- United States

- /

- Medical Equipment

- /

- NYSE:BSX

Boston Scientific's (NYSE:BSX) three-year earnings growth trails the stellar shareholder returns

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Boston Scientific Corporation (NYSE:BSX) share price has soared 125% in the last three years. How nice for those who held the stock! Also pleasing for shareholders was the 16% gain in the last three months. But this move may well have been assisted by the reasonably buoyant market (up 6.7% in 90 days).

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Boston Scientific

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

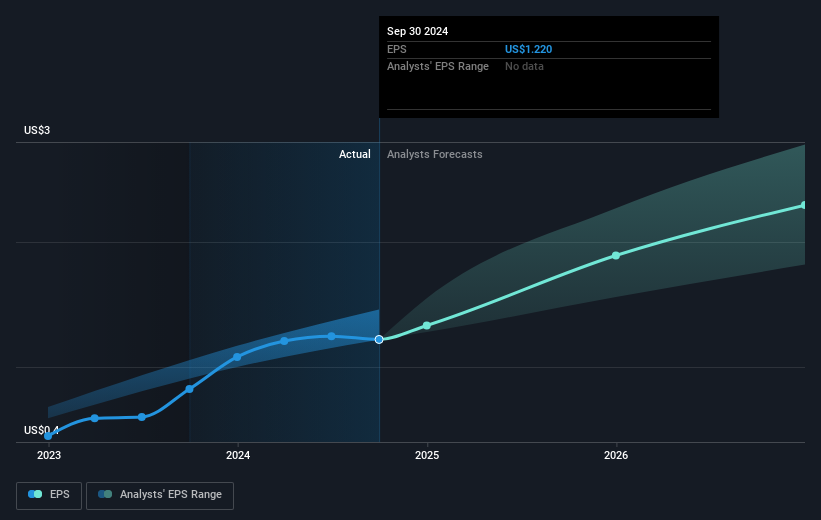

Boston Scientific was able to grow its EPS at 16% per year over three years, sending the share price higher. This EPS growth is lower than the 31% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It's not unusual to see the market 're-rate' a stock, after a few years of growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 75.21.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Boston Scientific has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Boston Scientific will grow revenue in the future.

A Different Perspective

It's nice to see that Boston Scientific shareholders have received a total shareholder return of 65% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 16% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Before forming an opinion on Boston Scientific you might want to consider these 3 valuation metrics.

We will like Boston Scientific better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Boston Scientific, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Boston Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BSX

Boston Scientific

Develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide.

Adequate balance sheet with moderate growth potential.