- United States

- /

- Medical Equipment

- /

- NYSE:BDX

The Bull Case For Becton Dickinson (BDX) Could Change Following Automation Partnership and New Clinical Study

Reviewed by Sasha Jovanovic

- In October 2025, Becton Dickinson partnered with Opentrons Labworks to automate workflows in BD’s single-cell multiomics instruments, and also began enrolling patients in the XTRACT Registry to assess real-world performance of the Rotarex Catheter System for peripheral artery disease.

- This combination links technological advancement in laboratory automation with expanded clinical validation efforts, marking significant developments in both research efficiency and medical technology outcomes for BD.

- We'll examine how automating BD’s single-cell research platforms with Opentrons could influence its long-term growth and operational outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Becton Dickinson Investment Narrative Recap

To be a shareholder in Becton Dickinson, you need to believe in its ability to drive growth through innovation in medical technology and efficiency in laboratory processes, while managing margin pressures and global trade headwinds. The recent announcements, including the Opentrons partnership for automation and the launch of the XTRACT Registry for PAD, reflect BD's ongoing push to reinforce leadership in advanced diagnostics, though they do not substantially impact the most important short-term catalyst: the execution of the pending separation of its Biosciences and Diagnostic Solutions business. The main risk remains: integration and transition challenges, which could create costs and earnings dilution if not executed smoothly in the coming quarters.

Among recent announcements, the multi-year partnership with Opentrons Labworks stands out as most relevant. By integrating robotic liquid-handling with BD's single-cell multiomics instruments, this deal directly targets BD’s efforts to boost innovation and automation, key to supporting operating margins and improving future revenue streams as the business transitions toward a more focused medical technology portfolio.

But on the other hand, investors should also be aware of the real risk of cost overruns and operational disruption during the Biosciences and Diagnostics business separation...

Read the full narrative on Becton Dickinson (it's free!)

Becton Dickinson's outlook projects $24.7 billion in revenue and $2.8 billion in earnings by 2028. This implies a 4.9% annual revenue growth and a $1.2 billion increase in earnings from the current $1.6 billion.

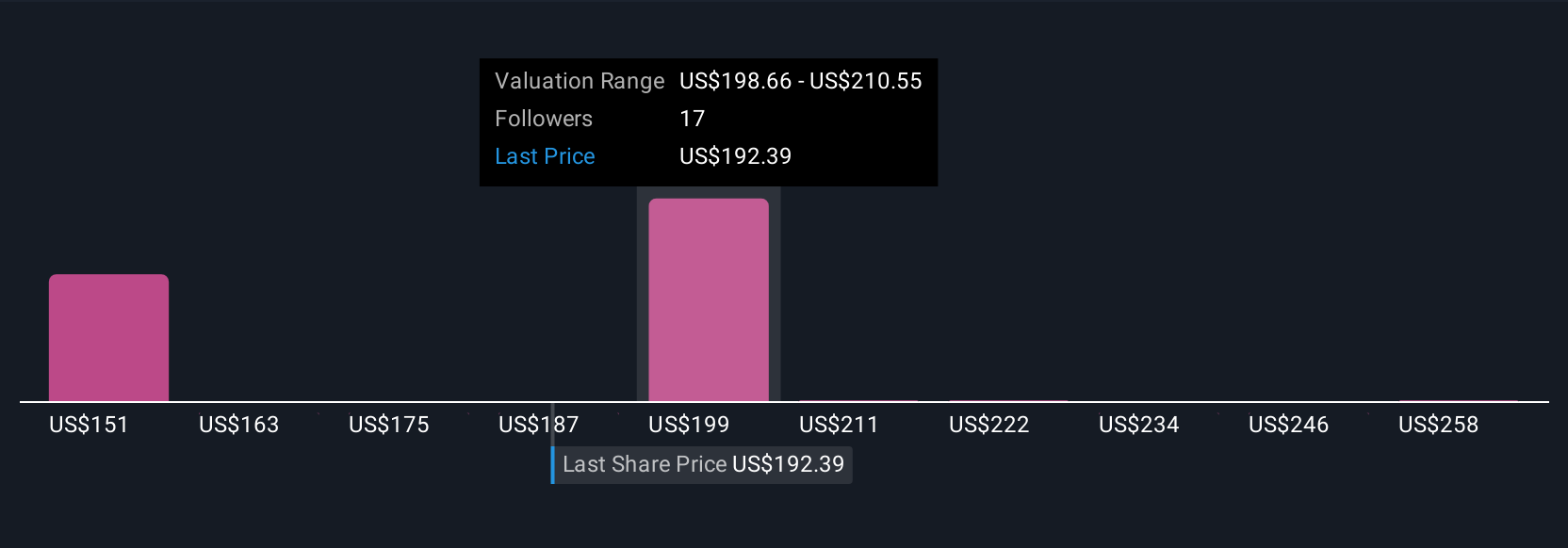

Uncover how Becton Dickinson's forecasts yield a $208.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Six private investor fair value forecasts from the Simply Wall St Community span from US$208 to US$341.87 per share. Execution risks in BD's business separation and global trade pressures add real uncertainty to future performance, so explore several opinions before making up your mind.

Explore 6 other fair value estimates on Becton Dickinson - why the stock might be worth as much as 83% more than the current price!

Build Your Own Becton Dickinson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Becton Dickinson research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Becton Dickinson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Becton Dickinson's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives