- United States

- /

- Medical Equipment

- /

- NYSE:BSX

How Investors May Respond To Boston Scientific (BSX) After Polen Capital’s Stake Highlights Farapulse Leadership

Reviewed by Sasha Jovanovic

- Earlier this week, Polen Capital acquired a 2% stake in Boston Scientific Corporation, drawing attention to the company's leadership in cardiovascular medical devices and its strong growth platforms, Farapulse and Watchman.

- This move underscores investor confidence in Boston Scientific's innovation in pulse field ablation treatments and its impressive operational and financial strength.

- We'll examine how Polen Capital's institutional investment and the spotlight on Farapulse's leadership may influence Boston Scientific's investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Boston Scientific Investment Narrative Recap

Shareholders in Boston Scientific need to believe in the company’s continued leadership in transformative cardiovascular technologies, especially the Farapulse pulse field ablation system and Watchman platform, as major drivers of long-term growth. Polen Capital’s acquisition of a 2% stake doesn’t materially change the short-term catalyst, which remains rapid physician uptake and expanded regulatory clearances for Farapulse; the biggest near-term risk continues to be competitive pressure in the pulse field ablation market.

Among recent company announcements, the September 2025 FDA approval of expanded labeling for the FARAPULSE PFA System stands out. By broadening its use to patients with persistent atrial fibrillation, this milestone directly supports the main growth catalyst for Boston Scientific and further reinforces institutional confidence like Polen Capital’s.

However, offsetting these strengths, investors should keep a close eye on rising pricing pressures from competitors and aggressive reimbursement cuts that could dampen near-term results...

Read the full narrative on Boston Scientific (it's free!)

Boston Scientific's narrative projects $25.4 billion in revenue and $4.8 billion in earnings by 2028. This requires 11.1% yearly revenue growth and a $2.3 billion increase in earnings from the current $2.5 billion.

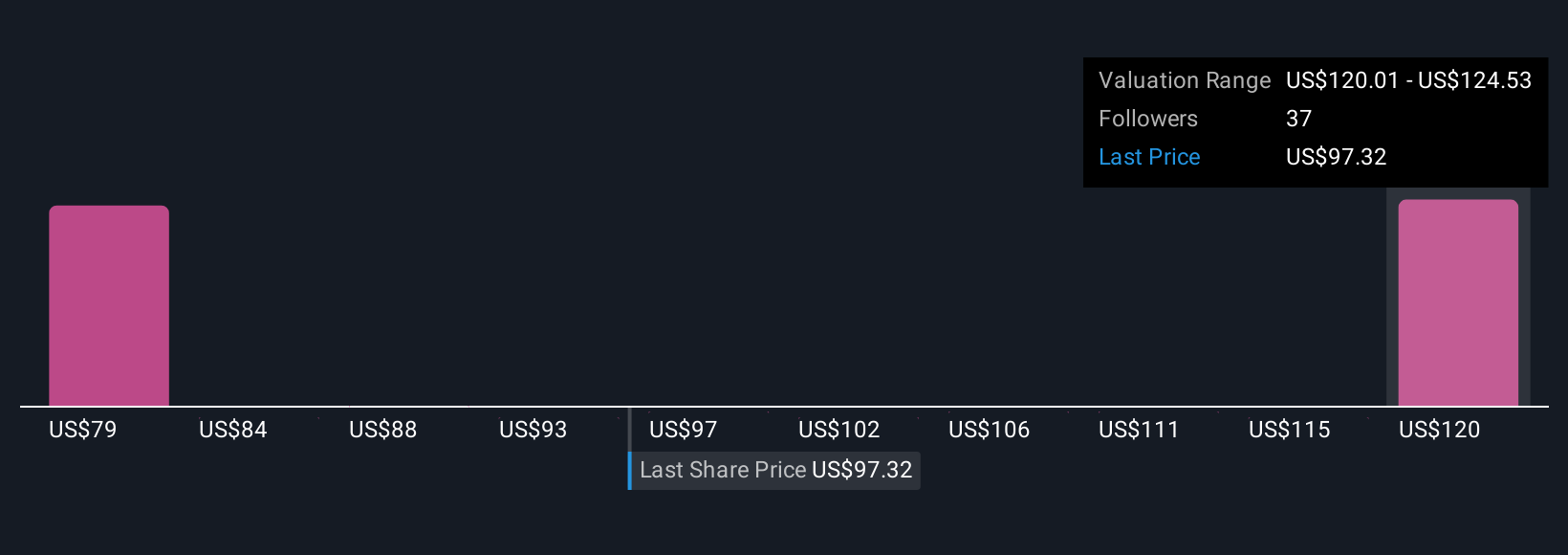

Uncover how Boston Scientific's forecasts yield a $124.53 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Boston Scientific ranging from US$79.40 up to US$124.53, based on 7 individual perspectives. With competitors rapidly advancing pulse field ablation systems, market participants should consider how competitive dynamics could affect future returns as opinions on valuation continue to differ widely.

Explore 7 other fair value estimates on Boston Scientific - why the stock might be worth as much as 27% more than the current price!

Build Your Own Boston Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boston Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Boston Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boston Scientific's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives