- United States

- /

- Medical Equipment

- /

- NYSE:FNA

After Leaping 29% Paragon 28, Inc. (NYSE:FNA) Shares Are Not Flying Under The Radar

Paragon 28, Inc. (NYSE:FNA) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 46% over that time.

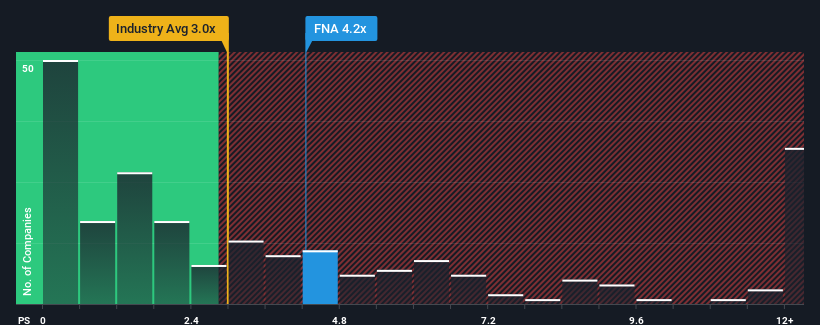

Since its price has surged higher, you could be forgiven for thinking Paragon 28 is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in the United States' Medical Equipment industry have P/S ratios below 3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Paragon 28

How Paragon 28 Has Been Performing

Recent times have been advantageous for Paragon 28 as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Paragon 28's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Paragon 28's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. Pleasingly, revenue has also lifted 87% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 9.6% each year, which is noticeably less attractive.

In light of this, it's understandable that Paragon 28's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Paragon 28's P/S Mean For Investors?

Paragon 28's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Paragon 28 maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Paragon 28 is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Paragon 28, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Paragon 28, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FNA

Paragon 28

Develops, distributes, and sells foot and ankle surgical systems in the United States and internationally.

Imperfect balance sheet very low.

Similar Companies

Market Insights

Community Narratives