- United States

- /

- Healthtech

- /

- NYSE:CTEV

The 5.9% return this week takes Claritev's (NYSE:CTEV) shareholders one-year gains to 432%

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Claritev Corporation (NYSE:CTEV) share price is up a whopping 432% in the last 1 year, a handsome return in a single year. Also pleasing for shareholders was the 34% gain in the last three months. Unfortunately the longer term returns are not so good, with the stock falling 43% in the last three years.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

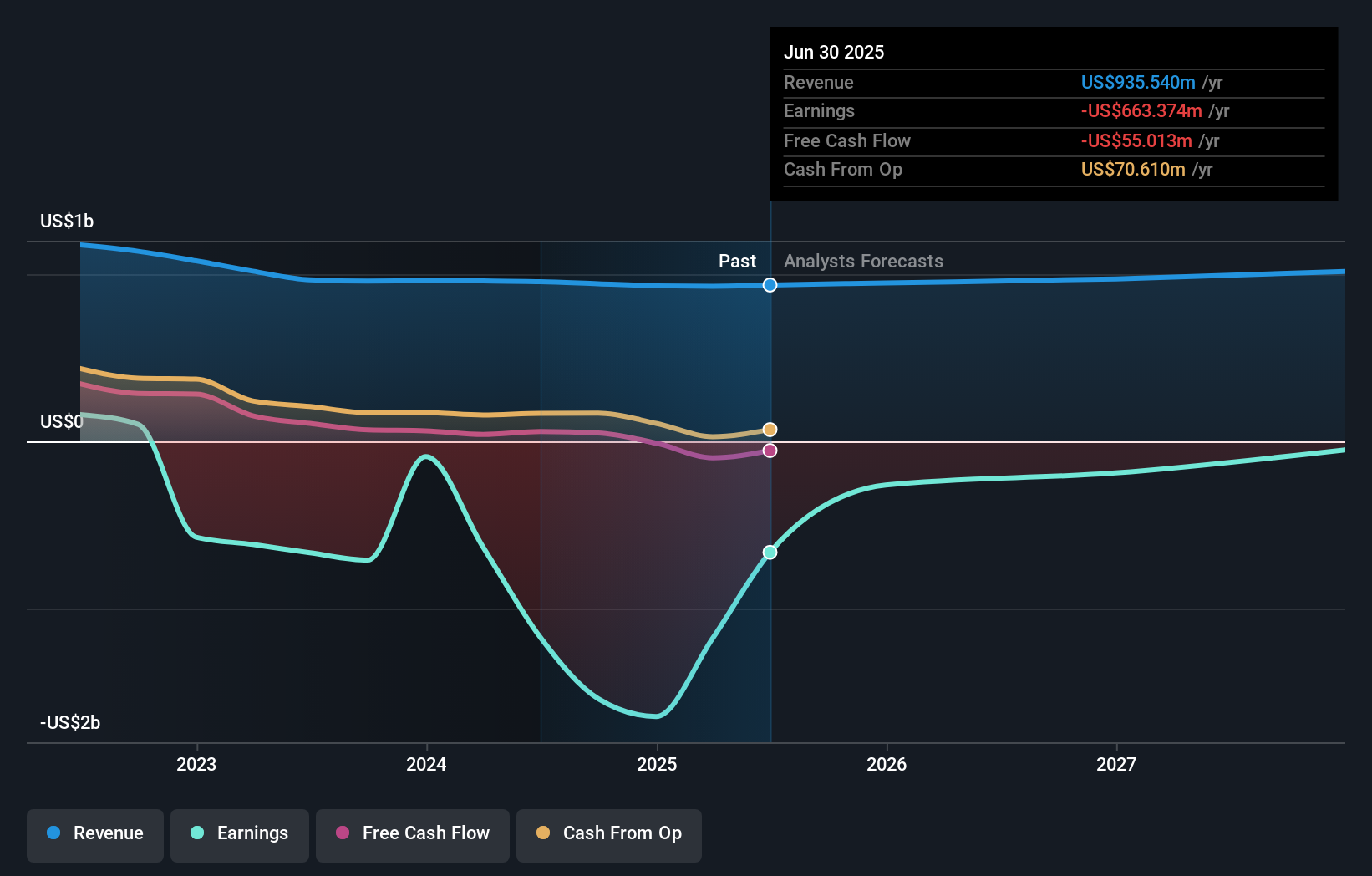

Claritev wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Claritev saw its revenue shrink by 2.0%. This is in stark contrast to the splendorous stock price, which has rocketed 432% since this time a year ago. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Claritev in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Claritev has rewarded shareholders with a total shareholder return of 432% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 13% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Claritev better, we need to consider many other factors. For instance, we've identified 4 warning signs for Claritev (1 is a bit unpleasant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives