- United States

- /

- Healthcare Services

- /

- NYSE:AGL

Recent 5.3% pullback isn't enough to hurt long-term agilon health (NYSE:AGL) shareholders, they're still up 28% over 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. For example, the agilon health, inc. (NYSE:AGL) share price is up 28% in the last 1 year, clearly besting the market decline of around 8.9% (not including dividends). That's a solid performance by our standards! agilon health hasn't been listed for long, so it's still not clear if it is a long term winner.

In light of the stock dropping 5.3% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for agilon health

Given that agilon health didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

agilon health grew its revenue by 48% last year. That's stonking growth even when compared to other loss-making stocks. The solid 28% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate agilon health in some detail. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

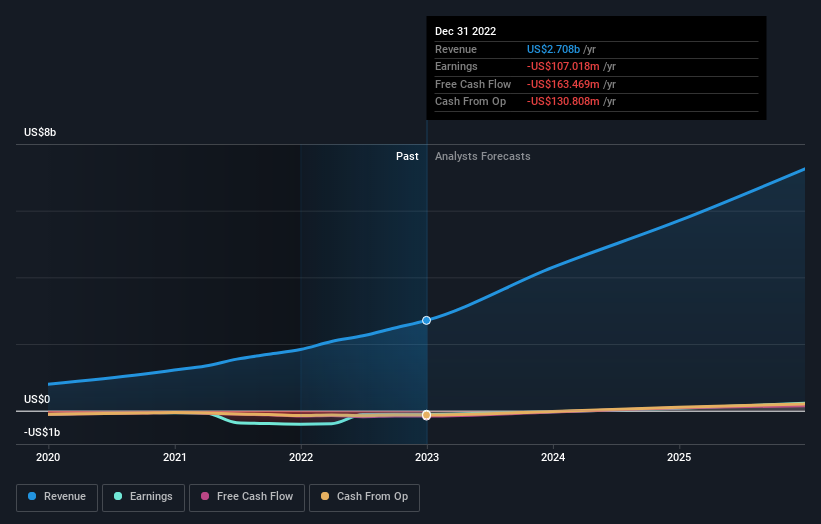

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

agilon health shareholders should be happy with the total gain of 28% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 30% in that time. This suggests the company is continuing to win over new investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with agilon health , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade agilon health, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AGL

agilon health

Provides healthcare services for seniors through primary care physicians in the communities of the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives