- United States

- /

- Healthcare Services

- /

- NYSE:HIMS

COO Transition and Role Consolidation Might Change the Case For Investing In Hims & Hers Health (HIMS)

Reviewed by Sasha Jovanovic

- On September 28, 2025, Hims & Hers Health announced that Chief Operating Officer Nader Kabbani would transition to an advisory role effective November 2, 2025, with Chief Commercial Officer Mike Chi stepping up as COO and consolidating operations, marketing, product, and commercial functions under his leadership.

- This leadership change comes amid the company's expansion into new digital health offerings and ongoing regulatory scrutiny, as investors anticipate the impact of unified executive oversight on operational effectiveness.

- We'll examine how the consolidation of commercial and operational leadership could influence Hims & Hers Health's investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Hims & Hers Health Investment Narrative Recap

For many shareholders, the core belief driving investment in Hims & Hers Health is that the company's telehealth platform can sustain high growth by tapping into underserved healthcare categories and expanding its subscription model. The recent unification of commercial and operational roles under new COO Mike Chi aligns executive oversight but does not materially shift the most important near-term catalysts, such as new category launches, or immediate regulatory risks that remain front and center for the business. The main focus continues to be the stability of revenue growth from high-demand offerings like GLP-1 weight loss treatments, now under stricter regulatory supervision.

One recent announcement closely tied to the company’s growth catalysts is the introduction of online, personalized low testosterone treatment, expanding the core men’s health platform. This move is part of a broader effort to increase user engagement and improve retention, which is critical as Hims & Hers seeks to weather regulatory challenges and customer acquisition headwinds that can affect revenue and earnings volatility.

On the flip side, investors should keep a close eye on the risk of renewed regulatory scrutiny, since…

Read the full narrative on Hims & Hers Health (it's free!)

Hims & Hers Health is projected to reach $3.3 billion in revenue and $261.3 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 18.3% and an earnings increase of $67.7 million from current earnings of $193.6 million.

Uncover how Hims & Hers Health's forecasts yield a $47.42 fair value, a 19% downside to its current price.

Exploring Other Perspectives

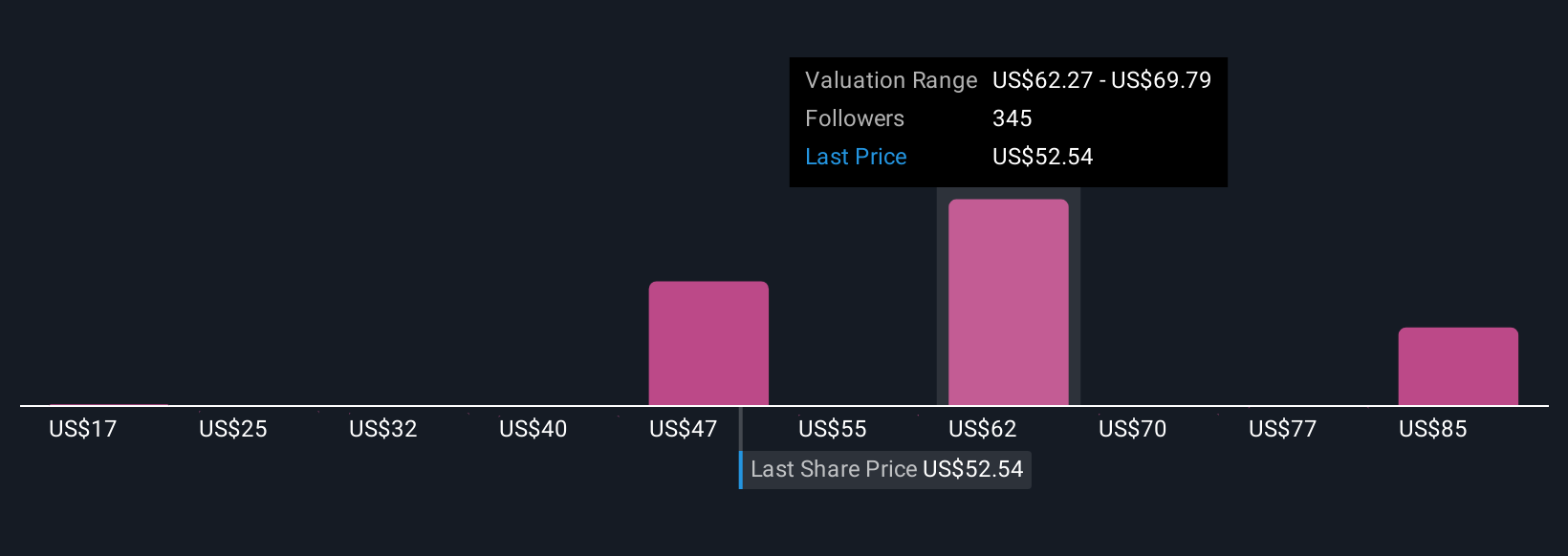

Fifty members of the Simply Wall St Community offered fair value estimates for Hims & Hers Health ranging from US$17.15 to US$92.35 per share. Even with this diverse outlook, regulatory pressures and reliance on high-growth segments remain important issues that may affect the company's future performance, explore these varied views to see how your perspective fits in.

Explore 50 other fair value estimates on Hims & Hers Health - why the stock might be worth as much as 59% more than the current price!

Build Your Own Hims & Hers Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hims & Hers Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hims & Hers Health's overall financial health at a glance.

No Opportunity In Hims & Hers Health?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIMS

Hims & Hers Health

Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives