- United States

- /

- Healthcare Services

- /

- NYSE:DGX

How Quest Diagnostics' (DGX) New Pharmacogenomic Test Is Reshaping Its Investment Story

Reviewed by Simply Wall St

- In late August 2025, Quest Diagnostics announced the launch of an advanced pharmacogenomic (PGx) laboratory test service designed to help healthcare providers tailor medication selection and dosing based on patients' individual genetic profiles across multiple medical specialties.

- This innovation highlights the growing role of personalized medicine in diagnostics, potentially supporting improved patient safety and more effective treatment decisions through actionable genomic insights.

- We'll now consider how Quest's expansion into personalized genomics may shape its investment outlook going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Quest Diagnostics Investment Narrative Recap

To be a shareholder in Quest Diagnostics, you need to believe in the continued growth of advanced diagnostic and preventive lab testing, as well as in the company’s ability to innovate and maintain pricing power. While the new pharmacogenomic (PGx) test underscores Quest’s commitment to personalized medicine, it does not materially shift the near-term catalyst: sustaining test volumes and pricing amid potential reimbursement pressures, especially from PAMA and public policy changes.

The most pertinent recent announcement to this dynamic is Quest’s FDA Breakthrough Device Designation for the Haystack MRD® test, which, like the PGx service, addresses evolving clinical needs in oncology and precision medicine. These innovations align with rising demand for specialized, actionable lab insights, supporting growth in higher-value test categories and potentially helping to offset headwinds from industry-wide price pressures.

By contrast, one key risk investors should be aware of is the potential impact of government reimbursement reductions and shifting payer mixes...

Read the full narrative on Quest Diagnostics (it's free!)

Quest Diagnostics is projected to reach $11.9 billion in revenue and $1.3 billion in earnings by 2028. This outlook is based on a 4.1% annual revenue growth rate and an increase in earnings of approximately $355 million from the current $945 million.

Uncover how Quest Diagnostics' forecasts yield a $188.19 fair value, a 3% upside to its current price.

Exploring Other Perspectives

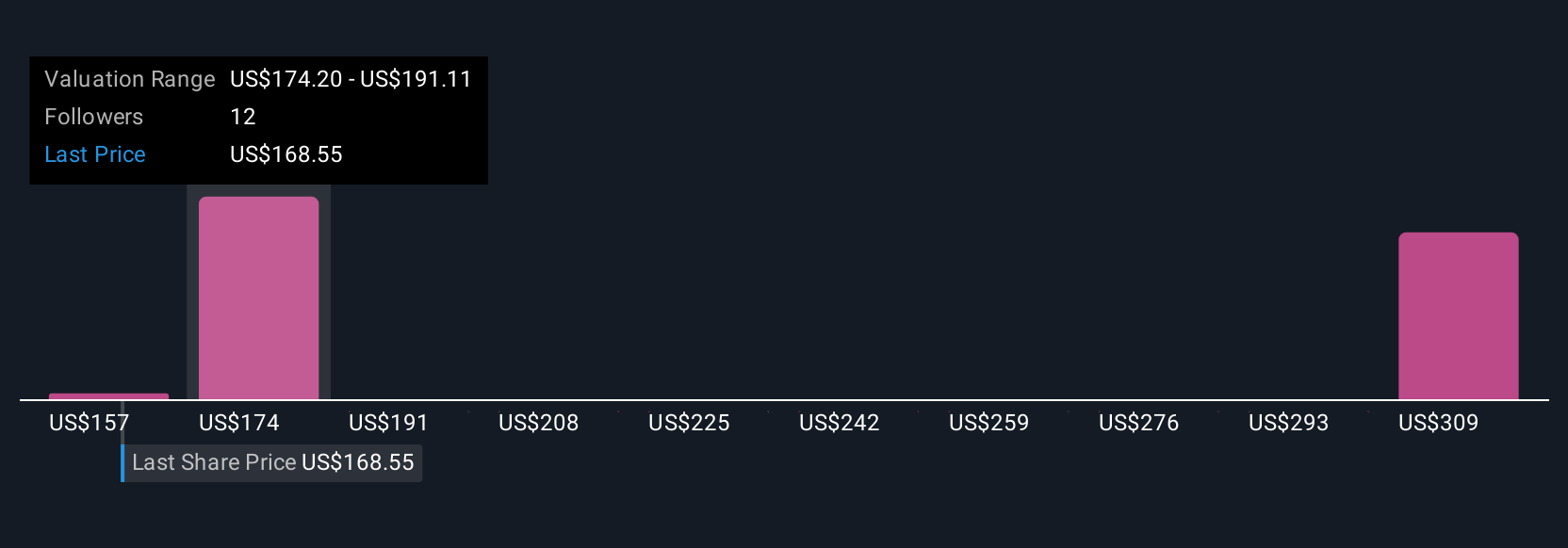

Fair value estimates from three Simply Wall St Community members span from US$157.30 to US$307.93 per share, illustrating widely different views on Quest's potential. While many see catalysts in advanced testing expansion, ongoing reimbursement changes could significantly affect future performance, explore diverse analyses to inform your approach.

Explore 3 other fair value estimates on Quest Diagnostics - why the stock might be worth 14% less than the current price!

Build Your Own Quest Diagnostics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quest Diagnostics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quest Diagnostics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quest Diagnostics' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quest Diagnostics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DGX

Quest Diagnostics

Provides diagnostic testing and services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives