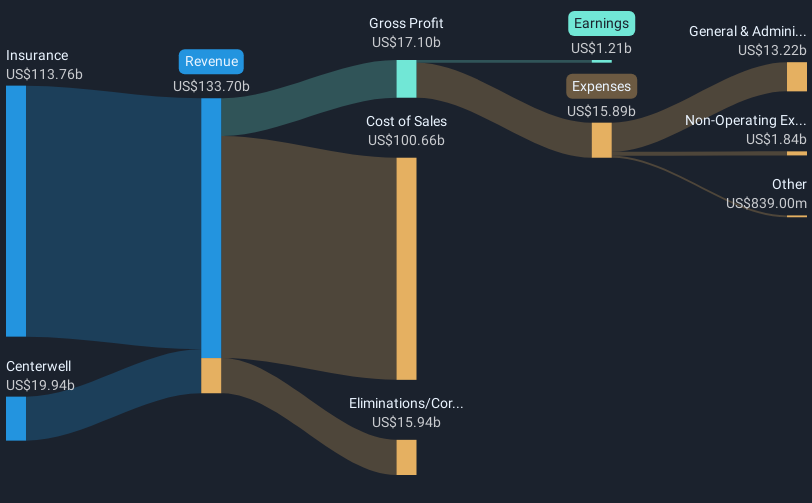

Humana (NYSE:HUM) recently announced a significant Fixed-Income Offering valued at approximately $250 million, alongside a partnership between CenterWell and Icon Health to enhance senior care. These developments coincide with a notable 18% increase in Humana's share price over the past month, contrasting with the overall market's 5% rise during the same period. While the market's positive trend may have offered a supportive backdrop, Humana’s distinct initiatives in refining its financial structure and expanding healthcare services likely reinforced investor confidence, distinguishing the company's stock movement from broader market averages.

Be aware that Humana is showing 2 risks in our investment analysis.

The recent developments at Humana, including the Fixed-Income Offering and partnership with Icon Health, are likely to bolster the company's strategy of optimizing operations and focusing on profitable segments. These initiatives could enhance operational efficiencies and support a more favorable revenue and earnings outlook. Analysts expect Humana's revenue to grow annually at 5.8%, with earnings anticipated to reach US$2.4 billion by April 2028. The recent share price increase could suggest that investors see potential alignment with these forecasts, bringing it closer to the consensus analyst price target of US$305.42, which is approximately 5.2% higher than the current price of US$281.95.

Over the past year, Humana's total return, including dividends, was a decline of 4.48%, underperforming the broader US Market's 3.6% gain and the US Healthcare industry's 13.6% increase. Despite the recent news and stock price movements, the company's longer-term performance highlights challenges it faces in sustaining competitive growth relative to its peers. Maintaining a competitive edge in Medicare Advantage and managing regulatory pressures remain critical for offsetting such headwinds as rising drug costs and healthcare system complexities. These factors will ultimately influence whether Humana can meet or exceed analyst expectations and improve its valuation position against projected industry dynamics.

Evaluate Humana's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives