- United States

- /

- Healthtech

- /

- NYSE:DOCS

Is Doximity’s (DOCS) Valuation Still Justified As Advertising Trends Face New Scrutiny?

Reviewed by Sasha Jovanovic

- Earlier this week, JP Morgan downgraded Doximity, citing concerns over the company's high valuation and uncertainty in its advertising trends.

- This highlights ongoing debate among analysts about the sustainability of Doximity's premium compared to industry peers, especially amid changing ad market conditions.

- We'll look at how JP Morgan's concern about advertising uncertainty may affect Doximity's evolving investment outlook and analyst assumptions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Doximity Investment Narrative Recap

For shareholders, the main investment thesis in Doximity is centered on its position as a digital hub for clinicians, benefiting from expanding adoption of its AI-driven workflow and telehealth products. While JP Morgan's downgrade points to concerns about high valuation and uncertainty in advertising trends, these issues do not appear to have a material near-term impact on Doximity's ability to benefit from broader digital adoption in healthcare, though unpredictability in pharma advertising spend remains a key short-term risk. One company announcement relevant in this context is Doximity's Q1 FY2026 results, which showed solid revenue (US$145.91 million) and net income (US$53.32 million) growth year-on-year. While this reinforces the platform's core usage strength and earnings momentum amid digital health expansion, the sustainability of these trends will likely hinge on continued marketing spend from pharmaceutical clients, aligning closely with the central risk highlighted by recent analyst commentary. In contrast, investors should be aware of how sudden shifts in advertising budgets or industry regulation could...

Read the full narrative on Doximity (it's free!)

Doximity's narrative projects $805.8 million in revenue and $280.5 million in earnings by 2028. This requires 11.0% yearly revenue growth and a $45.4 million earnings increase from $235.1 million today.

Uncover how Doximity's forecasts yield a $69.50 fair value, a 6% upside to its current price.

Exploring Other Perspectives

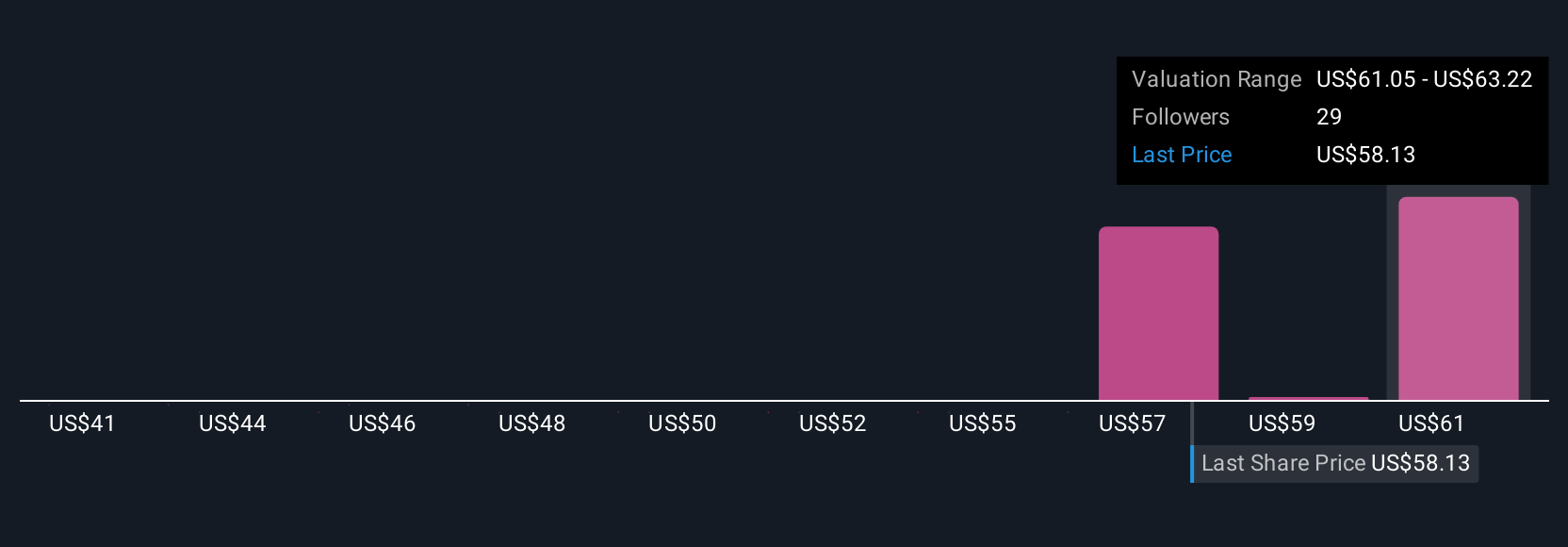

Seven different Simply Wall St Community members estimate Doximity's fair value anywhere between US$41.46 and US$78.58 per share. With ongoing concerns about uncertainty in advertising trends, you can see how market participants size up risk in vastly different ways, so explore several alternative viewpoints to see how your views compare.

Explore 7 other fair value estimates on Doximity - why the stock might be worth as much as 20% more than the current price!

Build Your Own Doximity Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Doximity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Doximity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Doximity's overall financial health at a glance.

No Opportunity In Doximity?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCS

Doximity

Operates as a digital platform for medical professionals in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives