- United States

- /

- Healthcare Services

- /

- NYSE:CNC

What the Expiring ACA Subsidies and Volatile Shares Mean for Centene’s 2025 Valuation

Reviewed by Bailey Pemberton

If you are staring at Centene’s stock chart and wondering what comes next, you are not alone. The past few weeks have been surprisingly eventful for this perennial player in the health insurance industry. After a punishing drop earlier in the year, down 36.5% year-to-date and nearly 47% over the past 12 months, Centene shares suddenly staged a sharp reversal, leaping 33.3% in the last month alone and 7.6% in just the past seven days. Clearly, something has changed in how investors are weighing both growth potential and risk.

Much of this recent volatility can be traced to lively headlines surrounding the health insurance landscape. The debate around extending Affordable Care Act subsidies has become a central political talking point, keeping pressure on insurers like Centene. Meanwhile, a series of legal decisions reaffirming the government’s ability to negotiate Medicare drug prices has added to the industry buzz. Talk of double-digit premium hikes for 2026 ACA plans signals that companies expect higher costs, but potentially higher revenue as well.

With all this noise, how do you decide if Centene is actually a value opportunity or simply a volatile bet? Our valuation score provides a starting point. Centene clocks in at 5 out of 6, meaning it is priced as undervalued by most standard metrics. However, those numbers only tell part of the story. Let’s dig into the valuation methods behind that score and consider if there is an even more insightful way to judge Centene’s prospects as an investment.

Why Centene is lagging behind its peers

Approach 1: Centene Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and discounting those amounts back to today's dollars. This approach aims to capture the present worth of all the cash Centene is expected to generate over time, providing a fundamental view of the stock’s potential.

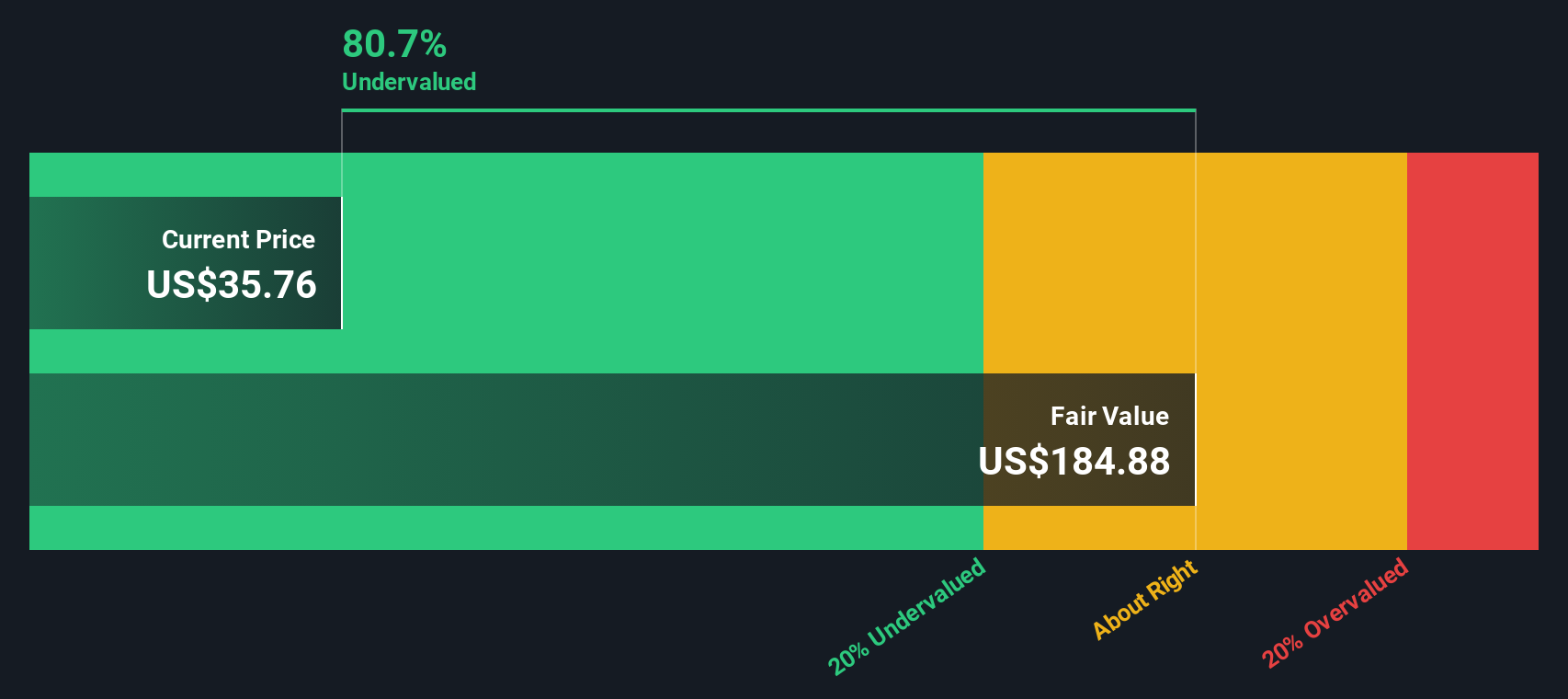

For Centene, the model begins with a Last Twelve Months Free Cash Flow of $911 million. Analyst estimates project this figure rising to around $3.6 billion by 2029. Beyond the coming five years, further growth estimates are extrapolated by Simply Wall St, with their projections climbing steadily through 2035. This scenario uses a “2 Stage Free Cash Flow to Equity” method to account for both near-term analyst views and longer-term company prospects.

After running these projections, the DCF intrinsic value is $187.86 per share. Compared with Centene's recent market price, this suggests the stock is trading at a 79.5% discount to its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Centene is undervalued by 79.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Centene Price vs Earnings

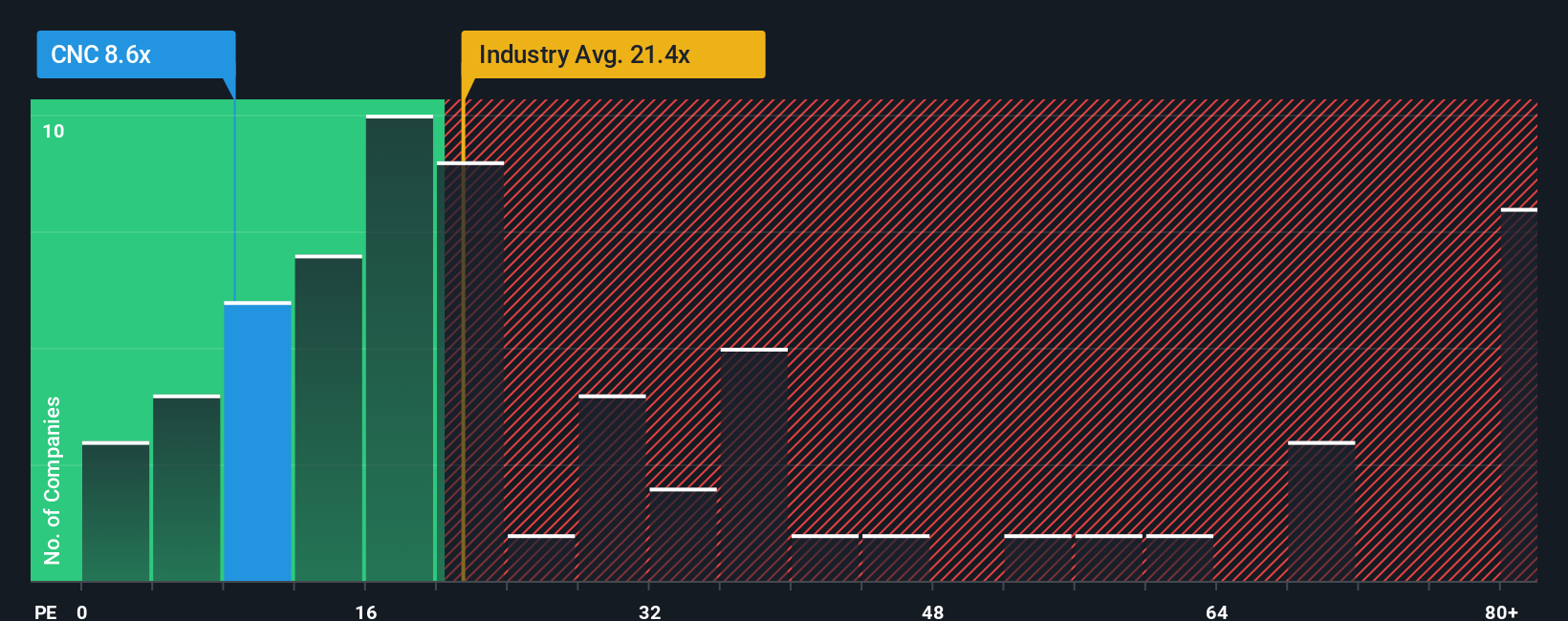

For companies that are consistently profitable like Centene, the price-to-earnings (PE) ratio is one of the most useful valuation metrics. It is widely used because it connects a company’s current share price to its per-share earnings, letting investors measure how much they are paying for each dollar of profit. Generally, higher growth expectations or a lower risk profile justify a higher “normal” PE, while slower growth or higher risk warrant something lower.

Centene currently trades at a PE ratio of 9.2x. That is significantly below the healthcare industry average of 21.6x and the peer group average of 25.5x. On the surface, this seems to indicate that Centene is undervalued compared to others in its sector. But it is important to consider more than just these basic benchmarks.

Simply Wall St’s “Fair Ratio” offers a more nuanced benchmark. Unlike the simple industry or peer averages, the Fair Ratio, here calculated at 38.8x for Centene, takes into account specifics like the company’s earnings growth, profit margins, size, risk exposure, and sector trends. This makes the Fair Ratio a more tailored, relevant point of comparison for today’s market.

Comparing Centene’s actual PE ratio of 9.2x to its Fair Ratio of 38.8x, the stock looks solidly undervalued based on current fundamentals and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Centene Narrative

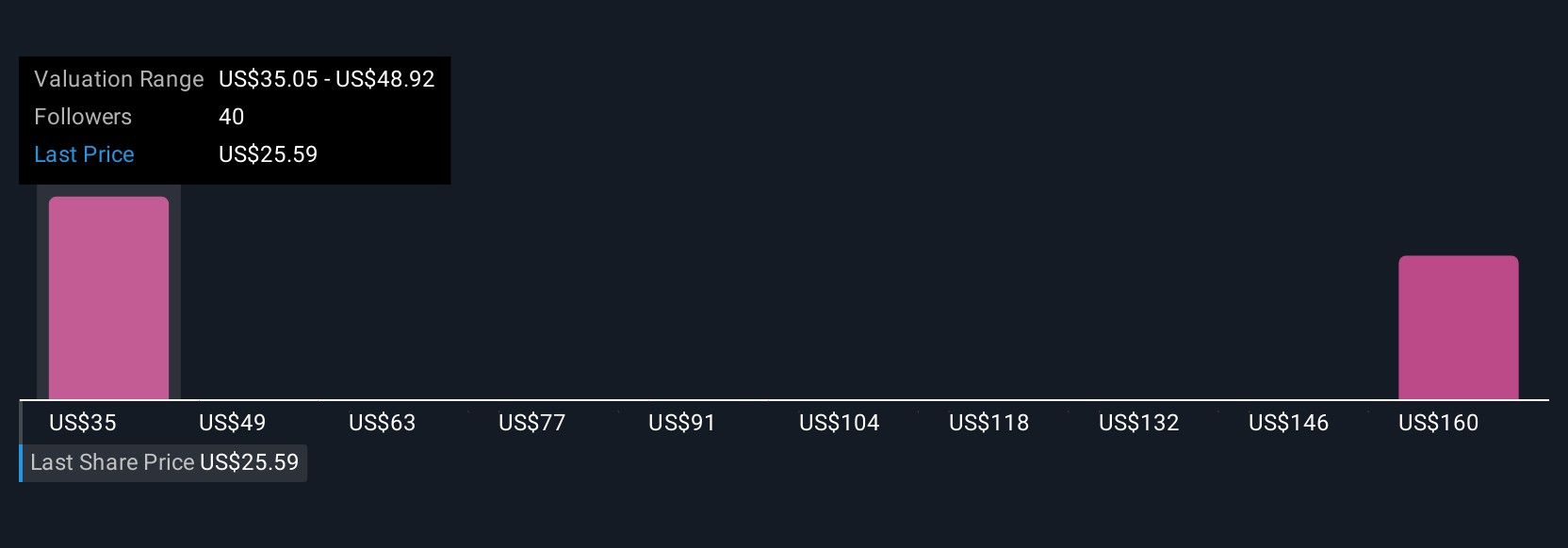

Earlier, we hinted at a more insightful way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company, built on your expectations for its future growth, earnings, and margins. By connecting the dots from your understanding of Centene’s business drivers and industry changes to actual financial forecasts and ultimately a fair value, Narratives enable you to turn numbers into a living investment thesis.

Accessible and easy to use within the Community page on Simply Wall St’s platform, Narratives are already used by millions of investors to sharpen their decision making. They let you compare your fair value with the current market price, helping you decide at a glance whether Centene is a buy, sell, or hold under your scenario. Plus, as news breaks or quarterly results drop, Narratives are automatically updated so your assessment is always fresh and relevant.

For example, one investor might believe Medicaid expansion will drive Centene’s revenue higher and forecast a fair value of $70.00 per share. A more cautious peer, concerned about policy risks and medical cost pressures, might only see a $24.00 fair value. Narratives make it easy to visualize and compare these perspectives so you can invest with greater conviction.

Do you think there's more to the story for Centene? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNC

Centene

Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives