- United States

- /

- Medical Equipment

- /

- NYSE:BFLY

Will Butterfly Network’s (BFLY) AI Ultrasound Push in Africa Redefine Its Long-Term Risk Profile?

Reviewed by Sasha Jovanovic

- Butterfly Network recently announced the launch of its innovative Gestational Age AI tool in Malawi and Uganda, marking an expansion of maternal and fetal health initiatives in Sub-Saharan Africa.

- Early data from this rollout shows measurable decreases in maternal mortality, highlighting the potential for scalable AI-driven ultrasounds in low-resource health systems.

- We'll examine how this expansion of AI-powered ultrasound into underserved global markets could reshape Butterfly Network's growth narrative and risk profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Butterfly Network Investment Narrative Recap

Butterfly Network’s long-term story rests on the belief that AI-powered, portable ultrasound can expand access to critical diagnostics globally, particularly in underserved markets, driving recurring revenue growth through new product and software rollouts. The recent appointment of John Doherty as CFO brings considerable financial leadership at a crucial juncture; however, this transition is not expected to remove the company’s biggest near-term risk, execution challenges in closing large enterprise and global health deals, given ongoing volatility in healthcare funding and capital spending.

Among the latest developments, the launch of the Gestational Age AI tool in Malawi and Uganda stands out for its measurable impact in maternal health, supporting the company’s international expansion catalyst. This initiative reinforces Butterfly’s push to generate stable revenue from global markets but does not address the execution risk of signing large-scale deployments and maintaining robust funding pipelines.

By contrast, investors should be aware that international project funding remains unpredictable, and...

Read the full narrative on Butterfly Network (it's free!)

Butterfly Network's narrative projects $135.9 million in revenue and $17.0 million in earnings by 2028. This requires 15.8% yearly revenue growth and a $79.8 million increase in earnings from the current $-62.8 million.

Uncover how Butterfly Network's forecasts yield a $3.17 fair value, a 34% upside to its current price.

Exploring Other Perspectives

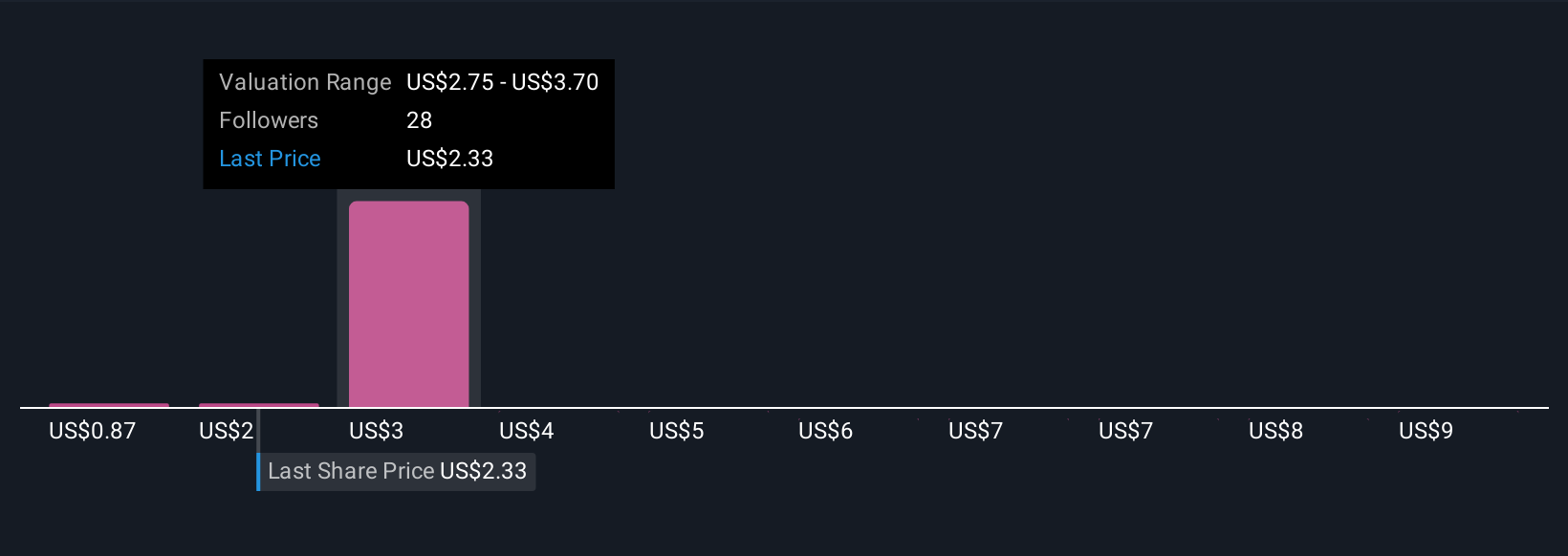

Nine individual fair value estimates from the Simply Wall St Community range from US$0.87 to US$10.29 per share. With such a wide spectrum of perspectives on Butterfly’s value, consider how ongoing unpredictability in international funding could influence revenue stability as you review these diverse viewpoints.

Explore 9 other fair value estimates on Butterfly Network - why the stock might be worth less than half the current price!

Build Your Own Butterfly Network Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Butterfly Network research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Butterfly Network research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Butterfly Network's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Butterfly Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFLY

Butterfly Network

Develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives