- United States

- /

- Medical Equipment

- /

- NYSE:HAE

Should US-China Trade Volatility Prompt a Rethink of Haemonetics' (HAE) Supply Chain Strategy?

Reviewed by Sasha Jovanovic

- Haemonetics Corporation recently announced plans to release its second quarter fiscal year 2026 financial results and host a conference call with investors on November 6, 2025.

- This update was followed by a wave of broad market volatility due to US-China trade tensions after new Chinese export controls on rare earth minerals and critical comments from President Trump raised supply chain concerns across multiple industries.

- We'll explore how worries over US-China trade disruptions and the potential for supply chain challenges could reshape Haemonetics' investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Haemonetics Investment Narrative Recap

Investors in Haemonetics need to believe in the company's ability to accelerate adoption of its core technologies while managing exposure to U.S.-centric risks and execution issues, particularly in its Interventional Technologies segment. Recent US-China trade tensions, and the resulting market volatility, do not appear to materially impact Haemonetics’ most important short-term catalyst (continued adoption of advanced plasma collection systems), but they increase attention on supply chain stability, a key risk for the business in the current environment.

Of the company's recent updates, the upcoming Q2 2026 earnings release scheduled for November 6, 2025 stands out as especially important. With renewed trade concerns and potential impacts on costs, the earnings call will be closely watched for early signs of any supply chain disruption or margin pressure, making it a critical event for tracking progress on Haemonetics’ operational catalysts and risk management commitments.

Yet, amid these signals, investors should not overlook the heightened exposure to supply chain risks and the implications this may have for...

Read the full narrative on Haemonetics (it's free!)

Haemonetics’ outlook anticipates $1.5 billion in revenue and $257.9 million in earnings by 2028. Achieving this would require a 2.6% annual revenue growth rate and a $94.6 million increase in earnings from the current $163.3 million.

Uncover how Haemonetics' forecasts yield a $78.64 fair value, a 57% upside to its current price.

Exploring Other Perspectives

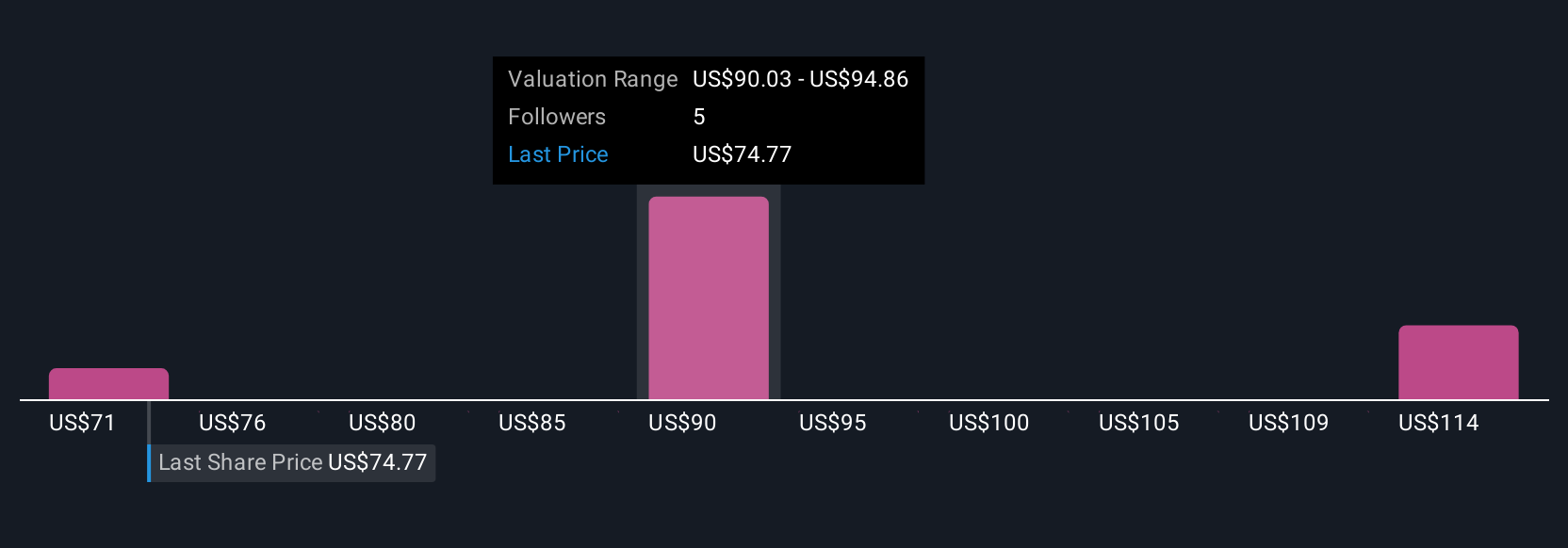

Individual fair value estimates from the Simply Wall St Community range from US$70.70 to US$99.53, with three distinct shareholder viewpoints represented. While market participants see opportunity in product innovation, the latest trade developments add fresh urgency to monitoring operational resilience and possible margin effects, be sure to weigh several perspectives before making decisions.

Explore 3 other fair value estimates on Haemonetics - why the stock might be worth just $70.70!

Build Your Own Haemonetics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Haemonetics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Haemonetics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Haemonetics' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haemonetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAE

Haemonetics

A medical technology company, provides a suite of hospital technologies solutions in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives