- United States

- /

- Software

- /

- OTCPK:INVU

3 Promising US Penny Stocks With Market Caps Under $500M

Reviewed by Simply Wall St

As major U.S. indexes experience fluctuations with technology stocks leading the decline and Treasury yields on the rise, investors are exploring alternative opportunities in less conventional areas of the market. Penny stocks, often representing smaller or newer companies, remain a relevant investment area despite their somewhat outdated name. These stocks can offer unique growth potential when backed by strong financials and fundamentals, presenting an underappreciated opportunity for those looking to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.786075 | $5.8M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.63 | $2.06B | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.33 | $517.9M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.57 | $51.81M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.21 | $8.33M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $3.75 | $114.35M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.56M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.07 | $98.03M | ★★★★★☆ |

Click here to see the full list of 755 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

OmniAb (NasdaqGM:OABI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: OmniAb, Inc. is a biotechnology company focused on the discovery and provision of therapeutic antibody discovery technologies in the United States, with a market cap of approximately $476.20 million.

Operations: The company generates revenue primarily through its Research Services segment, which accounted for $21.71 million.

Market Cap: $476.2M

OmniAb, Inc., a biotechnology firm, operates without debt and has maintained stable weekly volatility. Despite being unprofitable with losses increasing over the past five years, it holds sufficient short-term assets ($67.3M) to cover both short-term and long-term liabilities. The company reported a net loss of US$13.63 million in Q2 2024 but showed slight revenue growth from the previous year at US$7.61 million for the quarter. Management and board tenure is relatively new, averaging 1.9 years, suggesting a fresh leadership team navigating its path toward anticipated revenue growth of 28.46% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of OmniAb.

- Examine OmniAb's earnings growth report to understand how analysts expect it to perform.

Butterfly Network (NYSE:BFLY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Butterfly Network, Inc. develops, manufactures, and commercializes ultrasound imaging solutions both in the United States and internationally, with a market cap of $374.13 million.

Operations: The company's revenue is derived from providing an AI-enhanced personal ultrasound solution, amounting to $71.08 million.

Market Cap: $374.13M

Butterfly Network, Inc. operates in the medical equipment sector with a focus on AI-enhanced ultrasound solutions. Despite being unprofitable and having a negative return on equity of -56.08%, it reported revenue growth, reaching US$21.49 million in Q2 2024, up from US$18.49 million the previous year, and forecasts annual revenue growth of 16.84%. The company maintains sufficient cash runway for over a year without debt concerns and has experienced management with an average tenure of 2.8 years. Recent product advancements include the third-generation Butterfly iTHIRD QUARTER OF system launched in Europe, enhancing diagnostic capabilities significantly.

- Unlock comprehensive insights into our analysis of Butterfly Network stock in this financial health report.

- Gain insights into Butterfly Network's future direction by reviewing our growth report.

Investview (OTCPK:INVU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Investview, Inc., through its subsidiaries, offers financial products and services focusing on financial education, digital assets, and related technology for individuals, with a market cap of $16.38 million.

Operations: The company generates revenue primarily from its Online Financial Information Providers segment, totaling $65.87 million.

Market Cap: $16.38M

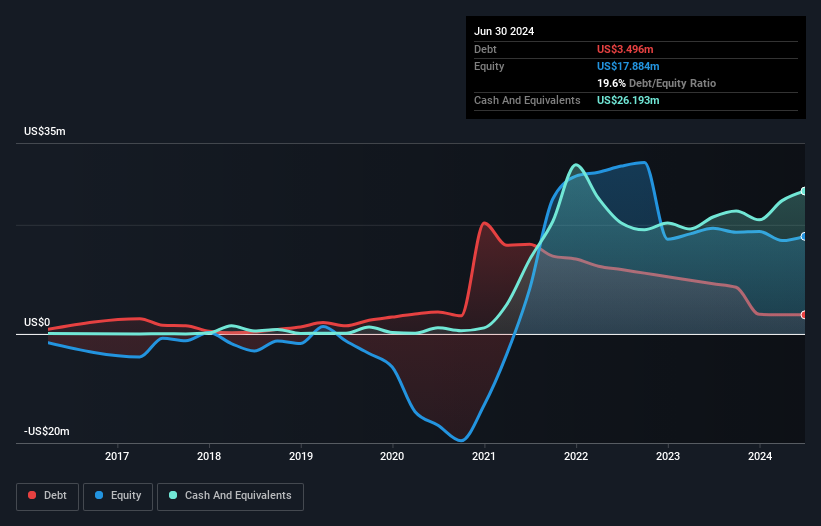

Investview, Inc., with a market cap of US$16.38 million, has shown financial stability and growth potential despite recent revenue declines. The company reported US$28.78 million in revenue for the first half of 2024, down from US$30.82 million the previous year, while net income rose to US$2.2 million from US$1.01 million, indicating improved profitability. Its short-term assets exceed both its short and long-term liabilities significantly, suggesting solid liquidity management. Additionally, Investview's debt is well-covered by cash flow and its price-to-earnings ratio suggests it may be undervalued compared to the broader U.S. market.

- Click to explore a detailed breakdown of our findings in Investview's financial health report.

- Examine Investview's past performance report to understand how it has performed in prior years.

Key Takeaways

- Take a closer look at our US Penny Stocks list of 755 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:INVU

Investview

Through its subsidiaries, engages in the provision of financial products and services in the areas of financial education, digital assets, and related technology for individuals.

Flawless balance sheet with acceptable track record.