- United States

- /

- Healthcare Services

- /

- NYSE:COR

Cencora (COR): A Fresh Look at Valuation Following Evercore ISI’s "Tactical Outperform" Upgrade

Reviewed by Kshitija Bhandaru

Cencora (COR) was just added to Evercore ISI's "Tactical Outperform" list, sparking renewed interest from investors as anticipation builds for the company’s upcoming earnings report this month. The move highlights growing confidence in Cencora’s U.S. pharmaceutical wholesale operations.

See our latest analysis for Cencora.

Cencora’s inclusion on Evercore ISI’s watchlist comes as the stock rides a wave of momentum, with a year-to-date share price return of 38.2% and a one-year total shareholder return of 41.6%. A series of operational updates and anticipation for next quarter’s earnings have kept investors’ attention firmly on the company, reinforcing optimism for its long-term prospects.

If you’re looking to uncover even more high-potential names beyond the headlines, this may be the perfect opportunity to explore fast growing stocks with high insider ownership.

With the stock delivering strong gains this year and trading close to analyst price targets, investors are left to wonder whether Cencora is still undervalued at these levels or if future growth is already reflected in the price.

Most Popular Narrative: 6.8% Undervalued

Compared to its last close price of $310.61, the most popular narrative values Cencora at $333.29, suggesting further upside. This sets the stage for a deeper look at what is driving the narrative’s optimism.

Cencora's ongoing investment in digital infrastructure and advanced analytics positions the company to capitalize on the accelerating digitization of healthcare and regulatory requirements like the Drug Supply Chain Security Act. This is improving supply chain efficiency and transparency, which should drive higher net margins and operating income over time.

Want to know the real story behind this valuation premium? The secret sauce is a strategy built around ambitious revenue growth, rising profit margins, and a future profit multiple that rivals fast-moving sectors. Curious how these factors stack up and what analysts are betting on? There is more to the story than meets the eye. Uncover the financial drivers behind this bullish price target.

Result: Fair Value of $333.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. These include pressure from generic competition and international market weakness, both of which could limit margin expansion despite ongoing growth efforts.

Find out about the key risks to this Cencora narrative.

Another View: Is Valuation Getting Stretched?

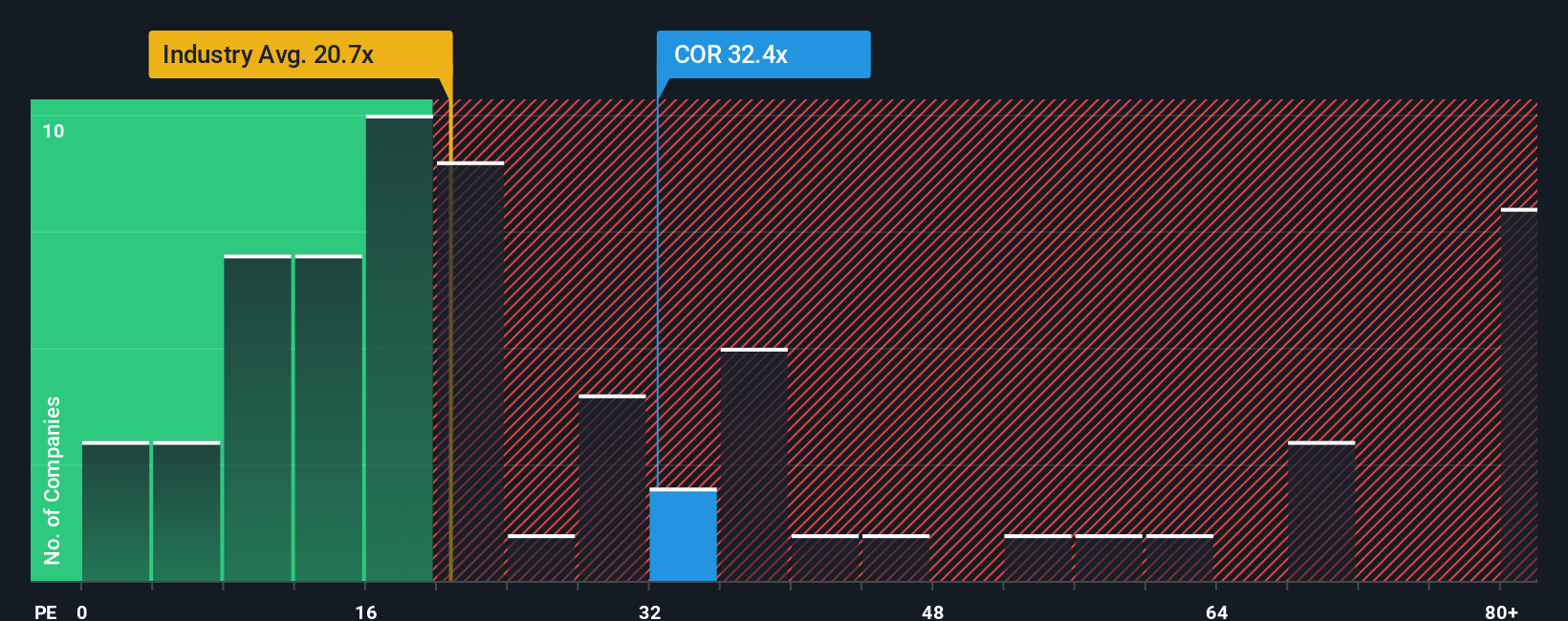

While the consensus narrative points to upside, the company’s current price-to-earnings ratio of 31.7x is noticeably higher than the US Healthcare industry average of 21.6x and the peer group average of 22.5x. It also exceeds its estimated fair ratio of 27.9x. These gaps suggest Cencora may be priced for perfection, leaving less margin for error if growth expectations slip. Could this premium be justified? Is caution the wiser move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cencora Narrative

If you have a different perspective or want to follow your own analysis, you can shape your own narrative using the latest data in just a few minutes, so why not Do it your way.

A great starting point for your Cencora research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investment journey further by tapping into exceptional stock opportunities that others might miss. Don’t let smart ideas pass you by. See what’s possible now.

- Boost your passive income as you check out these 19 dividend stocks with yields > 3%, featuring consistent payout leaders offering attractive yields above 3%.

- Seize the momentum in artificial intelligence by scanning these 25 AI penny stocks, filled with innovators transforming the future of tech.

- Secure your portfolio with value plays and spot companies trading under their cash flow worth by using these 891 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COR

Cencora

Cencora, Inc. sources and distributes pharmaceutical products in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives