- United States

- /

- Healthcare Services

- /

- NYSE:ARDT

Ardent Health (ARDT): Reassessing Valuation After Earnings Miss, Accounting Shift and Securities Law Probe

Reviewed by Simply Wall St

Ardent Health (ARDT) is back in the spotlight after its third quarter earnings miss and an accounting estimate change on revenue recognition, developments that have now drawn a securities law investigation from Robbins Geller Rudman and Dowd.

See our latest analysis for Ardent Health.

At around $8.93, Ardent Health’s recent 7 day share price return of 3.96 percent only partly offsets a steep 90 day share price return of minus 30.34 percent and a roughly minus 46.78 percent 1 year total shareholder return. This suggests sentiment has weakened as investors reassess risk after the earnings miss and investigation headlines.

If this kind of volatility has you rethinking where to deploy capital in healthcare, it might be a good time to scan other healthcare stocks that could offer a more resilient trajectory.

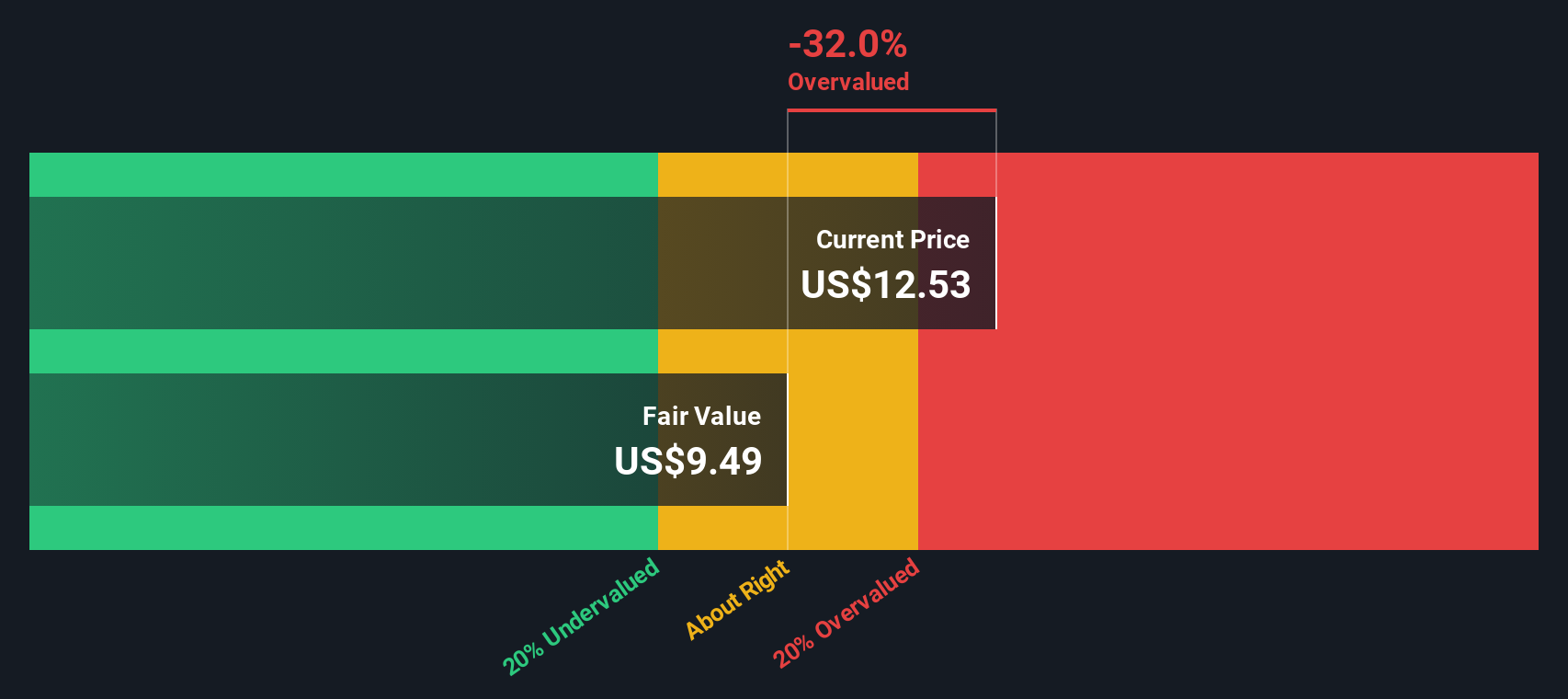

With shares still trading at a steep discount to analyst targets, but sentiment under pressure from legal and earnings setbacks, is Ardent Health now mispriced value in a resilient hospital operator, or is the market rightly discounting future growth?

Most Popular Narrative: 36% Undervalued

With Ardent Health last closing at $8.93 versus a narrative fair value of about $13.96, the story leans heavily toward a recovery thesis built on improving profitability.

The company's disciplined balance sheet management and ability to pursue strategic acquisitions and partnerships in attractive markets allow Ardent to capitalize on industry consolidation, expanding its scale and mitigating regulatory headwinds, ultimately supporting both revenue growth and margin expansion.

Curious how steady top line growth, fatter margins, and a richer earnings multiple all combine into that upside case? The narrative connects them in surprising ways that challenge today’s beaten down share price. Want to see which assumptions really move the valuation needle here?

Result: Fair Value of $13.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could quickly unravel if Medicaid funding is cut more aggressively than expected or if payer denials continue to climb.

Find out about the key risks to this Ardent Health narrative.

Another View: Cash Flow Says Something Different

While the narrative fair value points to upside, our DCF model paints a more cautious picture. It puts fair value near $7.08 versus the current $8.93 share price, implying Ardent could actually be overvalued on cash flows. Which story do you trust more, sentiment or cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ardent Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ardent Health Narrative

If you see the outlook differently or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ardent Health.

Ready for your next investing move?

Before you move on, give yourself an edge by scanning fresh opportunities that match your style, so the next big winner does not pass you by.

- Explore potential returns by targeting mispriced opportunities using these 915 undervalued stocks based on cash flows that pair strong fundamentals with attractive entry points.

- Consider trends in automation and machine learning through these 25 AI penny stocks and position yourself where innovation is accelerating fastest.

- Find possible income streams with these 13 dividend stocks with yields > 3%, focusing on companies that reward shareholders with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARDT

Ardent Health

Owns and operates a network of hospitals and clinics that provides a range of healthcare services in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)