- United States

- /

- Healthcare Services

- /

- NYSE:DGX

Quest Diagnostics (DGX) Is Up 7.1% After Q2 Results and Launch of New Diagnostic Tests – What's Changed

Reviewed by Simply Wall St

- Quest Diagnostics reported second quarter 2025 results last week, highlighting a rise in sales to US$2.76 billion and net income to US$282 million, while also unveiling new diagnostic tests for the Oropouche virus and Alzheimer's disease.

- Despite an impairment charge and slightly lowered annual guidance, the company's operational advances and new test launches appeared to drive optimism about future growth opportunities.

- We'll explore how Quest's introduction of advanced diagnostic offerings, particularly in neuro and infectious disease, may influence its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Quest Diagnostics Investment Narrative Recap

To be a Quest Diagnostics shareholder, you need confidence in ongoing test innovation and steady expansion, even as short-term results can be affected by regulatory and reimbursement risks. The recent quarterly update shows revenue and earnings gains alongside new test launches, but the lowered annual guidance and an impairment charge suggest these developments will not have a material impact on the near-term earnings outlook. Operational execution and the ability to adapt to reimbursement changes remain the top catalyst and risk to watch.

Among Quest's recent announcements, the rollout of an FDA-cleared blood test for Alzheimer's disease may be the most relevant. This offering enhances Quest’s position in advanced diagnostics, a key area that could offset margin pressure from rising operational costs if adoption grows.

On the other hand, investors should be aware of the potential impact of regulatory risks, such as…

Read the full narrative on Quest Diagnostics (it's free!)

Quest Diagnostics' outlook anticipates $11.7 billion in revenue and $1.2 billion in earnings by 2028. This implies a 4.8% annual revenue growth rate and an increase in earnings of $308 million from the current $892 million.

Exploring Other Perspectives

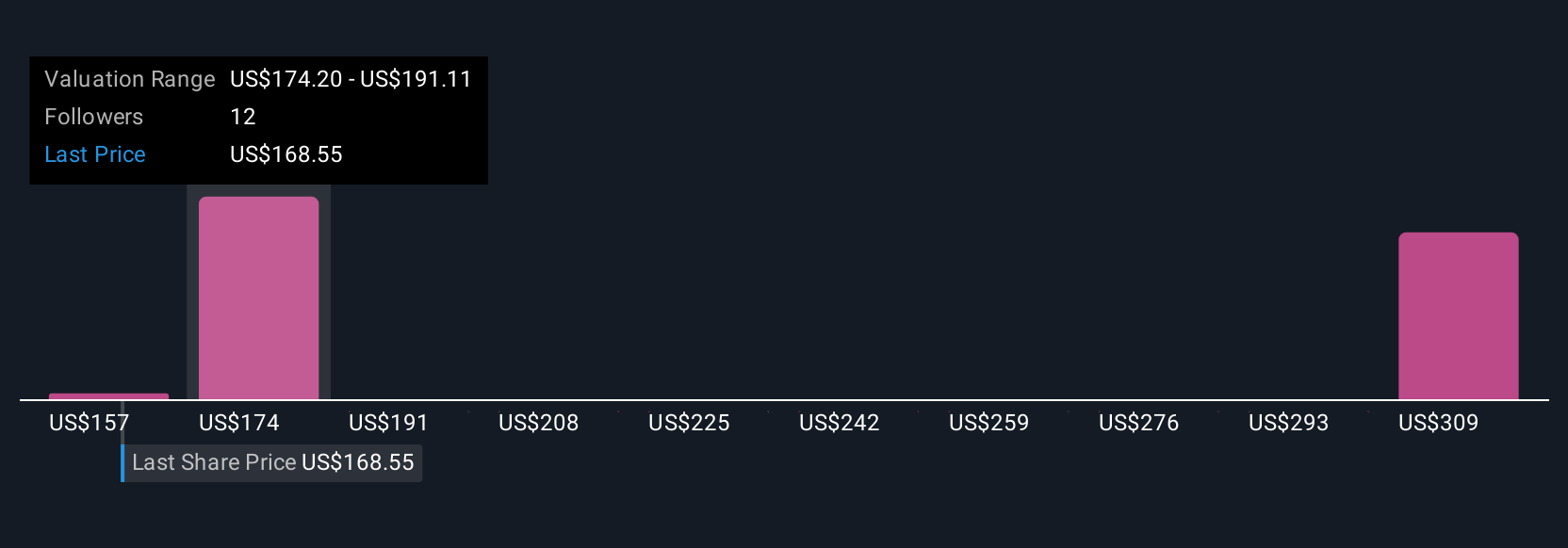

Fair value estimates from the Simply Wall St Community span a wide range, from US$157.30 to US$326.90, across three individual viewpoints. As you weigh these opposing perspectives, consider how regulatory risks can influence revenue and profit expectations over time.

Build Your Own Quest Diagnostics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quest Diagnostics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quest Diagnostics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quest Diagnostics' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives