- United States

- /

- Healthcare Services

- /

- NYSE:AGL

The Market Lifts agilon health, inc. (NYSE:AGL) Shares 41% But It Can Do More

agilon health, inc. (NYSE:AGL) shares have had a really impressive month, gaining 41% after a shaky period beforehand. But the last month did very little to improve the 67% share price decline over the last year.

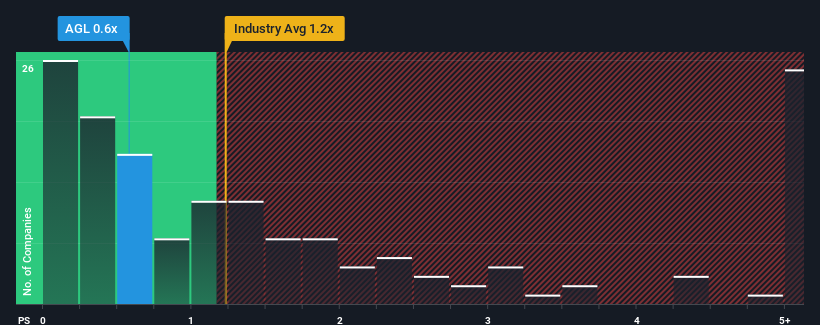

Although its price has surged higher, when close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider agilon health as an enticing stock to check out with its 0.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for agilon health

How agilon health Has Been Performing

With revenue growth that's superior to most other companies of late, agilon health has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on agilon health.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as agilon health's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 74% last year. The strong recent performance means it was also able to grow revenue by 263% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 24% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.0% per year, which is noticeably less attractive.

With this information, we find it odd that agilon health is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From agilon health's P/S?

The latest share price surge wasn't enough to lift agilon health's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at agilon health's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you take the next step, you should know about the 2 warning signs for agilon health that we have uncovered.

If you're unsure about the strength of agilon health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AGL

agilon health

Provides healthcare services for seniors through primary care physicians in the communities of the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives