- United States

- /

- Medical Equipment

- /

- NYSE:AORT

Artivion (AORT): Fresh AMDS Trial Data Spurs New Look at Valuation and Growth Potential

Reviewed by Kshitija Bhandaru

Artivion (AORT) turned heads after revealing fresh clinical data for its AMDS device at a major cardiothoracic meeting in Europe. The presentation’s strong safety and effectiveness results could carry significant weight as the company seeks regulatory approval.

See our latest analysis for Artivion.

Artivion’s momentum has been hard to ignore this year. Favorable AMDS trial results have fueled optimism, and a string of positive clinical milestones has caught investor attention. The shares have climbed steadily, and their 55% total shareholder return over the past 12 months highlights the company’s growth potential as regulatory hopes build.

If you’re interested in discovering how other healthcare innovators are performing, now is the perfect time to check out the See the full list for free..

Yet with shares up sharply and the company trading just below analyst price targets, the big question for investors is whether Artivion remains undervalued or if the market is already pricing in future growth potential.

Most Popular Narrative: 8.8% Undervalued

Compared to the recent closing price of $40.63, the narrative’s fair value estimate of $44.54 suggests room for upside, fueled by market optimism surrounding clinical and commercial catalysts. This viewpoint factors in updated analyst expectations and positive sentiment from key opinion leaders in cardiology.

“Ongoing U.S. launch of AMDS, with positive physician feedback, rapid clinical adoption post-training, and a significant $150 million annual market opportunity, indicates accelerating market penetration. This should materially contribute to both top-line revenue growth and high-margin product mix, improving EBITDA margins over the long term.”

Curious about the trends behind these bullish forecasts? The secret sauce in this narrative is an aggressive outlook on top-line and margin expansion. Want to know exactly what assumptions underlie the substantial lift in fair value? Explore the narrative and see for yourself what is driving these numbers.

Result: Fair Value of $44.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as underwhelming innovation from new product launches or growing pricing pressures could quickly shift the outlook for Artivion and its future growth.

Find out about the key risks to this Artivion narrative.

Another View: Market Compares Multiples

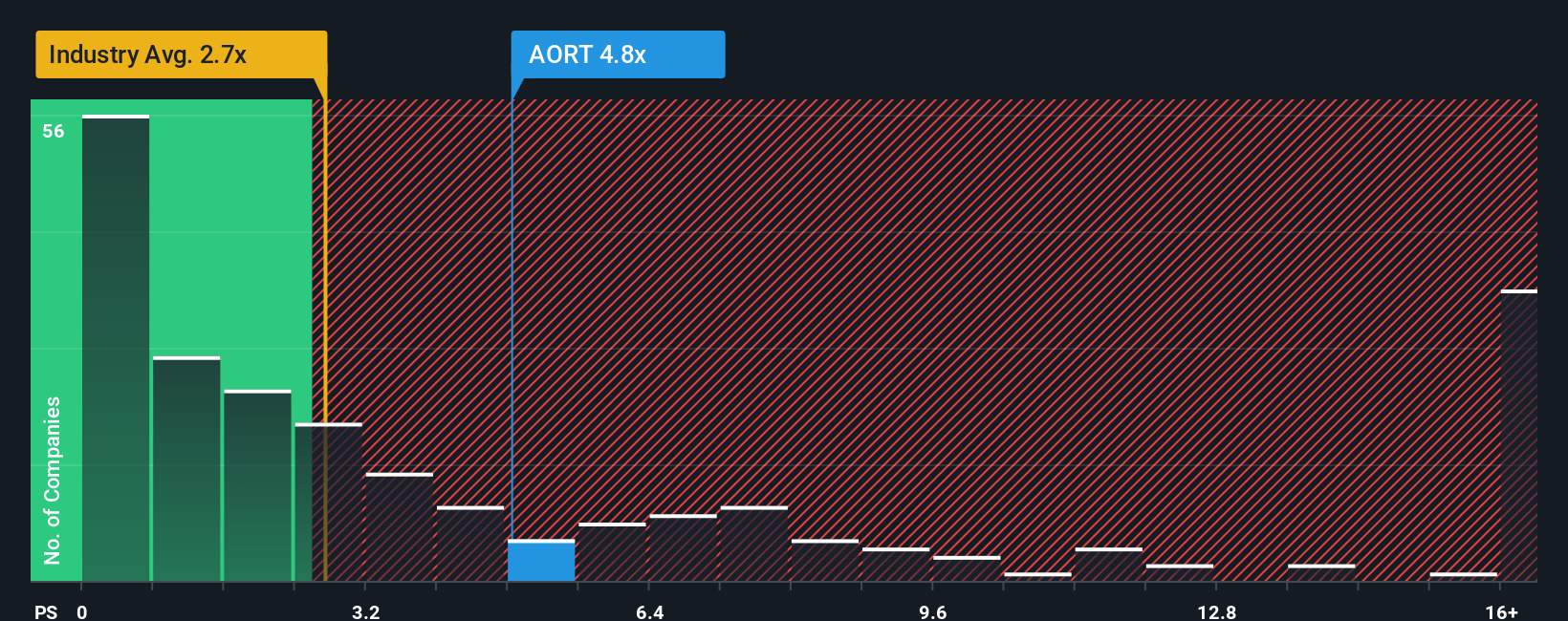

While the previous fair value estimate suggests Artivion is undervalued, a look at its price-to-sales ratio paints a more cautious picture. With a current multiple of 4.7x, Artivion trades well above both the industry average of 2.8x and its peer average of 3.7x. Even when compared to a fair ratio of 2.7x, the shares appear expensive, signaling valuation risk if market expectations shift or growth stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Artivion Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Artivion research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your portfolio stand out by acting on powerful market trends and finding tomorrow’s leaders. Don’t let great opportunities slip through your fingers.

- Capture the excitement in artificial intelligence by checking out these 25 AI penny stocks, which offer massive potential as the sector accelerates innovation and real-world adoption.

- Fuel your search for steady, inflation-beating income by browsing these 18 dividend stocks with yields > 3%, featuring robust payouts from companies built for resilience.

- Seize ground-floor potential with these 3575 penny stocks with strong financials, which combine value, growth prospects, and the drive to become the market’s next breakout winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AORT

Artivion

Manufactures, processes, and distributes medical devices and implantable human tissues worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives