- United States

- /

- Medical Equipment

- /

- NYSE:BDX

The Bull Case For Becton Dickinson (BDX) Could Change Following Orphan Drug Summit Presentation – Learn Why

Reviewed by Simply Wall St

- Becton, Dickinson and Company recently presented at the 2nd Annual Orphan Drug Summit on July 17, 2025, in Boston, with Sam Butler as a key speaker.

- This high-profile appearance drew attention as investors speculated about potential updates to the company's pipeline or new initiatives in rare disease therapeutics.

- We'll explore how Becton Dickinson's prominent role at the Orphan Drug Summit may influence its outlook in the high-growth rare diseases segment.

Becton Dickinson Investment Narrative Recap

Investors in Becton, Dickinson and Company typically believe in the company’s ability to drive growth through innovation, operational efficiency, and a sharpened focus in medical technology. While the company’s presentation at the Orphan Drug Summit underscores its expanding profile in high-growth rare disease markets, this news alone is unlikely to move the needle on near-term catalysts like the Biosciences and Diagnostics business separation or alleviate concerns about persistent headwinds in China.

One of the announcements most connected to this conference is BD’s raised revenue guidance for fiscal 2025, now forecast at between US$21.8 billion and US$21.9 billion. This guidance serves as a key near-term reference point and will be under scrutiny, particularly as BD faces both operational transformation and external uncertainties such as Chinese market challenges.

However, investors should also be aware that ongoing risks in China, where volume-based procurement and single-digit revenue declines persist, could...

Read the full narrative on Becton Dickinson (it's free!)

Becton Dickinson's outlook anticipates $24.5 billion in revenue and $2.9 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.5% and an increase in earnings of $1.4 billion from the current $1.5 billion.

Exploring Other Perspectives

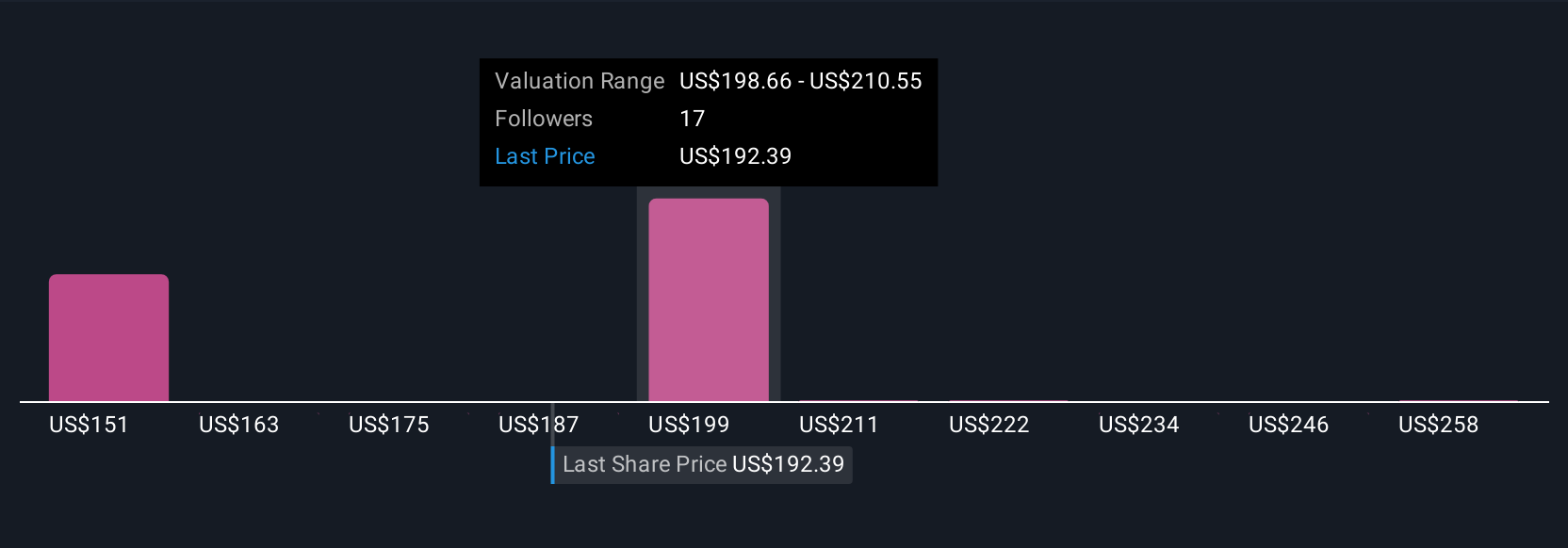

Fair value opinions from the Simply Wall St Community span US$157.48 to US$225 across four analyses, reflecting wide variation in outlooks. With ongoing revenue pressure in China still a central risk, you can compare these perspectives to understand the full picture and see how your own views align.

Build Your Own Becton Dickinson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Becton Dickinson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Becton Dickinson's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives