- United States

- /

- Healthcare Services

- /

- NYSE:HUM

Humana (HUM): Exploring Valuation Following Recent Share Price Stability

Reviewed by Kshitija Bhandaru

Humana (HUM) shares showed little movement today, bouncing back slightly after their recent dip this month. Investors are watching to see if the healthcare giant's fundamentals will drive further upside, as the stock tries to regain momentum.

See our latest analysis for Humana.

After a choppy few weeks, Humana’s share price has barely budged from where it started the year, as recent investor caution follows a lackluster longer-term performance. The company’s one-year total shareholder return sits just above break-even, reflecting muted momentum compared to its historical highs.

If you’re considering what else is shaping the healthcare landscape, it’s worth exploring new opportunities using our dedicated screener: See the full list for free.

Yet with Humana’s muted long-term returns and only modest growth in revenues and profits, the key question emerges: are investors overlooking an undervalued healthcare contender, or has the market already factored in all future gains?

Most Popular Narrative: Fairly Valued

Humana’s most widely tracked narrative pegs its fair value close to today’s price, signaling that analysts see little room for dramatic mispricing. This perspective considers Humana’s growth drivers, profit trajectory, and risk factors in the calculations behind its valuation.

The analysts have a consensus price target of $298.955 for Humana based on their expectations of its future earnings growth, profit margins, and other risk factors. However, there is a degree of disagreement among analysts, with the most bullish reporting a price target of $353.0 and the most bearish reporting a price target of just $250.0.

The real story is hidden in a complex mix of robust revenue acceleration and a future profit margin shift that could reshape Humana’s worth. The underlying question is how much those optimistic earnings forecasts and a sharply lower valuation multiple can influence consensus on the company's potential. Want to see the specific assumptions driving this midpoint valuation? Dive in and discover which projections tip the balance.

Result: Fair Value of $292.87 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and shifts in Medicare Advantage star ratings still present challenges. These factors could quickly alter Humana's growth outlook.

Find out about the key risks to this Humana narrative.

Another View: Discounted Cash Flow Signals Upside

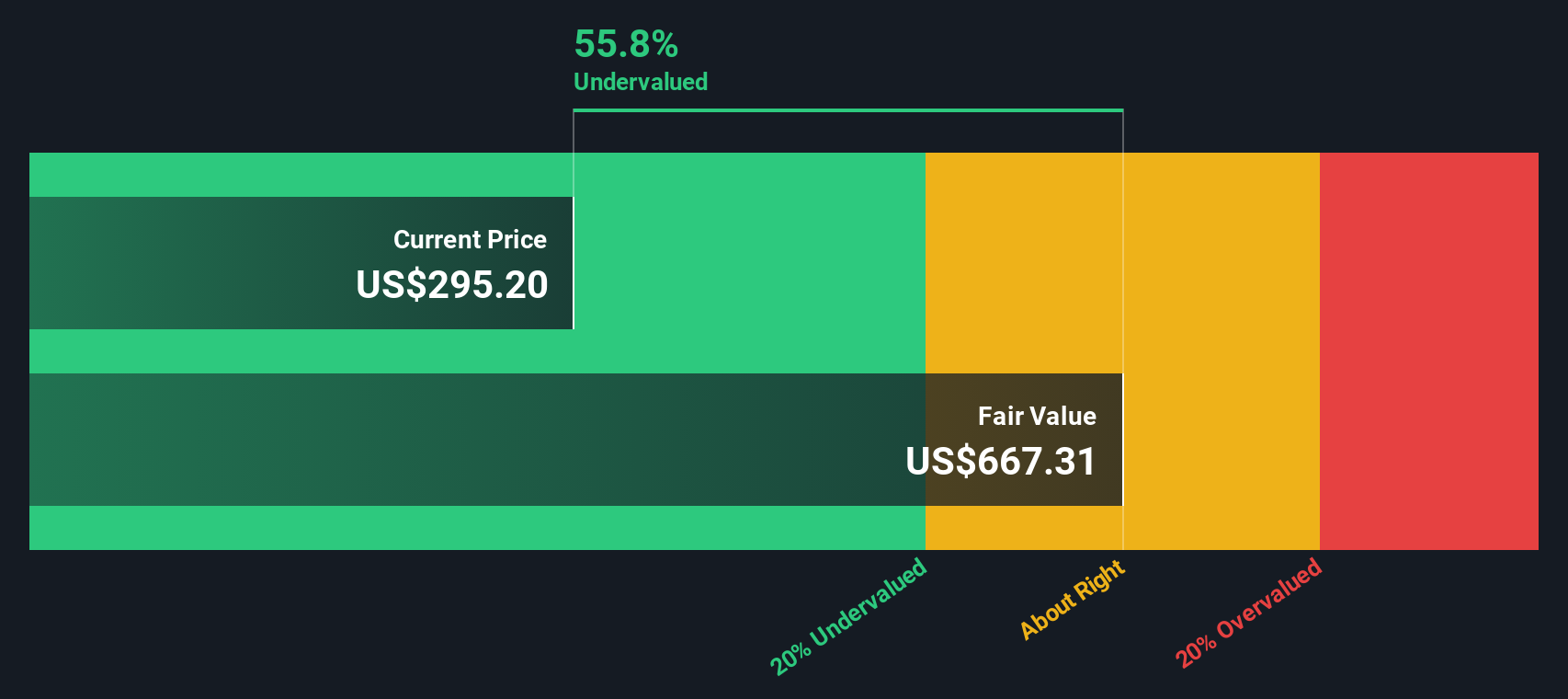

While analysts see Humana as fairly valued using traditional methods, our SWS DCF model takes a different stance. This approach estimates Humana’s intrinsic value at $667.31 per share, which suggests it could be deeply undervalued at current levels. Could the market be underestimating its long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Humana for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Humana Narrative

If you have a different perspective or want to draw your own conclusions from Humana’s numbers, you can quickly craft a personalized narrative in just minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Humana.

Looking for more investment ideas?

Move beyond familiar stocks and energize your portfolio by seeking out truly fresh opportunities in today’s market. The right screener could point you toward a potential winner before the crowd catches on.

- Boost your income potential by targeting strong payouts. Start with these 19 dividend stocks with yields > 3% delivering reliable yields over 3% and solid financial health.

- Get ahead of the curve with these 25 AI penny stocks at the forefront of artificial intelligence innovation, transforming industries and creating new growth frontiers.

- Step into tomorrow’s technology now by checking out these 26 quantum computing stocks where pioneers in quantum computing are redefining what is possible in computing power and security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUM

Humana

Provides medical and specialty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives