- United States

- /

- Medical Equipment

- /

- NYSE:AORT

Positive AMDS Clinical Results Might Change the Case for Investing in Artivion (AORT)

Reviewed by Sasha Jovanovic

- Artivion recently announced positive late-breaking clinical trial results for its AMDS device at the 39th European Association for Cardio-Thoracic Surgery Annual Meeting, highlighting strong resolution rates for visceral and renal malperfusion as well as favorable safety outcomes.

- This data supports widening adoption of Artivion's AMDS platform and underlines the growing importance of clinical evidence in driving innovation within the cardiac device sector.

- We'll explore how these new clinical results for AMDS could influence Artivion's investment narrative and expectations for future market growth.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Artivion Investment Narrative Recap

To hold Artivion shares, investors need to believe in the company’s ability to drive consistent revenue growth from new cardiac device launches while defending its position in a competitive, price-sensitive market. The recent positive clinical AMDS trial results strengthen the case for AMDS adoption, reinforcing near-term growth catalysts, but do not materially reduce ongoing risks like regulatory complexity and the company’s limited financial flexibility.

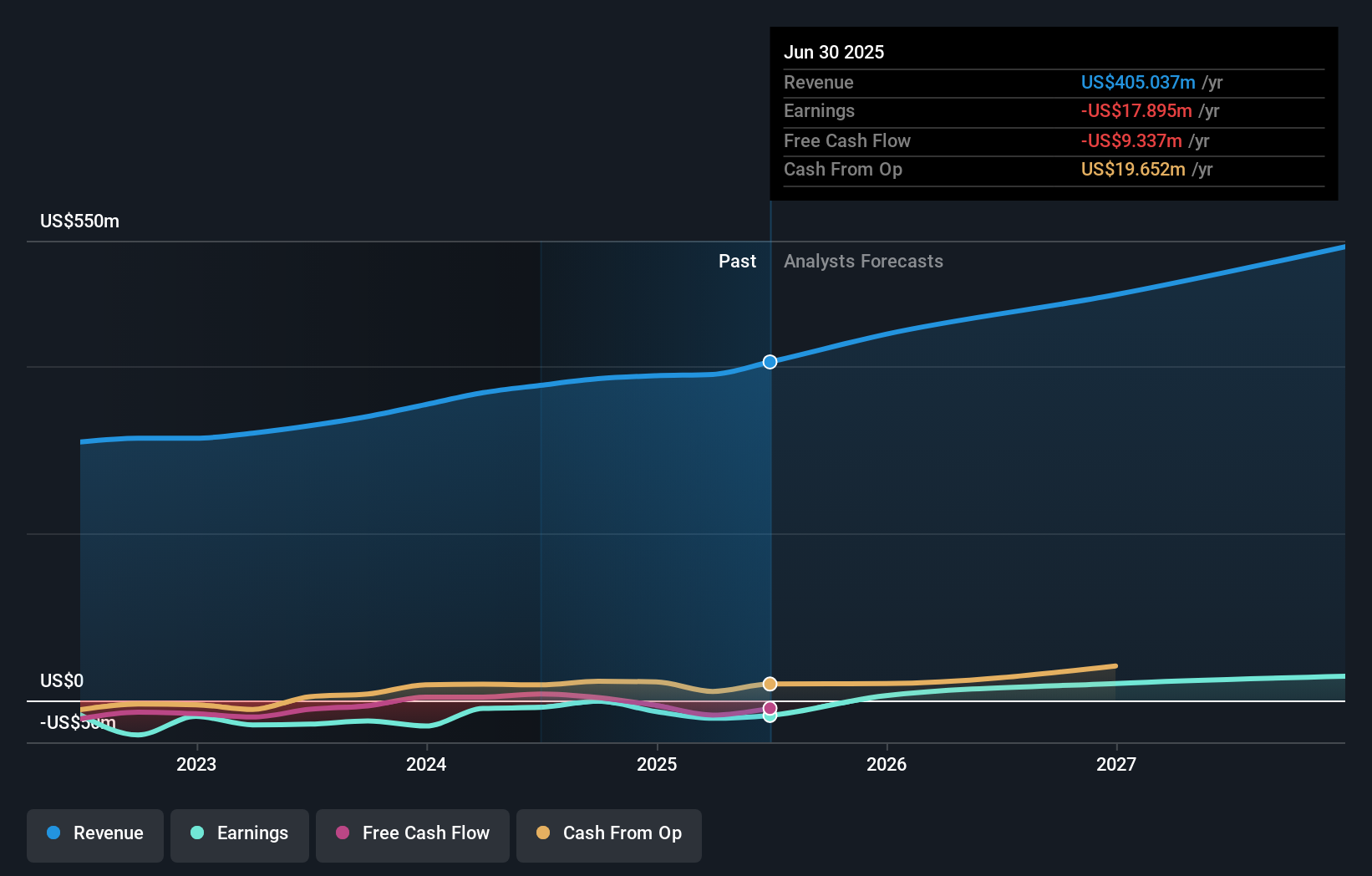

One relevant recent announcement is the expanded 2025 revenue guidance following second-quarter earnings, which now targets US$435 million to US$443 million in revenue. Stronger clinical evidence supporting AMDS may help the company meet or approach these short-term growth targets, though broader risks around scaling profitability and funding innovation remain important to watch.

In contrast, investors should not overlook the risk that Artivion’s revenue trajectory is still vulnerable if new product uptake falls short or...

Read the full narrative on Artivion (it's free!)

Artivion's outlook anticipates $571.4 million in revenue and $37.4 million in earnings by 2028. This scenario assumes a 12.2% annual revenue growth rate and an earnings increase of $55.3 million from the current level of -$17.9 million.

Uncover how Artivion's forecasts yield a $44.54 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Artivion, ranging widely from US$5.68 to US$44.54 per share. While clinical trial successes support optimism on growth, it’s clear expectations for future performance and value differ sharply across participants.

Explore 2 other fair value estimates on Artivion - why the stock might be worth as much as 11% more than the current price!

Build Your Own Artivion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Artivion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artivion's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AORT

Artivion

Manufactures, processes, and distributes medical devices and implantable human tissues worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives