When Zosano Pharma Corporation (NASDAQ:ZSAN) reported its results to December 2020 its auditors, Deloitte & Touche LLP could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Given its situation, it may not be in a good position to raise capital on favorable terms. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

Check out our latest analysis for Zosano Pharma

What Is Zosano Pharma's Debt?

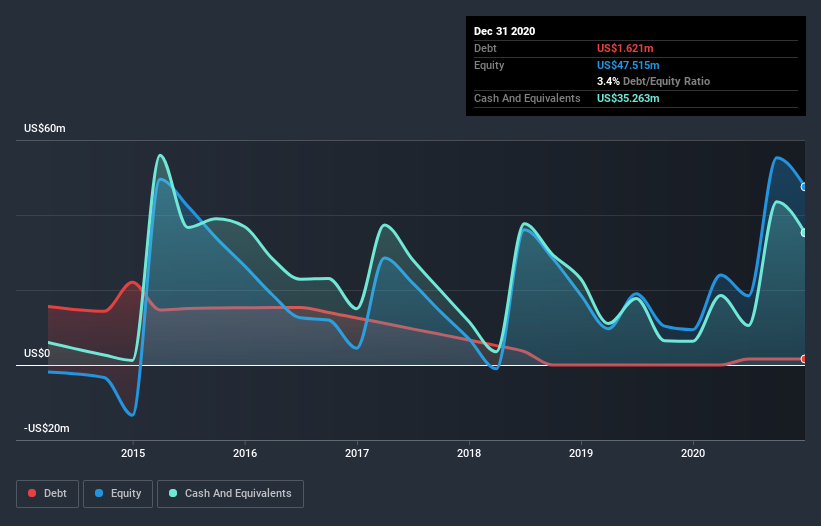

The image below, which you can click on for greater detail, shows that at December 2020 Zosano Pharma had debt of US$1.62m, up from none in one year. However, its balance sheet shows it holds US$35.3m in cash, so it actually has US$33.6m net cash.

How Strong Is Zosano Pharma's Balance Sheet?

We can see from the most recent balance sheet that Zosano Pharma had liabilities of US$14.5m falling due within a year, and liabilities of US$9.99m due beyond that. Offsetting these obligations, it had cash of US$35.3m as well as receivables valued at US$124.0k due within 12 months. So it can boast US$10.9m more liquid assets than total liabilities.

This surplus suggests that Zosano Pharma has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Zosano Pharma has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Zosano Pharma's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given its lack of meaningful operating revenue, Zosano Pharma shareholders no doubt hope it can fund itself until it can sell some of its new medical technology.

So How Risky Is Zosano Pharma?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Zosano Pharma had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$40m and booked a US$33m accounting loss. With only US$33.6m on the balance sheet, it would appear that its going to need to raise capital again soon. With very solid revenue growth in the last year, Zosano Pharma may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 6 warning signs for Zosano Pharma (of which 4 can't be ignored!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Zosano Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Zosano Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zosano Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:ZSAN.Q

Zosano Pharma

Zosano Pharma Corporation, a clinical stage biopharmaceutical company, focuses on providing therapeutics and other bioactive molecules to patients suffering from migraine using its transdermal microneedle system.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives