- United States

- /

- Healthcare Services

- /

- NYSE:CHE

Chemed Corporation's (NYSE:CHE) Popularity With Investors Is Clear

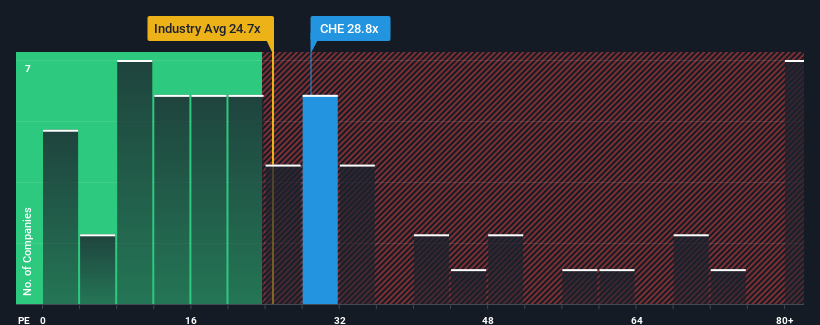

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Chemed Corporation (NYSE:CHE) as a stock to avoid entirely with its 28.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Chemed as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Chemed

How Is Chemed's Growth Trending?

Chemed's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. EPS has also lifted 20% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 16% over the next year. That's shaping up to be materially higher than the 14% growth forecast for the broader market.

With this information, we can see why Chemed is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Chemed maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Chemed you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CHE

Chemed

Provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives