- United States

- /

- Medical Equipment

- /

- NYSE:GMED

Can Globus Medical’s (GMED) Global Expansion Unlock Sustainable Returns for Investors?

Reviewed by Sasha Jovanovic

- In recent news, Globus Medical expanded its presence to 64 countries and introduced more than 10 new products in 2023, underscoring its focus on global growth and innovation.

- Despite these achievements and strong constant currency revenue growth, the company's return on invested capital has declined, signaling challenges in translating expansion and innovation into higher returns.

- We'll examine how Globus Medical's rapid global expansion and steady product innovation may influence its long-term investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Globus Medical Investment Narrative Recap

To be a shareholder in Globus Medical, you need to believe in the company's ability to convert its global expansion and continuous innovation, like launching over 10 new products in 2023, into profitable and sustainable growth. While broadening its international reach and a strong pipeline should help drive competitiveness, the recent news has not materially reduced the most important short-term catalyst: increasing high-margin sales from robotics and enabling technologies. The main risk remains the company's ability to improve returns on these investments amid tougher international competition and evolving healthcare markets.

Among recent announcements, the July 2025 launches of DuraPro™ and Verzera™ surgical systems are particularly relevant, building on Globus Medical's push to expand technologically advanced offerings. These introductions support the catalyst of capturing greater market share in minimally invasive and robotics-enabled surgery, reinforcing the company's plan to drive earnings growth through innovation and high-value product differentiation.

However, investors should remain aware that despite impressive top-line momentum, ongoing challenges in generating higher returns on invested capital mean...

Read the full narrative on Globus Medical (it's free!)

Globus Medical's outlook forecasts $3.4 billion in revenue and $538.8 million in earnings by 2028. This is based on a projected 9.0% annual revenue growth rate and an earnings increase of $182.2 million from the current $356.6 million.

Uncover how Globus Medical's forecasts yield a $80.30 fair value, a 33% upside to its current price.

Exploring Other Perspectives

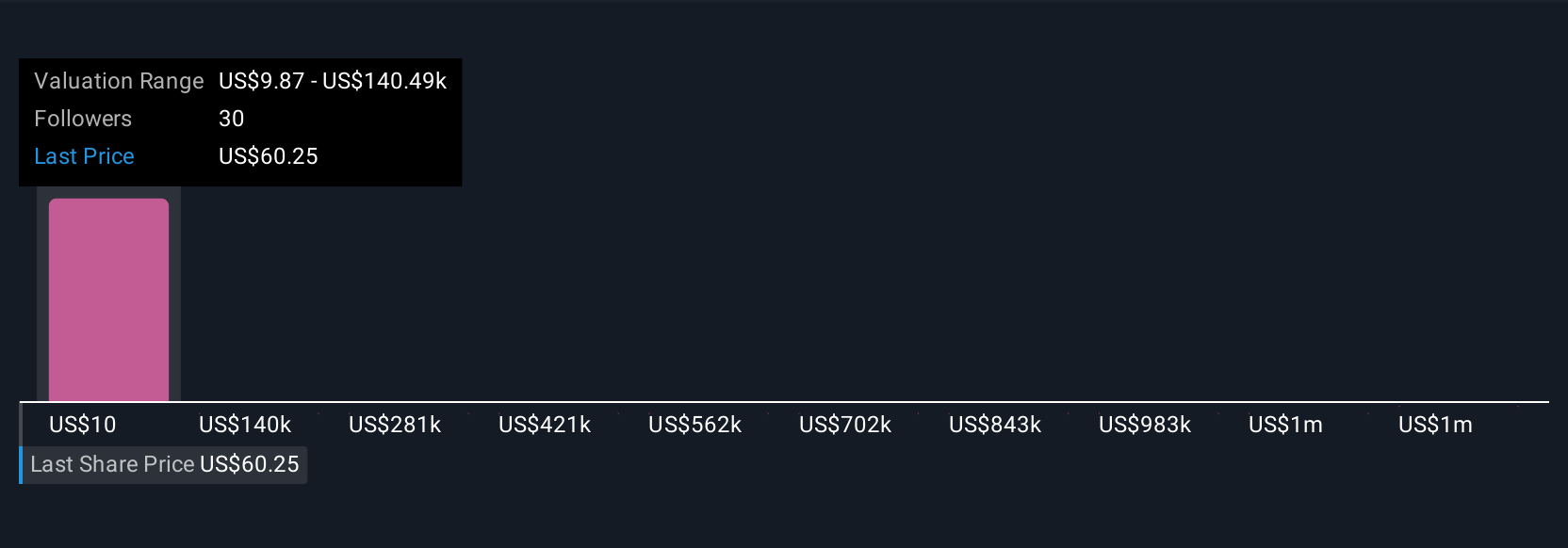

Five members of the Simply Wall St Community estimate Globus Medical's fair value from as low as US$10 to as high as US$1,404,795, underlining dramatic diversity in outlooks. While some see significant opportunity, many are watching closely to see if the company's investments in technology and new markets will translate into improved returns and higher margins, reminding you to consider a range of viewpoints when forming your own perspective.

Explore 5 other fair value estimates on Globus Medical - why the stock might be a potential multi-bagger!

Build Your Own Globus Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globus Medical research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Globus Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globus Medical's overall financial health at a glance.

No Opportunity In Globus Medical?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GMED

Globus Medical

A medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives