- United States

- /

- Medical Equipment

- /

- OTCPK:ZSAN.Q

Is Zosano Pharma (NASDAQ:ZSAN) Weighed On By Its Debt Load?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Zosano Pharma Corporation (NASDAQ:ZSAN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Zosano Pharma

What Is Zosano Pharma's Net Debt?

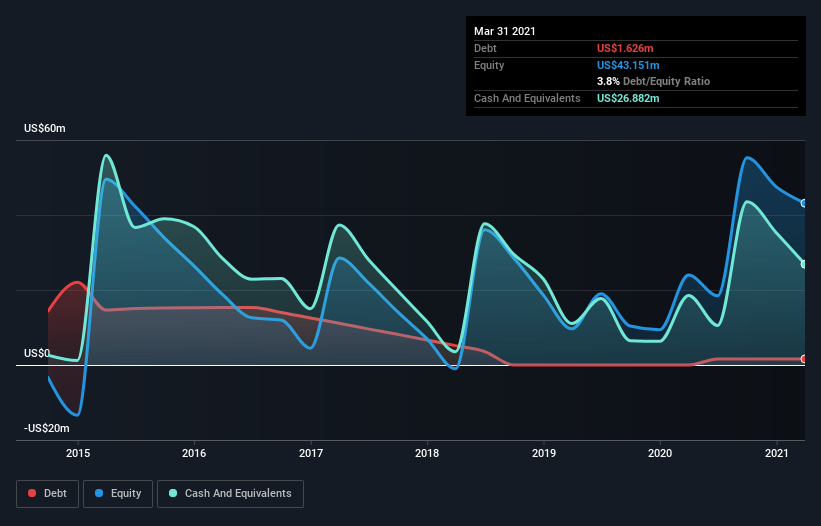

As you can see below, at the end of March 2021, Zosano Pharma had US$1.63m of debt, up from none a year ago. Click the image for more detail. But on the other hand it also has US$26.9m in cash, leading to a US$25.3m net cash position.

How Healthy Is Zosano Pharma's Balance Sheet?

The latest balance sheet data shows that Zosano Pharma had liabilities of US$14.4m due within a year, and liabilities of US$8.15m falling due after that. Offsetting these obligations, it had cash of US$26.9m as well as receivables valued at US$243.0k due within 12 months. So it actually has US$4.57m more liquid assets than total liabilities.

This short term liquidity is a sign that Zosano Pharma could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Zosano Pharma has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Zosano Pharma can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Given its lack of meaningful operating revenue, Zosano Pharma shareholders no doubt hope it can fund itself until it can sell some of its new medical technology.

So How Risky Is Zosano Pharma?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Zosano Pharma lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$41m of cash and made a loss of US$33m. Given it only has net cash of US$25.3m, the company may need to raise more capital if it doesn't reach break-even soon. The good news for shareholders is that Zosano Pharma has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. While unprofitable companies can be risky, they can also grow hard and fast in those pre-profit years. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 5 warning signs for Zosano Pharma (3 are a bit unpleasant) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Zosano Pharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zosano Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:ZSAN.Q

Zosano Pharma

Zosano Pharma Corporation, a clinical stage biopharmaceutical company, focuses on providing therapeutics and other bioactive molecules to patients suffering from migraine using its transdermal microneedle system.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives