- United States

- /

- Healthcare Services

- /

- NYSE:DGX

Quest Diagnostics (DGX): Exploring Valuation After Recent Share Price Pause

Reviewed by Simply Wall St

If you have been watching Quest Diagnostics (DGX) lately, the recent dip in its stock price might have raised an eyebrow or two. Shares edged down about 0.4% after a period of impressive year-to-date growth. While there is no headline-grabbing event behind this move, subtle shifts like this often prompt investors to step back and re-evaluate what the market may be signaling about future prospects.

Looking at the bigger picture, Quest Diagnostics has quietly outperformed many of its peers. After gaining more than 22% over the past year, the stock has continued to build positive momentum, with a 7% climb over the past three months. Meanwhile, annual revenue and net income both recorded increases in the low to mid-single digits, pointing to steady operational progress rather than dramatic swings. The question is whether this solid but unflashy growth supports the valuation implied by recent price action.

With the share price now taking a breather, some may wonder if this is a smart entry point for those betting on further upside, or if the market is already factoring in everything Quest Diagnostics can reasonably deliver.

Most Popular Narrative: 2.4% Undervalued

According to the community narrative, Quest Diagnostics is currently viewed as slightly undervalued based on expectations of steady profit and revenue growth, automated efficiencies, and opportunities in wellness-focused diagnostics.

The rising importance of health data analytics and Quest's role as a "lab engine" for consumer wellness brands positions the company to benefit from new revenue streams and further monetization opportunities as healthcare becomes more data-driven. This supports long-term earnings power.

Want to know the engine driving this value call? Here is a hint: Analysts are betting on robust expansion, future-proof margins, and a dramatic shift in the company’s earnings power. Are you curious why the community thinks this growth lab should be trading higher? Dive in to discover the key assumptions. One number might surprise you.

Result: Fair Value of $188.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent industry-wide price pressures and possible reimbursement cuts remain significant risks. These factors could challenge the narrative and impact Quest Diagnostics' growth outlook.

Find out about the key risks to this Quest Diagnostics narrative.Another View: A Different Angle on Value

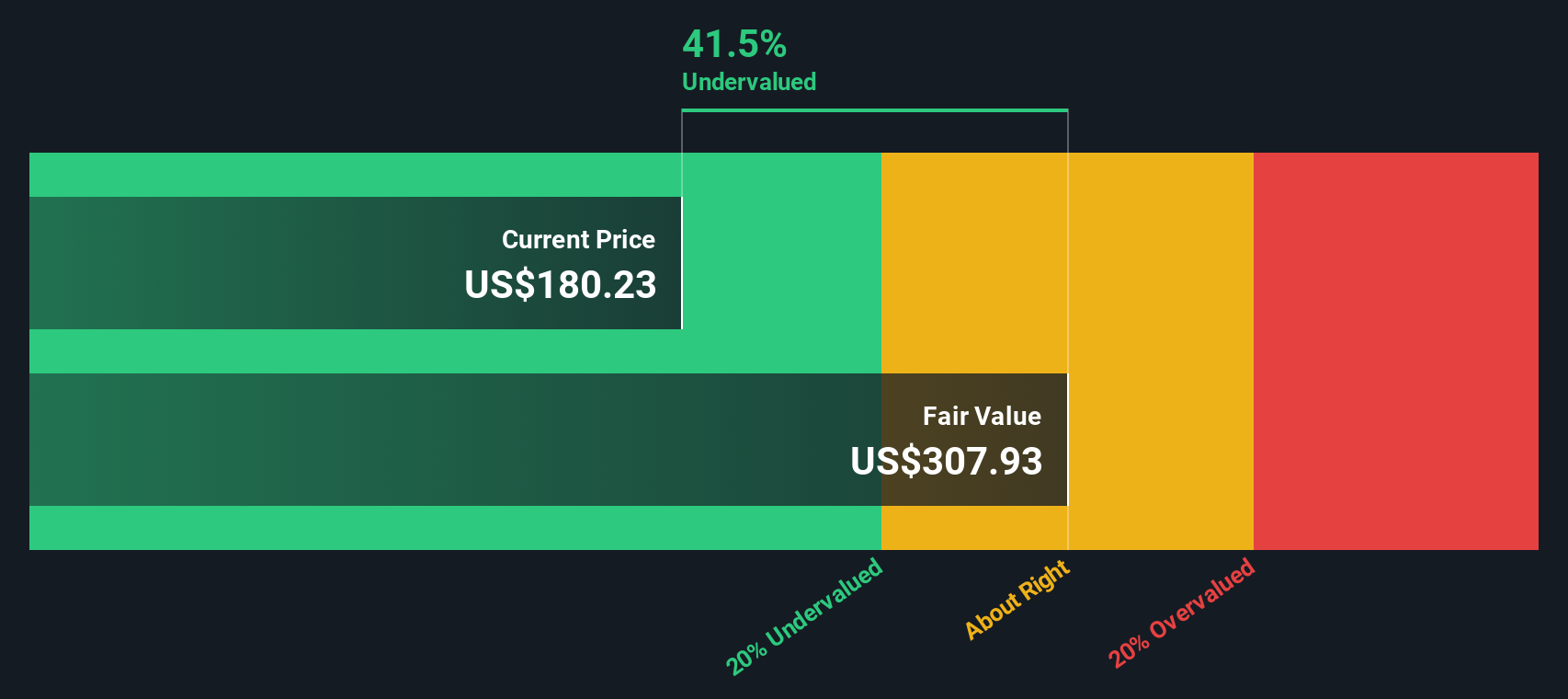

While some see upside based on future profits, our DCF model suggests an even greater disconnect between the current share price and the underlying value. Could this method shine a light on hidden potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Quest Diagnostics Narrative

Keep in mind, if you have your own perspective or want to dive deeper into the details, crafting your own narrative is quick and straightforward. do it your way.

A great starting point for your Quest Diagnostics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

If you want to stay ahead of the curve, don’t settle for ordinary picks. Unlock fresh investment ideas tailored to different market trends and financial goals. Let your curiosity guide you, and make sure you are not missing out on winning stocks that fit your strategy.

- Identify reliable income streams by checking out dividend stocks with yields > 3%. These stocks pay yields above 3 percent and could fortify your portfolio against market swings.

- Catch the surging momentum of technological disruption with AI penny stocks. Find standout companies shaping the future of artificial intelligence.

- Capitalize on groundbreaking breakthroughs by scouting quantum computing stocks. See which quantum computing pioneers are set to transform tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives