- United States

- /

- Healthcare Services

- /

- NYSE:HNGE

Is It Too Late to Consider Hinge Health After Its Strong 2025 Share Price Rally?

Reviewed by Bailey Pemberton

- If you are wondering whether Hinge Health is still worth buying at today’s price, you are not alone. The stock has quickly moved onto many investors’ watchlists and is begging for a closer look at its underlying value.

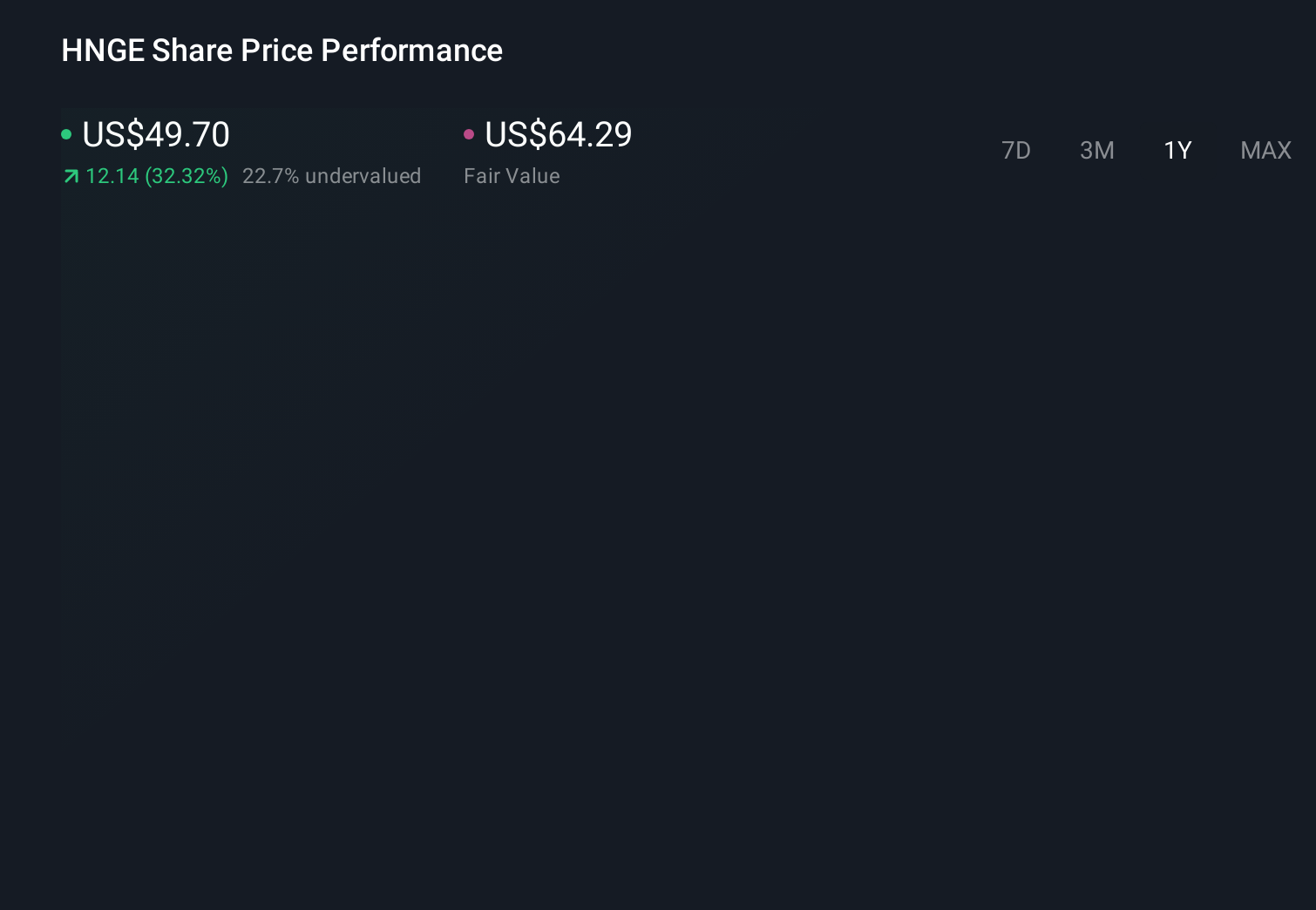

- After rallying about 7.5% over the last week and 11.7% over the past month, Hinge Health is now up roughly 31.7% year to date. This is the kind of move that often forces investors to ask whether the market is getting ahead of itself or finally catching up.

- Recent headlines have highlighted Hinge Health’s growing presence in digital musculoskeletal care, including new employer partnerships and expanded coverage with health plans, which help explain the renewed optimism baked into the share price. Investors are focusing on how these contracts could scale over time and potentially justify the recent run up if the company executes well.

- On our checklist of six core valuation tests, Hinge Health scores a 4/6 valuation score, suggesting it looks undervalued on several but not all fronts. In the next sections we will unpack those methods in detail while also exploring a more nuanced way to think about what the stock is really worth.

Approach 1: Hinge Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to a present value. For Hinge Health, the model uses a 2 Stage Free Cash Flow to Equity approach based on projected dollar free cash flows.

The company generated roughly $145.9 million in free cash flow over the last twelve months, and analysts expect this figure to keep expanding as the business scales. Projections, which combine analyst estimates for the next few years and longer term extrapolations by Simply Wall St, indicate free cash flow could reach about $507.5 million by 2035, with interim milestones such as $356 million in 2029.

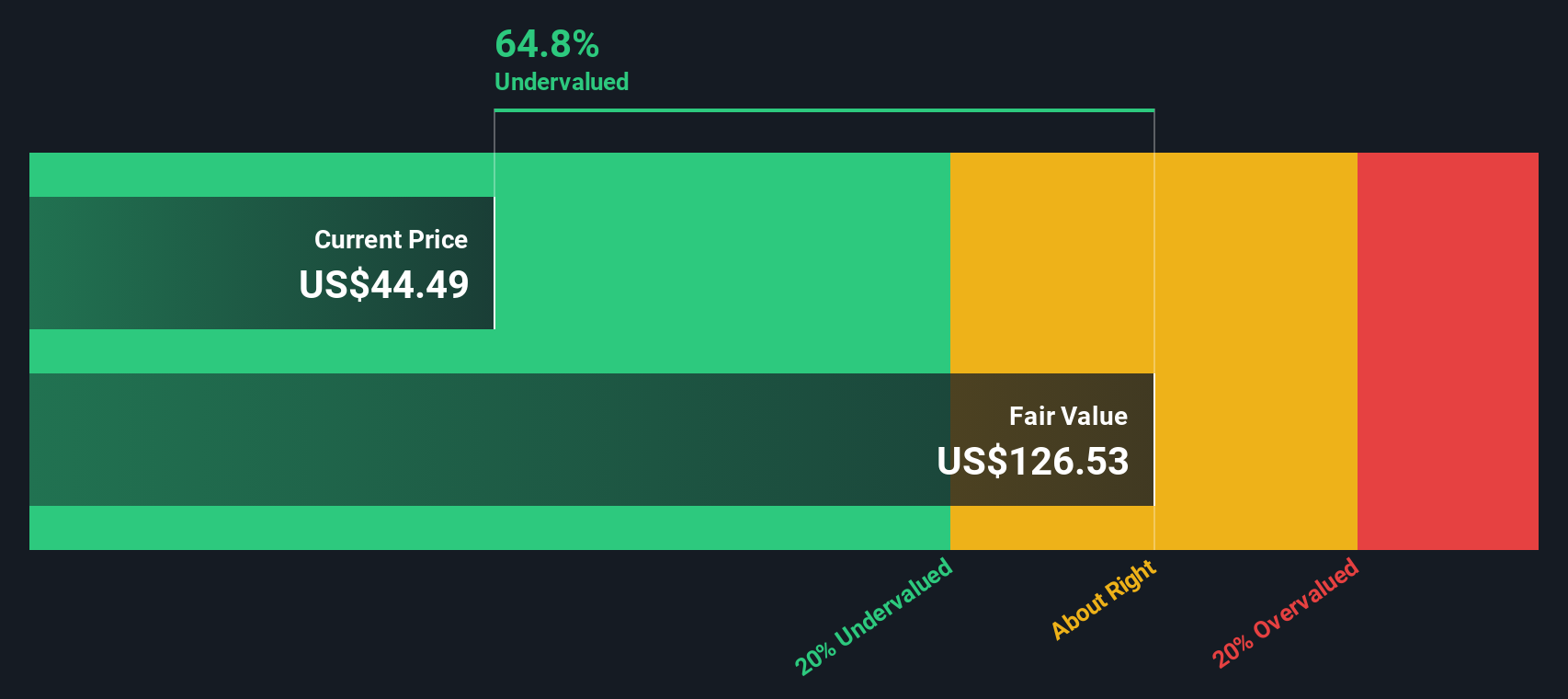

When these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $122.72 per share. Compared with the current share price, this implies the stock is trading at a 59.7% discount, which the analysis interprets as significantly undervalued on cash flow grounds.

Result: UNDERVALUED (based on this DCF model)

Our Discounted Cash Flow (DCF) analysis suggests Hinge Health is undervalued by 59.7%. Track this in your watchlist or portfolio, or discover 900 more undervalued stocks based on cash flows.

Approach 2: Hinge Health Price vs Sales

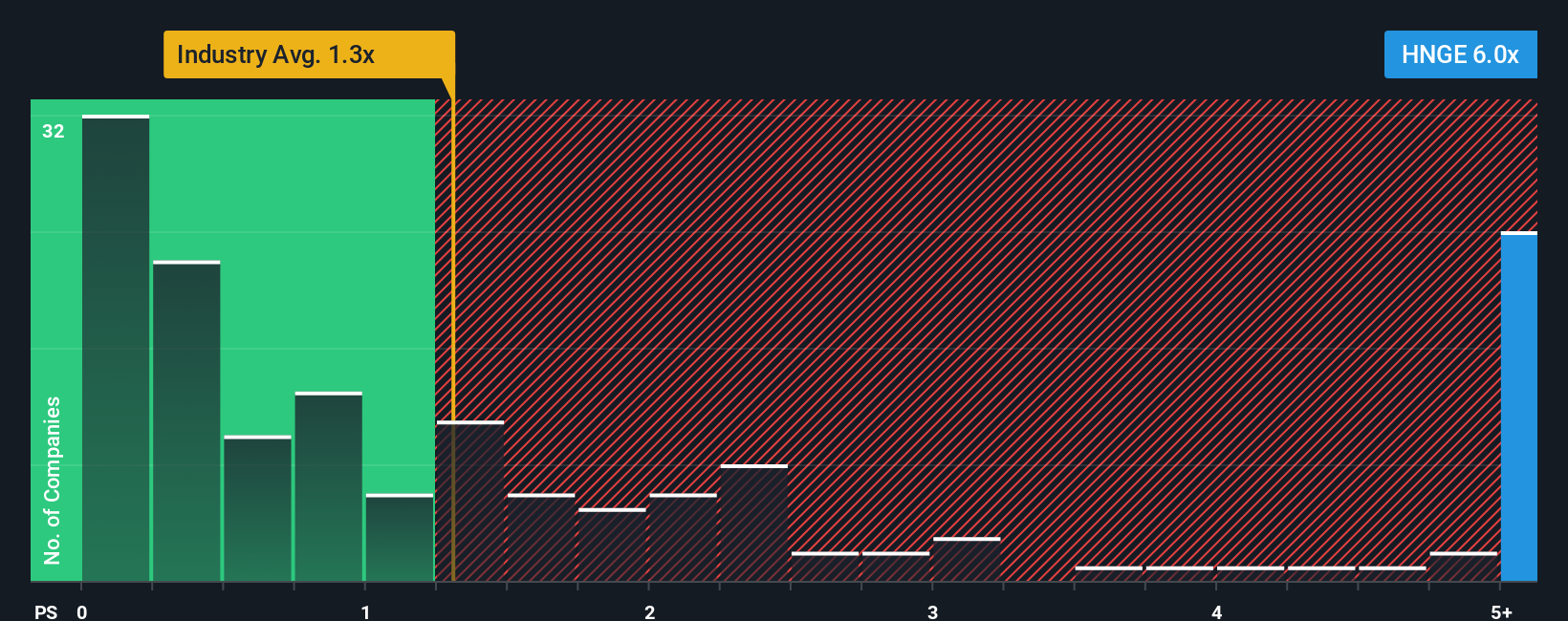

For a fast growing company that is not yet valued on steady profits, the price to sales ratio is often a more reliable yardstick than earnings based metrics. It lets investors compare what the market is paying for each dollar of revenue, which is particularly useful when margins are still evolving as the business scales.

In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher price to sales multiple, while slower growth or higher risk should pull that multiple down. Hinge Health currently trades at about 7.29x sales, which is well above the broader Healthcare industry average of roughly 1.28x but below the peer group average of around 9.99x.

Simply Wall St’s Fair Ratio framework estimates that, considering Hinge Health’s growth outlook, margins, risk profile, size and industry, a more appropriate multiple today would be closer to 6.44x sales. This firm specific benchmark is more informative than a simple industry or peer comparison because it adjusts for the company’s own fundamentals rather than assuming all businesses deserve the same multiple. With the current 7.29x sales sitting above the 6.44x Fair Ratio, the shares screen as modestly expensive on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hinge Health Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter way to connect the story you believe about a company with the numbers behind it. A Narrative is simply your perspective on Hinge Health, translated into assumptions about its future revenue, earnings and margins, which then flow into a financial forecast and ultimately a fair value estimate. Narratives on Simply Wall St, available to millions of investors via the Community page, make this process easy and accessible by guiding you through those assumptions without requiring complex spreadsheets or advanced finance knowledge.

Once you have a Narrative, you can quickly compare your fair value to the current share price to decide whether Hinge Health looks like a buy, a hold or a sell, and your view will automatically update as new information such as earnings, guidance or major news is released. For example, one Hinge Health Narrative might assume rapid adoption and assign a much higher fair value than another Narrative that expects slower contract wins and more competitive pressure.

Do you think there's more to the story for Hinge Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hinge Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HNGE

Hinge Health

Focuses on scaling and automating the delivery of healthcare services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)