- United States

- /

- Healthcare Services

- /

- NYSE:CCM

Positive Sentiment Still Eludes Concord Medical Services Holdings Limited (NYSE:CCM) Following 26% Share Price Slump

Concord Medical Services Holdings Limited (NYSE:CCM) shares have had a horrible month, losing 26% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 52% share price decline.

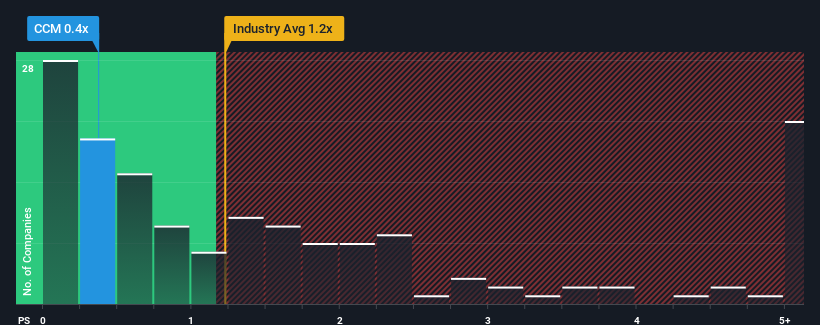

Since its price has dipped substantially, when close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Concord Medical Services Holdings as an enticing stock to check out with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Concord Medical Services Holdings

How Concord Medical Services Holdings Has Been Performing

Concord Medical Services Holdings has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for Concord Medical Services Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Concord Medical Services Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Concord Medical Services Holdings' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 141% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 7.6% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that Concord Medical Services Holdings is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Concord Medical Services Holdings' P/S Mean For Investors?

The southerly movements of Concord Medical Services Holdings' shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Concord Medical Services Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Concord Medical Services Holdings (at least 3 which don't sit too well with us), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Concord Medical Services Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Concord Medical Services Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CCM

Concord Medical Services Holdings

Through its subsidiaries, operates a network of radiotherapy and diagnostic imaging centers in the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives